October 24, 2005

RIM's BlackBerry Under Threat from Rivals & Other Risks

Despite RIM's September win in its long-running patent dispute with NTP, the company suffered a real setback last week when a judge refused to delay NTP's appeals court case:

Despite RIM's September win in its long-running patent dispute with NTP, the company suffered a real setback last week when a judge refused to delay NTP's appeals court case:

The refusual to stay the case comes two months after a three-judge panel from the appeals court upheld most of the 2003 verdict, which has raised the seemingly remote possibility that RIM might be forced to stop selling BlackBerrys without a settlement.But the August decision also identified certain errors during the trial, thereby reversing some of the infringement finding and asking the trial court to review whether those errors tainted the overall jury verdict.

NTP, based in Arlington, Va., has disputed the significance of that ruling as well as a series of recent "preliminary" rejections by the U.S. Patent and Trademark Office of the five patents RIM was found to have violated.

RIM has asserted that the patent office's actions hold enough weight to sway the court case, while NTP has dismissed them as a common formality in the agency's lengthy review process.

Settlement talks in the case broke down in June, several months after the companies appeared to reach an agreement that called for a $450 million payment to NTP.

RIM has indicated it will ask the trial court to enforce the settlement, while NTP has maintained that the companies failed to reach a definitive agreement over licensing terms for the patents in dispute.

"We're willing to settle the case, but not on terms that RIM is going to dictate," said Donald E. Stout, an attorney for NTP. "If the judge says `NTP you're right, there's no contract,' we will offer RIM a license with terms and conditions that we're willing to grant them a license under. And if they don't take that, we'll seek to enforce the injunction" fro RIM to stop selling BlackBerry mobile devices and service."

RIM, in a statement, said it "maintains that an injunction is inappropriate given the facts of the case and substantial doubts raised subsequent to trial as to the validity of the patents in question."

On the other hand, it would seem NTP's patents aren't that strong in the first place:

American Technology Research analyst Rob Sanderson said the latest ruling should not come as a surprise."What RIM was asking was to not move this case forward until the Supreme Court can decide. That request is almost never granted, so it's not unexpected," he said.

He said decisions for the lower court judge will include whether to reconfirm the injunction, whether to stay it pending review, and whether the earlier settlement was valid.

Sanderson said RIM may have helped its position by showing it was willing to settle, as courts prefer to see settlements in such cases.

He also noted that the U.S. Patent and Trademark Office recently finished reexamining eight NTP patents and issued initial rulings rejecting 100 percent of the claims.

Those rulings are not final and NTP has said it plans to see the full reexamination process through, which could take years. Some analysts have said that until that process is complete, the patents remain valid in the eyes of the court.

Still, the bigger they are the harder they fall and everybody wants to be king of the hill - with that, competitors were coming out of the woodwork with solutions at the recent CTIA wireless show:

Several mobile e-mail access companies this week will announce products and services designed to compete with Research In Motion Ltd.'s BlackBerry platform, but RIM continues to hold its own, with new carriers and device partnerships due by year's end.At the CTIA Wireless IT & Entertainment show in San Francisco, Intellisync Corp. will introduce Intellisync Unified Messaging for Mobile Devices. "Intellisync has moved into the wireless enterprise space full force," said Bill Jones, a product manager at the San Jose, Calif., company. "This is really unified messaging."

A new version of the company's Intellisync Mobile Suite, the new platform makes e-mail, voice mail, text and instant messaging accessible on a single device screen. This includes the ability to view all the major IM networks, including AOL, Google, Jabber, ICQ, MSN Messenger and Yahoo IM, as well as corporate platforms such as Microsoft Live Communications and IBM Lotus Sametime.

The platform has new presence capabilities, officials said. An IM client allows others to see when a user is online, but Unified Messaging lets users specify how they would like to be contacted, setting their status to let colleagues know to use a text message rather than a voice call.

Unified Messaging also includes a data collection feature that lets a user see all the information relating to one contact—e-mail, voice mail and SMS (Short Message Service) messages—in a single view.

Supporting PalmSource Inc.'s Palm OS, Microsoft Corp.'s Windows Mobile and Symbian Ltd.'s Symbian OS, the Unified Messaging platform will be available in November, both as a private-label offering from carriers and directly from Intellisync's enterprise sales force, officials said.

Nokia's e-mail platform challenges Blackberry. Click here to read more.

Seven Networks Inc. will announce three new carrier partnerships in Europe and Asia, resulting in a total of 73 carriers offering the Redwood City, Calif., company's mobile e-mail platform.

Currently 140 carriers sell BlackBerry devices and services, and that number will soon exceed 200, said RIM officials in Waterloo, Ontario.

Visto Inc. at the show will announce support for 17 new devices on its Visto Mobile platform, meaning the platform supports 60 devices, said Visto officials in Redwood Shores, Calif.

But RIM has been slowly inching out of its BlackBerry device comfort zone via its BlackBerry Connect program, which enables non-RIM devices to work with the BlackBerry Enterprise Server. BlackBerry Connect has been slow to gain traction in the United States, but that seems to be changing.

By the end of the year, BlackBerry Connect support will be available in the United States on both the Nokia 9300 and on Palm Inc.'s Treo devices, according to industry sources. Cingular Wireless will be offering these BlackBerry-connected products, sources said. By November, T-Mobile USA Inc. and Verizon Wireless will be selling Windows Mobile devices that support BlackBerry Connect, sources said.

Competitors argue that BlackBerry Connect is not the same as building support for a device from the ground up. Still, it's not easy to pull customers away from the BlackBerry.

"It would take a lot for me to switch from RIM at this point," said Nicholas Gass, IT manager at Color Kinetics Inc., a digital lighting company in Boston. "Our infrastructure is established, both back and front end, and we've established a comfort level with all aspects of the BlackBerry product line."

All competitive comparisons aside, I have to say, it's hard not to admire RIM's founders for all the philathropic work they do which also serves a dual purpose role in original research to support economic development - and in so doing seem to be building Canada's future competitiveness in the process.

- Arik

August 25, 2005

Northwest Airlines: Mechanics Strike Will Negatively Impact Future of Organized Labor

Thanks to savvy planning ahead on the part of Northwest Airlines (thank goodness I'm not traveling much in August) it would appear the mechanics strike is, not only, having minimal impact on operations, but causing significant enough dissent in the ranks of Northwest's other unions (pilots, stewardess, etc.) that fears it could undermine the very character of organized labor - at least in the airline industry - do not go unfounded.

While the AMFA (Aircraft Mechanics Fraternal Organization) would have us avoid flying Northwest because of warnings planes are unsafe under "scab" oversight, the walkoff by 4,400 mechanics, cleaners and custodians appears to be having a somewhat counter-intuitive impact... teaching Northwest (and competing airlines) that it can indeed survive or even thrive without union labor.

No new talks are scheduled between Northwest and the union, which is refusing to take pay cuts and layoffs that would have reduced their ranks by nearly half. The mechanics averaged about $70,000 a year in pay, and cleaners and custodians made around $40,000. The company wants to cut their wages by about 25 percent. AMFA represents about 3,500 mechanics, about 790 cleaners and 75 custodians.

Northwest has said it needs $1.1 billion in labor savings but only pilots have agreed to reductions, accepting a 15 percent pay cut worth $300 million when combined with cuts for salaried employees. It is negotiating with ground workers and flight attendants, and it has said it can reopen talks with pilots once it gets concessions from the other groups.

Company executives credit their contingency plan that took 18 months to create and say the plan to use temporary workers in place of striking workers required extensive analysis, as well as the cooperation of other unions and the federal government - even consulting with White House.

With more than one labor expert observing Northwest's ability to switch to new work routines and keep operating, at last at outset of the labor action, sends an important signal to unions that strikes may have lost their power as tools to fight job losses and other cuts.

- Arik

August 10, 2005

General Motors Success in China Proves Company Can Compete After All (Free of Union Labor, At Least)

General Motors has apparently figured out how to build the right car for the right market - in this case, $5,000 minivans that get 43 miles to the gallon in city driving.

The minivans, which GM builds in a joint venture with a Chinese partner, have a quarter the horsepower of American minivans, weak acceleration and a top speed of 81 miles an hour - but they're selling like hotcakes. The New York Times reported that GM has sold more than 170,000 very small vehicles in China - enough to pass Volkswagen this year in sales in a market that VW has dominated for two decades, becoming, with its Chinese partner Wuling, the top automobile company in China.

The Wuling Sunshine minivan is a far cry from its bigger-is-better image of GM in United States, where it produces some of largest gas guzzlers on market, like Hummers. The minivan's development was led by Philip Murtaugh, the maverick executive who was able to create in China the kind of innovative environment that GM has struggled for decades to achieve in its American operations; but Murtaugh's success in China has led to his departure from company, in what may be telling sign of corporate culture at GM. A good summary comes from IHT:

-

The seats are only a third of the thickness of seats in Western models but look plush compared to similar Chinese cars.

Murtaugh's decision to invest in such practical vehicles went against the grain of a company known in the United States for producing some of the biggest gas-guzzlers on the market, like the Hummer. But in what may be a telling sign of the corporate culture at GM, his success in China led not to promotion, but to his departure from the company.

Meanwhile, the minivans have been a big hit in China, helping GM sell more than 170,000 compact vehicles and pass Volkswagen this year in sales in a market the German manufacturer has dominated for two decades.

They have also helped turn China into GM's biggest center of automotive profit - in contrast to losses in manufacturing operations in the United States - and its second-largest market in terms of the number of vehicles sold, after the United States.

Whether GM can duplicate elsewhere its success in China or even keep its pace here is unclear. But one thing is sure: Murtaugh was able to create a circle of innovation around the Wuling Sunshine minivan, the kind of environment GM has struggled for decades to foster in its American operations.

A genial, soft-spoken man in a company known for autocratic leaders, Murtaugh showed more talent in building a business than arguably any other GM executive of the past quarter century. From his base in Shanghai, he ran the company's China operations for more than nine years.

Yet he repeatedly made the best calls in the industry, only to find himself suddenly unemployed this spring and living in a small community in rural Kentucky.

Murtaugh resigned in March after the rising importance of China to GM prompted senior company executives in Detroit and Asia to intervene and take more direct control of the business. GM has firmly pegged its fortunes in the United States to sales of the biggest gas-guzzlers - the immense Hummers and Chevrolet Suburbans - even as oil prices soar past $60 a barrel and many Americans grow nervous about paying more than $50 for a tank of gas.

But here in China, GM was the only multinational automaker that spotted the potential back in the late 1990s for building lots of small, inexpensive, fuel-sipping cars, minivans and pickups.

"It is impressive, and it is strategically very smart," said Michael Dunne, the president of Automotive Resources Asia, a consulting firm based in Beijing and Bangkok.

GM's reward came in the first half of this year, when demand for utilitarian vehicles in China soared in response to steep gasoline prices and rising prosperity among the peasants and small business owners. GM's sales of spartan minivans and pickups and very small cars have climbed faster than its rivals, to 172,368 in the first half of this year, up 48.7 percent from a year earlier.

GM's Asian and Pacific division - just 5 percent of the company's worldwide sales - are increasingly dominated by the fortunes of its China business. The unit earned $176 million in the second quarter even as the company's overall automotive operations lost $948 million because of heavy losses in North America.

The factory here now runs day and night, six days a week. "When the employees stop for lunch, the maintenance people run in," said Yao Zuo Ping, the chief of manufacturing here.

Murtaugh played a central role in 1996 in setting up the company's main operation in China, a 50-50 joint venture with Shanghai Automotive Industry Corp., or SAIC. Instead of following the usual GM career track of bouncing through assignments around the world every two years, Murtaugh stayed on to run the operation for nearly a decade.

In the late 1990s, he noticed that millions of small business owners and affluent peasants were not prosperous enough to afford the latest Western models. But they were saving enough to acquire more spartan vehicles selling for less than $5,000.

"Essentially, it is his baby," said Stephen Small, the joint venture's GM-appointed chief financial officer.

Murtaugh never learned to speak Chinese, but he was instrumental in setting up the Liuzhou joint venture, which is 34 percent owned by GM and 50.1 percent by SAIC. The rest is held by the Liuzhou Wuling Automotive Co. His personal skills and ability to explain the latest ways to run a factory, often borrowed from Japanese carmakers, made a deep impression with executives here, as did his regular visits.

"Murtaugh himself was actually paying a lot of attention to our facility here," said Shen Yang, the president of the joint venture and a leading executive at the factory for more than a decade before GM invested here.

Murtaugh said by telephone from his home in Cadiz, Kentucky, that he made safety suggestions at the start of his very first visit to the factory in 1999. "We got about 20 paces inside the stamping plant and I said to Shen Yang, 'how many eye surgeries and finger amputations do you perform every year?"'

In early March, GM gave more power to executives in Detroit to oversee design, engineering and various manufacturing disciplines all over the world, including in China. The shift is supposed to allow greater coordination between the now-sprawling operations in China and the rest of GM's businesses.

In late March, Murtaugh resigned, at 49 years old. Murtaugh and the company said that the decision to leave GM was his, and that he was not fired.

But Shen, the president of the joint venture here, becomes visibly emotional at Murtaugh's surprise departure.

"I have a very good relationship with Murtaugh, he is my friend, and seeing him leave is very hard on me," Shen said, his voice catching slightly.

Regardless, it's forced VW to cut prices - according to Financial Times, Auto Asia, up to 14 percent just recently:

-

Responding to a loss of its previously commanding Chinese market share to GM’s Chinese joint venture, one of Volkswagen's two assembly joint ventures operations in China yesterday announced price cuts of up to 14% in its model range. Prices on 10 derivatives of four model families - Gol, Passat, Santana and Santana 3000 - were lowered by between six and 13.7 per cent on 8 August.

However, VW’s other Chinese joint venture, with First Auto Works (FAW), announced yesterday that it would not follow suit, but rather, hold current car prices. It is one of the first occasions since the beginning of China’s automotive market growth spurt that a domestic joint venture partner appears to have forced decisions that may not necessarily accord with the wishes of its Western partner.

VW’s partner in Shanghai VW is the state-controlled SAIC (Shanghai Automotive Industries Corp.), which independently spent £67m last year in acquiring intellectual property from MG Rover’s parent company, but failed last month to secure ownership of the British firm’s remaining assets. SAIC recently announced it will invest independently in a new plant which will make its own-badged cars derived from the Rover 25 and 75 model designs it acquired when considering a joint venture with MG Rover.

As a pioneer of inward investment, VW built up a large lead in the smaller, government fleet-dominated Chinese car market with the Santana, a derivative of the 1970s VW Passat, when cars remained unavailable to private Chinese consumers. Subsequently, the success of GM’s Wuling Sunshine small car, among others such as the Buick Sail, has helped GM overtake VW as China’s biggest-selling car brand, and the country recently became GM’s automotive operations’ largest profit centre.

A price ‘war’ in China could affect the majority of joint venture assembly and supplier firms which have invested heavily in China in recent years; a cooling of the Chinese consumer car market, together with raw materials cost increases, has already halved the Chinese automotive industry’s average profitability in the past half year, according to official sources.

China showed some recovery in demand for new cars in June and July after a pause in market growth; the China Association of Automobile Manufacturers (CAAM) cited stabilising car prices as an important factor in the regrowth of demand.

To build the cars in China, GM rebuilt a former tractor factory in ways that could become a model for automobile production in China for years to come. The assembly process has only one robot, for sealing windshields, relying mostly on workers earning $60 a month, above average for this region. That comes after GM's experience in Shanghai, where it installed four dozen robots for its first assembly line only to find them much costlier and less flexible than people; GM's second assembly line there was built with only four robots.

Still, while a $5,000 vehicle is probably not feasible here in the United States, Americans would no doubt be happy to pay two or three times that much for a vehicle getting that kind of mileage, hard seats and not.

- Arik

June 23, 2005

AMC + Loews = Consolidation Hitting the Slumping Theater Business

AMC Entertainment and Loews Cineplex Entertainment have decided to combine to see if maybe, together, they can beat the biggest moviegoing slump in 20 years. Not that movies, necessarily, are the problem or aren’t popular. It’s just that, the theater distribution channel is obsolete, undifferentiated and destined to become even more so, unless theater chains can create some integrated experience that would warrant fighting the crowds instead of cozying up at home with movies on demand or DVDs by mail, rented or bought outright.

The second and third (respectively) leading theater chains agreed to merge into a 5,900 screen movie-viewing goliath with operations throughout the the country and overseas. The deal is valued roughly at $4 billion and will put them second to Regal Entertainment group, the largest movie entity with 6273 screens in 558 theaters.

What's an even broader reason for the consolidation? Maybe Batman has a shot at saving Hollywood this summer... or maybe, Tom Cruise...?

-

For four months, Hollywood has been waiting for a movie to reverse its grim box-office slump. "Batman Begins" looked like the perfect candidate. A once-beloved franchise that hadn't been in theaters for eight years, the film had been re-imagined by the hip English director Christopher Nolan and was propelled by an ardent fan base, a huge marketing push and numerous rave reviews.

But like so many other recent releases, the tale of the Caped Crusader failed to save the day, further cementing 2005 as the year of the missing moviegoer.

In an era when a pair of movie tickets can cost more than a DVD, and in a season when the films seem like sorry retreads of years past, consumers are leaving one of America's great pastimes.

Compared with last year, box-office receipts have been down every weekend since late February; the last time comparable business was off for such a long span was in 1985.

This summer's movie season has been especially brutal. North American theater attendance from early May to June 19 was off nearly 11% from a year ago, tracking firm Exhibitor Relations Co. estimated Monday. If the year's overall weak admission trend holds, it will mark the lowest number of moviegoers since 1996 and the third consecutive year of decline, a skid that hasn't been seen since 1962.

Even with the price of a ticket exceeding $10 in some big cities, box-office receipts have fallen almost 7% from a year ago, according to Nielsen EDI, which tracks box-office performance.

Although the inescapable culprit may be second-rate storytelling, the weaker-than-expected opening of "Batman Begins" suggests that other factors are contributing to the decline. The expensive flops include pedigreed films such as "Cinderella Man" and "Kingdom of Heaven," as well as what should have been action blockbusters: "XXX: State of the Union" and "Elektra."

Some people attribute the nose dive to the growing popularity of DVDs, which now can come out mere weeks after movies arrive in theaters. More worrisome, executives say, is the industry's penchant for flooding the market on opening weekend, often putting a would-be blockbuster in more than 4,000 theaters. Beyond the added expense of those wide releases, the strategy leaves little time for curiosity to build for good movies and accelerates bad buzz, which can now be passed with viral speed on the Internet.

"Now at midnight on Friday evening, you're dead or alive," said Lucy Fisher, a producer of the upcoming "Bewitched" and a 30-year veteran of the industry. "However long it took to make the movie, by Friday night, except for Academy[-Award-type] movies, your fate gets cast."

Just as home entertainment systems — including plasma screens and surround sound — have become increasingly lavish, the overall moviegoing experience has become a shell of its former self. Even as theaters offer stadium seats and martinis, moviegoers are being bombarded with countless advertisements and coming attractions.

"Going to a movie theater used to be a unique way of seeing a movie and carried with it a romantic notion — it was a special forum you shared with a group of people," said Terry Press, the head of marketing for DreamWorks. Theater advertising is annoying and ruins the value of movie previews, which are a studio's most powerful marketing tool, Press said. "At least at my house I have the ability to fast-forward through the commercials," she said.

Said Richard Zanuck, a producer of the forthcoming "Charlie and the Chocolate Factory": "I don't like [commercials] at all. People come to see the movie. The movie experience is supposed to be that…. They've come to see the film and not to be sold something else."

In fact, 73% of adults prefer watching movies at home, according to an Associated Press-AOL poll released last week. A quarter of those polled said they had not been to a theater in the last year.

Despite bad news on the home front, the studios have seen some of their losses mitigated by international box-office receipts and exploding DVD sales, which have become increasingly important to the overall profit of a film.

But how well a film does in U.S. theaters typically sets the stage for its profitability. And its opening weekend grosses foreshadow its ultimate domestic take. In this equation, studio executives cynically say, quality has become increasingly irrelevant. Whether good or bad, a film can be expected to make three times its opening weekend grosses in the U.S.

If a movie doesn't do well in its first weekend, a studio will often pull the plug on its marketing resources, saving that money for its video release.

"There's not that much separation between the theatrical release and the video release. It suggests that the movie is becoming the trailer for the DVD," said Jeff Berg, chairman and chief executive of International Creative Management, a talent agency. "Because the studios are compressing the release window [between a movie's theatrical release and its DVD release], it's easier for the consumer to wait 12 to 13 weeks to get the DVD and own it."

Although the final accounting for 2005 releases cannot yet be determined, their domestic runs indicate the prospects are decidedly dim.

The $88-million "Cinderella Man" has grossed just $43.9 million in domestic theaters, and the $140-million "Kingdom of Heaven" has sold only $46.7 million worth of tickets domestically (although it has grossed more than $158 million overseas). "Batman Begins," which cost more than $150 million to make, grossed $72.9 million in its first five days of release. (Movie studios typically collect about half the box-office receipts, with the rest going to the theater owners.) The underachievers also include smaller films such as "The Honeymooners" and "Lords of Dogtown."

Many in the business are hoping this is just a temporary downturn. Some say comparisons with last year are unfair because 2004 included Mel Gibson's surprise hit "The Passion of the Christ," which grossed more than $370 million.

Dan Fellman, president of domestic distribution for Warner Bros., which made "Batman Begins," said the film's opening should not be considered weak. And he suggested that this year's slump wasn't a harbinger of more fundamental change in America's moviegoing habits.

"In any business, whether it's the stock market or whatever, you aren't going to have every year exceed the year prior," Fellman said. "Like any business that has a little bit of a downturn, you can't panic because of six months."

Now show business executives are waiting to see whether Steven Spielberg's "War of the Worlds" can save Hollywood when the Tom Cruise sci-fi thriller opens June 29. But it would need to be almost a "Titanic"-size hit to make up the lost ground.

Quite frankly, the only big-screen flick I’d planned to see this summer was “Revenge of the Sith”, which I think reflects a lot of people’s attitudes these days – if the entertainment experience would be diminished on a small screen then it’s probably worth paying fifteen or twenty bucks to go to a movie, spend a nice away from home and crowd into a theater with a bunch of snotty middle schoolers… if not, then hey! I’d rather watch at home.

- Arik

June 21, 2005

Gruner + Jahr Dump Inc. and Fast Company Magazines

Five years ago Gruner + Jahr paid a total of $571 million for two magazines - Fast Company and Inc. Yesterday they sold them for $35M. Fantastic ROI of -93%. Brilliant. Here's the rundown:

-

Gruner + Jahr, a division of the German media conglomerate Bertelsmann, has reached an agreement to sell its two American business magazines, Inc. and Fast Company, for about $35 million, a fraction of what it paid for the publications, according to a person with knowledge of the deal.

The tentative agreement with Joseph Mansueto, founder of an investment research company, was expected to be announced Tuesday, the person said.

Gruner + Jahr bought both magazines five years ago for $550 million - Inc. from Bernard Goldhirsch for $200 million and Fast Company from Mortimer Zuckerman for $350 million.

Last month, Gruner + Jahr sold its women's magazines - Family Circle, Parents, Child and Fitness - to Meredith Corp. for $350 million. With the sales, the company, troubled by a two-year-old circulation scandal, has effectively shed its American magazines; it retains ownership of a magazine-printing company. As part of the deal last month, if Gruner + Jahr had not been able to sell Inc. and Fast Company by June 30, the two titles would have gone to Meredith.

Initially, about 20 buyers expressed interest in Inc. and Fast Company. The list was eventually narrowed to six: Mansueto, founder of the investment research concern Morningstar; The Economist; Time Inc.; American City Business Journal, owned by the Newhouse family; Alta Communications, a venture capital firm in Boston; and Abry Partners, an equity firm also in Boston that represents managers from Gruner + Jahr.

As of Monday night, only Mansueto and The Economist were still in the hunt. The final decision, the person close to the sale said, hinged on Mansueto's desire to keep the magazines afloat, saving about 100 jobs.

"It was very, very tight," this person said. "There were a number of small things that added up, but Mansueto will continue to publish Fast Company, and The Economist didn't plan to do that."

Mansueto is chairman and chief executive of Morningstar, based in Chicago, which provides a broad array of financial information to individuals and professional investors through newsletters and online services. It was Mansueto as an individual, not the company, that bid for the two titles. He is also a part owner of Time Out Chicago.

Gruner + Jahr drew unwanted publicity in 2003 during a trial between the company and Rosie O'Donnell, a former talk show host, over a failed venture.

TheDeal.com reported yesterday that the Economist actually had the higher bid:

-

While Morningstar founder Joe Mansueto has the inside track in the auction for Inc. and Fast Company magazines, the Economist Group is closing fast, with a deal hinging on a few critical factors that could bring victory to either party, according to a source close to the process.

None of the issues to be resolved are contractual, said the source. Rather, they are deal-specific. For example, Inc. and Fast Company operated as a department within a division (Gruner+Jahr USA) within a corporation (Bertelsmann AG). As such, neither magazine has audited financial results. The question for Mansueto and the Economist Group is: How comfortable do you feel doing a deal without them?

According to the source, the Economist Group actually submitted a richer offer than Mansueto, though neither bid is believed to be much higher than $40 million. But given the strict June 30 deadline, Mansueto's flexibility — he can simply write a check without seeking board approval — gives him an edge.

Mansueto's plan to continue publishing Fast Company, which was widely expected to be shuttered with a change of control, also works in his favor. So, too, does his relationship with auction manager AdMedia Partners Inc., with whom Mansueto worked on taking a 40% stake in Time Out Chicago a few years ago.

But the Economist Group did submit a higher offer than Mansueto and, according to the source, "really, really wants" Inc. and Fast Company. And unlike Mansueto's investment in Time Out Chicago, which is a passive one, re-establishing Inc. and Fast Company as viable consumer magazines will be a massive undertaking that will fall squarely on Mansueto's shoulders.

Best of luck with that... sounds like he'll need it.

- Arik

May 02, 2005

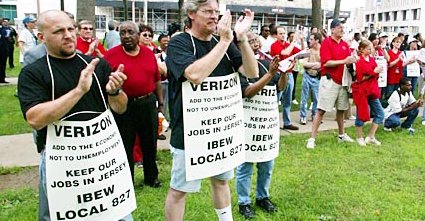

Throwing in the Towel: Verizon "Wins" Qwest for MCI

Verizon will acquire MCI for $8.35 billion after Qwest capitulated, saying the bidding process was "permanently skewed" against it. Verizon won its costly, 11-week fight to acquire MCI on Monday after Qwest bitterly withdrew from the bidding war deciding the long-distance company "never intended to negotiate in good faith." The final blow came when MCI said some of its biggest customers just don’t want to do business with Qwest, so Qwest "qwit" a few hours later.

The best part of the deal for Qwest is, it cost its rival a billion dollars (almost) more than it'd originally intended, perhaps having the desired effect the company had been seeking all along. Here's a rundown of the bloodbath from the Washington Post:

-

Though marred by one of the largest accounting scandals in U.S. history and a shrinking business of providing long-distance service for consumers, MCI still sports a valuable stable of corporate and government customers that Verizon and the much smaller Qwest sought in order to compete in the new environment. MCI also operates an extensive chunk of Internet "backbone," the network that carries data traffic around the world.

For Washington area MCI employees, the buyout probably will bring more pain and uncertainty after several years of steady layoffs.

In February, when they first made plans to team up, Verizon and MCI said the acquisition would save about $1 billion a year and result in the loss of 7,000 jobs from a merged workforce of about 250,000. The firms have not said how many of those jobs might be in the region, where they employ roughly 3,500 people.

In choosing Verizon's sweetened bid over the weekend, MCI's board spurned for a third time higher offers from Qwest. Qwest lashed out at its takeover target upon hearing the news yesterday but said it would end its pursuit.

"It is no longer in the best interests of shareowners, customers and employees to continue in a process that seems to be permanently skewed against Qwest," the Denver-based phone company said in a news release.

"It is only fair to conclude that MCI is more interested in bending to Verizon's will than serving its shareholders."

If the AT&T and MCI takeovers are approved by the Federal Communications Commission and the Department of Justice, they will all but eliminate the independent long-distance business that flowered after regulators forced phone companies to share their lines.

Today, regional phone giants such as Verizon and SBC can offer long-distance service bundled at attractive prices with local service, while their wireless divisions offer free long-distance service.

Internet telephone service also is growing, with some plans including low-cost calls to Canada and parts of Europe.

Verizon's latest bid for MCI, totaling roughly $8.5 billion in cash and stock, is less than Qwest's latest offer of roughly $9.74 billion. But MCI's directors reasoned that the much larger Verizon is less burdened by debt, has an extensive wireless business and could take better advantage of MCI's assets than Qwest.

"From the standpoint of risk versus reward, Verizon's revised offer presents MCI with a stronger, superior choice," said MCI Chairman Nicholas deB. Katzenbach.

Under Verizon's latest offer, MCI shareholders would receive about $26 per share, $5.60 of which would be in cash and the rest in Verizon stock. The total price tag of the deal could rise depending on the price of Verizon stock.

Overall, Verizon's offer is about $900 million more than its previous bid.

Qwest's offer would have netted MCI shareholders about $30 a share, with about $16 in cash and $14 in stock.

MCI said in a news release that "a large number" of its business clients said they preferred an acquisition by Verizon and requested the right to terminate their contracts if Qwest were the buyer. MCI did not name the customers.

Some large MCI shareholders, who had helped keep the bidding war alive, continued to criticize the company's board for consistently embracing lower Verizon bids.

"No one jumped for joy" when Verizon revealed its latest offer, said David Ahl, an independent telecommunications consultant who is advising several of MCI's biggest shareholders. "No one said 'Oh, we're saved.' "

Ahl, who also personally owns stock in MCI and Qwest, said the new Verizon bid appeared designed primarily to bring other MCI shareholders up to par with Mexican financier Carlos Slim Helu, who had been the company's largest owner.

As the prospect of a proxy war for the company grew, Verizon secured a 13.4 percent stake in MCI by buying Helu's shares for $25.72 each, higher than its bid for the company at the time.

Ahl speculated that Qwest might still urge MCI shareholders to reject the Verizon deal.

But Steven M. Cohen, chief investment officer of Kellner Dileo Cohen & Co., a New York hedge fund that holds MCI stock, said it appears to him that Qwest is abandoning its pursuit.

"I'm disappointed in the MCI board," which "repeatedly has given its blessing to a lower-priced Verizon bid," Cohen said.

A Qwest spokeswoman declined to comment about the company's plans beyond its written statement. "The proposed industry mega-mergers will undoubtedly reduce consumer choice," the company said. "These issues will need to be addressed during the regulatory approval process for the Verizon/MCI and SBC/AT&T mergers."

Qwest already has told regulators it opposes the SBC-AT&T combination.

Of course, the fix was in a while back from the shareholder lobby. Three weeks ago, Mexican billionaire Carlos Slim Helu sold his shares of MCI to Verizon for more than $25.72 per share, which, with contingencies factored in, amounts to more than $27.00 per share. Since then, a number of MCI’s shareholders have been openly critical of MCI’s board, saying that it was creating two classes of shareholders by accepting any Verizon bid below what Slim was getting.

Still, Qwest stuck it to Verizon in the end - and the biggest winners in all of this are MCI's shareholders. Carlos Slim alone netted several hundred million dollars profit from those MCI bonds he bought on the cheap a few years back in the post-Worldcom fiasco. And that's real money.

- Arik

April 02, 2005

April Fools: Google Gulp Fakes-Out Investors with Diversification Strategy

Google put one over on users Friday, pitching a new product called Google Gulp on its home page, a new line of "smart drinks" designed to "maximize your surfing efficiency by making you more intelligent, and less thirsty," Google said.

Google put one over on users Friday, pitching a new product called Google Gulp on its home page, a new line of "smart drinks" designed to "maximize your surfing efficiency by making you more intelligent, and less thirsty," Google said.

Naturally, April Fools!

Well, it was original, anyway... and one mightn't doubt their aspirations for other lines of business, when they just can't shake the one-trick-pony label despite all the attempts at diversification.

- Arik

March 28, 2005

The New Sony PSP Handheld: a Clear Victory of Form Over Function

Immersion Corp., a San Jose company who, in a 2002 lawsuit, accused Sony of patent infringement with the Dual Shock controller for the PlayStation and PlayStation2. Dual Shock technology makes the controller shake in rhythm with what's going on in the game. Sony denies that Dual Shock violates Immersion's patents and, while the district court decision included an order to suspend PlayStation sales, that order does not hold while an appeal is being heard so Sony will continue to sell its game machines in the United States.

But the bigger question may be, will anybody buy this thing? The PSP faces tough competition from the Nintendo DS as it sparks a battle for the $4.5 billion global handheld entertainment market, just at a time when Sony's in the midst of a pitched internal battle to get back on its feet after product successes fell short. Then, the PSP launches as more of a legacy product than anything - c'mon guys, the Memory Stick is a big failure and your failure to use non-proprietary technology standards will lead to the ultimate failure of the consumer electronics business in the long-run! I cannot believe you people can't see this!?! Simply stunning. Anyways, Red Herring broke it down for us on how the competitive battle lines are drawn:

-

The PSP’s unique features are console-quality graphics, a 24-title movie lineup, Wi-Fi capabilities, and the amalgamation of games, music, and movies in one gadget. Sony is expected to ship at least 3.7 million units to North America during 2005, according to research firm IDC.

Nintendo, so far, has been the leader in the portable gaming market with the GameBoy Advance and, more recently, the $150 Nintendo DS. The $250 PSP is the “first legitimate competitor to Nintendo’s dominance” in the handheld market, said IDC analyst Shelly Olhava. Other competitors in the market are Nokia’s Ngage portable and Gizmondo Europe’s portable.

David Cole, an analyst with DFC Intelligence, thinks that the PSP could become a long-term product and build a base for Sony for several years. “[Sony] is so strong in the game industry, it should do very well,” said Mr. Cole. “It really satisfies the need of the portable audience.”

The target audience for the PSP is adults between the ages of 18 to 34 rather than the younger audience gaming companies usually target. Nintendo, on the other hand, is more popular with the younger audience. “I think Sony decided that’s where they were really strong,” said Mr. Cole.

The PSP is a black gadget weighing just under 10 ounces with a 4.3-inch widescreen and high-resolution TFT display. It also has digital photo display and supports digital music playback in MP3 and ATRAC formats.

The processor is a high-capacity Universal Media Disk (UMD), which is an optical medium enabling feature films and high-quality games to be played on the portable. The 60-mm disk has a storage capability of 1.8 GB. This format will be utilized across the Sony family of products and is available for outside hardware makers and non-game entertainment content providers to use.

The portable gaming market worldwide was about $4.5 billion in 2004 and is expected to grow to $9 billion in 2009, according to DFC Intelligence. The PSP first launched in Japan on December 12 and has sold 1.18 million units there so far.

Mr. Cole expects the PSP to get a better reception in North America, where Sony plans to ship 1 million units for the launch. Company officials said that most U.S. stores are on their third and fourth waiting lists for the PSP. “The Japan market hasn’t been doing very well in general. Any product tends to do better [in the U.S.],” he said.

European launch uncertain

Analysts are expecting long lines outside stores on the night of the launch in North America. The demand for the PSP has reached such a peak that its European launch, which was scheduled for March 31, could take several more months.

Ms. Olhava said Sony hasn’t been able to handle shipments because of logistical problems. “I have heard that Sony has manufacturing issues,” she said. “It’s a brand-new product and it’s bound to have some hiccups along the way.

One problem could be the $250 price. “It’s an unproven price point and that will be a real challenge,” said Mr. Cole. Early adopters are price-insensitive, he said, but consumers will get tighter with their wallet after the first 1 million sales.

The Nintendo DS has already launched in the three major markets—North America, Europe, and Japan. The DS, which launched in North America on November 21, sold 1.5 million units by February. Company officials have said that Nintendo plans to ship 6 million DS units globally by the end of March.

Analysts feel the 2005 holiday season and the software availability will determine which portable product succeeds. “Both the DS and PSP are excellent portable systems,” said Mr. Cole. “You really will be able to get the analysis going into the holiday season.”

Meanwhile, every review I've read of the device itself leaves me wondering if it's worth the trouble. Jim Louderback has a few backhanded compliments in that regard, "it's going to redefine handheld gaming. But it's not going to be as popular or as successful as everyone claims. If Sony's expecting an iPod killer, this isn't it. Here's what I see as the good and the not-so-good in Sony's latest platform." More of his review is excerpted below:

-

Screen: A standout display, for sure. It's big, wide, and captivating. Colors are rich and detailed. Response rates seemed superb while I was playing Ridge Racer. But there's a downside to all those pulsating pixels, too. First, Sony opted for a very reflective coating. This makes the image look great, but also turns the screen into a mirror in bright light. Even in lower light, the reflections can become annoying in some situations. Don't plan on taking it hiking; this is not a player for the great outdoors.

Graphics: Far better than the competition's, the graphics engine made the smallish screen look much bigger. Although some of the early titles probably won't take advantage of all the power, Ridge Racer at least looked fantastic.

Sound: I have no complaints here. The audio quality was simply stunning on my tests, especially when paired with high-quality headphones. The built in speakers are weak and tinny, as you can imagine, but the top-notch audio—when combined with the zippy screen—creates a truly immersive gaming experience on the go.

Controls: The PSP includes the standard complement of PlayStation 2 controls—although it has only one joystick and one pair of shoulder buttons—and pads that are reasonably easy to use. It has no touch screen, unlike the Nintendo DS, but includes a real portable-gaming breakthrough: a tiny round nub that appears to be the twisted progeny of a joystick and the IBM TrackPoint mouse replacement. Instead of having to be yanked back and forth, this "pointing pad" glides almost effortlessly across a small part of the PSP's surface. It provided a perfect stand-in for a steering wheel in Ridge Racer, and it'll probably become the controller of choice for all but the most precise and demanding tasks.

Games: The PSP's launch library is good for a new platform, with about two dozen titles available now. Over time, expect to see PS2 retreads and brand extensions galore. But those titles will only reinforce one of the PSP's problems: It's a portable version of a home console, but nothing more. The Nintendo DS, with a touch screen, microphone, and unique dual-screen design, offers more potential for breakthrough styles of portable gaming that don't rely on the archetypes established by console games.

Just because you build it, however, doesn't mean they'll come. Even though the DS has been out for four months, only a paltry number of titles are available, and few take much advantage of the unique DS features. The DS has one ace card: It's compatible with the huge library of Game Boy Advance titles too, which makes it a better upgrade for existing Nintendo handheld customers.

Movies: The PSP has also been widely touted as a portable movie player. The device includes a new optical disc format, called UMD (for Universal Media Disc). Each disc is about twice the size of a quarter, and can hold an entire movie. In fact, the first million PSPs here in the U.S. will come bundled with Spider-Man 2 on UMD. Sony's penchant for launching unsuccessful proprietary media formats is legendary (witness Beta, Memory Stick, etc.), and I believe UMD as a broad media storage technology will fail here, too.

Why? First, because it's highly unlikely that many users will purchase movies in a format that works only on portable players—and no one will replace their home DVD player to go with UMDs. Movie availability is likely to be limited to Sony's back catalog and a smattering of other titles at first, so there won't be much to watch. What about rentals? The picture is murky there, too. Shernaz Daver, from Netflix, said that the company "will support any format as long as it becomes popular," but wasn't ready to commit at launch.

The big bugaboo here is that you can't make your own discs. And if Junior can't drop Letterman or the X Games onto a disc at night and watch it the next day, then the idea that any significant number of people are going to buy the PSP to watch videos is moot.

About five years ago, a company called Data Play released a nifty new quarter-sized optical media format. It was recordable, tiny and promised a revolution in media players. But before Data Play could get it to market, tiny hard-drive and flash-based players took off. Data Play sunk without a trace, and even though Sony has far bigger resources to bring to bear, UMD will too.

Oh, one other fundamental drawback for the PSP as a movie and video player: It lacks a kickstand or other way to keep it upright. Playing games is interactive; you want to hold the player while you frag. Watching video is passive and, based on my experience with first-generation portable video systems from Archos and Creative, if it doesn't stand on its own, it just isn't worth carrying.

Music: The PSP has the potential to be a great music player, but unfortunately it relies on a flash-based Memory Stick to store music. The system comes with a 32MB Memory Stick, enough for an hour or so of very compressed music—if you didn't have to share the Memory Stick with saved games. But even if you also picked up a 1GB Memory Stick—for an additional $130—you still wouldn't have enough space for music. I frequently hear iPod Mini users complain that even 4GB isn't enough for them. Sure, you can pick up a 4GB Memory Stick, if you've got a spare $500 lying around. I suggest a Creative Zen Xtra or Apple iPod instead.

In a pinch, the PSP can stand in as a music player. But until you can load 10GB or more onto the system—without spending as much on the memory card as you would on a brand new iPod—few people will use it as their primary music player. To support music and movies, Sony will have to add a mini-hard drive to the PSP, which will only make it heavier and more power-hungry.

Battery Life: Speaking of power, Sony claims you can get six hours of hard-core game play or movie playback on a single charge. If the PSP delivers on that promise, that's good. Based on my own experience with battery-powered devices, though, you're better off cutting that number in half. Even three hours of game play or movie watching is pretty good, except when your batteries cut out during a long flight or a boring class. Better pack a spare battery or two.

Price: $250 for a game-playing, movie-watching, music-playing device is pretty darn good, especially for one with a screen as beautiful as the PSP's. It must cost them more than that to make each one, which means they intend to profit on the games and the movies, instead.

To justify that price, though, the PSP will have to do more than just play games, as Nintendo's offerings cost half as much or less. Many hard-core gamers will certainly pony up, but the jury is out on whether enough casual gamers will adopt it to make it a success. My best guess is no.

Connectivity: Like the DS, the PSP will ship with built-in wireless networking. That's great for group gaming, but why is there no built-in Web browser or e-mail client? And no way to connect your PSP to your PC wirelessly to transfer music and movies to the Memory Stick? All the parts are there, but the whole is sadly lacking. I, for one, would love to see Skype for the PSP—that would have been a real breakthrough!

Reliability: This is the great unknown:. How well will the PSP hold up to months and years of heavy playing and portable jostling? I'm not particularly bullish, especially because that large screen is unprotected. Sure, the PSP comes with a slip-on foam case, but it's so nondescript that I almost lost it five times in one week. In just a few short months, a scratched screen will take much of the luster off of the PSP.

The Nintendo DS's clamshell design makes it much more likely to survive years on the road, especially in the backpacks of all those hyperactive kids and one clumsy journalist. I was almost scared to travel with the fragile-seeming PSP, particularly because we only had one in the entire company.

And how long will the battery last? Regular gamers will probably need a new one every year or so, which creates a tremendous after-market opportunity.

Finally, what about the internal software? Is it robust enough for all the banging—and hacking—that's bound to go on? Will it need regular flash updates? And how do you distribute a flash update to the PSP if you don't have a wireless network? Via UMD? Memory Stick? I don't know about you, but I certainly don't have a memory stick reader for my PC. Fortunately there's also a standard USB 2.0 port. Perhaps you'll download updates off the Web site and send them to the PSP via this port.

All in all, I think the PSP will be extremely popular among hard-core gamers, especially those who spend hours each week banging on their PS2s. I wouldn't buy it for kids, though, because it's too fragile. And I think the lack of robust media playback—non-writable UMD, paltry and expensive Memory Stick storage options—make it less than ideal for casual gamers.

In the end, the PSP excels at just one thing: portable gaming. Casual gamers who already own a satisfactory portable gaming platform, whether it's an old Game Boy Advance or even a game-playing cell phone, have little incentive to switch. And anyone looking for a portable media player that will unseat Apple's iPod needs to keep looking. Because when it comes to everything else, the PSP just doesn't cut it.

And, PC Magazine sums it up even more concisely, a victory of form over function:

-

Those in the target demographic have eagerly awaited its arrival. And even people other than 15- to- 25-year-old males may have more than a passing interest in one of the year's most anticipated pieces of gadgetry: the Sony PSP. Originally conceived as the PlayStation Portable (and now simply called the PSP), the slick, gorgeous device succeeds spectacularly as a portable gaming console. If you view its music- and video-playback capabilities as bonus features, you'll be thrilled; if you were hoping it would be best-in-class at all its endeavors, you'll be slightly disappointed.

Clearly breakthrough product innovation can make or break the company that gets it to market; but there must be a compelling customer value-proposition inherent in the product itself, differentiated in the way it is built/sold/positioned, or it must be disruptive to existing markets for there to be a hope for success. It sounds to me like the Sony PSP falls short on all three counts, despite all the hype and lawsuit PR.

- Arik

March 14, 2005

Dr. Dre's Protégé Formula: The Secret to Aftermath's Hip-Hop Success

Brendan Koerner broke it down for us in a fascinating analysis on Slate.com of the secret to the success Dr. Dre's formulated at Aftermath Entertainment in grooming protégés like Eminem and 50 Cent to supa-MC-dom... The Game appears to be next up.

-

Dre isn't just consistently good—he's good in a consistent way. No matter if the front man is 50 Cent, Eminem, The Game, or Dre himself, the man's sound is similar from album to album. Dre achieves this by working with up-and-coming talents rather than established MCs who might want too big a say in how the album turns out. Dre was attracted to The Game because of his gangster persona and laid-back vocal style, but a more important factor might have been the young rapper's willingness to subordinate his technique to the Dre formula—the beats come first, and the lyrics are dessert. Meanwhile, ego clashes recently scuppered planned collaborations between Dre and Rakim, and Dre and Ice Cube.

Dre also realizes that once he's created a star, he can no longer exert his preferred level of control. Which may be why he rewards his former protégés with labels of their own (Eminem has Shady Records, 50 Cent has G Unit). It gives them something to do, which frees him up to look for more pliable talent. The end result? A sound that's so consistent the industry's hype artists can bank on it. Magazines and clothing companies can be confident that the pre-release capital they spend plugging Dre's protégés is a safe bet—sort of like buying hip-hop's version of municipal bonds.

When it comes to winning this kind of free, pre-release exposure, Dre has one last trick up his sleeve: He keeps himself scarce. Contrast the Dre approach with that of more prolific beatsmiths. The Neptunes, for example, rent themselves out as hired guns so often that a new Neptunes-produced track is certainly no cause for an XXL cover story. Dre, on the other hand, rarely takes on freelance work for non-Aftermath artists, preferring to keep his creative focus on projects he controls completely. Since 1998, only five albums can truly be considered pure Dre projects—the first two releases from Eminem, the debuts of 50 Cent and The Game, and his own 2001. The scarcity of Dre's work ensures that each release is an event, one that garners lavish media and consumer attention. And as music snobs are forever complaining—and the inexplicable success of Ashlee Simpson's Autobiography proves—exposure is what really propels an album to No. 1.

Ah, yes... invoking the name of Ashlee "Appetite for Humiliation" Simpson in the same piece as Eminem and 50 Cent... what's the world coming to? Still, the lesson of "if you love it, let it go" in constructing a hip-hop dynastic family network serves as an interesting model for spinning off success in promising new acts.

One the rest of the business world might well learn from... step up to get your rep up.

- Arik

March 11, 2005

Dan Rather Steps Down from CBS Evening News Presenting Opportunity for Media Innovation

Dan Rather's last night as anchor of the CBS Evening News, leaving 24 years to the day after taking over from predecessor (and only the second anchor in the history of the broadcast) Walter Cronkite, came and went with a touch of drama and sadness, despite the fact I've never considered him much of a "news man". Here's hoping, as he wished himself in an interview, that his best days are indeed ahead of him.

The larger question now is, wither the CBS Evening News? In an era when the whole genre is encountering shrinking viewership and increasing dependence on the wrong demographics, this presents some startlingly interesting opportunities for CBS to effect change - and, with it, competitive advantage - in revamping the medium for the modern era. Slate.com's media critic, Jack Shafer, offered up some cool ideas:

-

CBS should worry less about who anchors its evening news ship than what the ship looks like. Any of the current CBS doofuses will do as an anchor. It's not like Brian Williams and Peter Jennings light my charisma candle. CBS could steal a march on NBC and ABC and the cable networks by designing a program that reflects changing viewer habits. It needs to break the code of why viewers have turned off the news.

First, CBS should target serious news consumers, the sort of devotees who follow breaking news all day through news radio, cable, and the Web. Dedicate the program to breakingest of breaking news and ditch the news-you-can-use and heart-warming features unless they're stupendous. Produce a program that's worldly and doesn't waste time. The BBC World News, which airs on many PBS affiliates, is a good model, even if it is excessively chatty for my tastes.

Next, reduce the number of commercials. Right now, about eight of the 30 minutes of an evening news slot are ads, which makes the program too short and too frequently interrupted to be compelling. The Journalism.org study asserts that one reason the network's morning "news" programs have gained viewers steadily since 1998 is that viewers have realized that they often program big blocks—up to 20 minutes—free of commercial interruption. Advertise the CBS Evening News as the program that gives hardcore news consumers two minutes more news per half hour. Cutting ads will reduce revenue, of course, but it will build audience, which is the longterm problem the program faces.

Swing a deal with CNN to rebroadcast a refreshed version of the CBS Evening News in the 10 p.m. slot. One reason behind the evening news fade is that it's still scheduled for an era when moms stayed at home and cooked for dad, who didn't have a long commute. How many 30-year-olds do you know who would watch the evening news at 6:30 p.m. or 7 p.m. if you paid them? The network's morning shows have benefited by giving busy viewers a two-hour window through which to watch. Nobody expects them to watch the whole thing. A 10 p.m. cable slot for the CBS Evening News would similarly appeal to busy people. Sharing news resources with CNN, which has been on the table before, would be an excellent idea to add quality and scope to CBS's coverage.

Next, CBS News should partner with a premier daily newspaper—the New York Times, the Washington Post, the Los Angeles Times, or the Wall Street Journal—to give viewers a taste of tomorrow's news tonight. The networks already use the morning New York Times as a cheat sheet for the evening program. Why not use it as a preview of tomorrow's news? The New York Times already does a two-minute show based on this idea for the Discovery Times cable channel at 10 p.m., so W. 43rd Street might not be keen on partnering. What's in it for the newspaper to partner? The Web sites for both the Post and the Los Angeles Times already draw more readers nationally than they do locally. CBS News could steer additional eyes to those Web pages.

Next, hire a brainy and thoughtful commentator. Eric Severeid (good), Bill Moyers (bad), and Bill Bradley (uneven) once delivered interesting commentaries on CBS Evening News. In our increasingly opinionated world, CBS would seem futuristic by going retro and including a video columnist.

TiVo and other technologies have destroyed the concept of "appointment viewing." CBS should respond by putting the goddamn broadcast on the Web. Computers and television aren't converging—they've converged—and I want to watch the news 1) when I want to watch it and 2) on whatever monitor I'm looking at. CBS could start by streaming the program onto the Web at the same time it broadcasts the show. Then it should video-podcast it. Other time-shifting opportunities await. Monetize the evening program by putting it on the various cable video-on-demand services. Do the same with the CBS News archives. Wired Editor Chris Anderson's "long tail" thesis implies that there's money in all of those old documentaries, news magazines, and news casts. Thomas W. Hazlett of the Manhattan Institute urges CBS to allow viewers to personalize the Web version of the news and suggests that it be the first network to bring television news video to capable cell phones.

George Washington University professor of journalism Mark Feldstein thinks a network should abandon the traditional evening news time slot and program an hourlong news show starting at 8 p.m. Producing a money-making news program in prime time will become economically feasible if network entertainment ratings continue to decline. Ceding the 6:30 p.m. or 7 p.m. slot back to the affiliates would make them very happy (because it will make them money).

Arizona State University professor of journalism Craig Allen, author of News Is People: The Rise of Local TV News and the Fall of News From New York, suggests that one of the networks will eventually euthanize the program. Eliminating an early evening program from a network line-up was one of Rupert Murdoch's bright ideas when he started Fox. Instead of battling the other networks for profits in an overpopulated news slot, Murdoch programmed entertainment at the local level and put his energies into producing an hourlong local program at 10 p.m. for the various Fox affiliates that he owned.

The woolly mammoth was far too specialized—and too dumb—a beast to adapt to its changing environment. The producers at CBS News may be specialized, but they're not stupid. But if they continue to play by the current set of evening news rules, they're destined to to lose. Unless they want future news archaeologists to find them frozen alive in pack ice, they need to stop thinking about who is going to be their next anchor and start changing the news environment. Without subscribing to his news values, they need to ask themselves, What would Rupert Murdoch do?

Indeed! Murdoch might have objectionable politics for some, but he seems to know how to appeal to the marketplace with exactly what people want to watch. Taking a page from his competitive strategy seems like the best idea CBS has gotten in... oh, I dunno... about 24 years.

- Arik

March 10, 2005

Gates Gets His Groove On: Fulfilling Upgrade Value-Prop Strategy for Longhorn & Office in 2006

Fresh from his recent knighthood with the Queen, this morning's announcement that Microsoft would acquire Ray Ozzie's Groove Networks was viewed with broad optimism by most as the father of Lotus Notes, Microsoft Exchange's biggest competitor and, later on, an ultimate victim of Redmond's unrelenting competitive strategy, is set to become Chief Technology Officer at Microsoft in the process. Here's a good summary of what went down:

-

Terms of the deal weren't disclosed. Groove will continue to be run out of its Beverly, Mass., headquarters and will become part of Microsoft's Information Worker Business. Ozzie will report directly to Microsoft Chairman and Chief Software Architect Bill Gates.

Founded in 1997, Groove develops peer-to-peer software called Virtual Office that enables ad hoc workgroups to collaborate seamlessly in realtime.

Groove's software complements Microsoft's SharePoint Services and SharePoint Portal Server. Groove has worked closely with Microsoft on its collaboration technologies since its founding. In October, Microsoft invested $51 million in Groove, acquiring a 20 percent stake in the ISV. Redmond, Wash.-based Microsoft later was part of $38 million investment in Groove after the company had layoffs and a restructuring. Overall, Groove has received $155 million in financing since its founding.

Ozzie is best known for his creation of Lotus Notes. He left Lotus after the company was acquired by IBM and launched Groove as a dedicated Microsoft ISV. Lotus Notes competes directly with Microsoft Exchange. But in 1994, Microsoft named Ozzie a "Windows Pioneer," a rank given to only seven people, Microsoft said.

However, this wasn't all that surprising... Here's a summary of the technology and business implications:

-

Industry observers have long predicted that the two companies would combine forces because of Microsoft's substantial investment in Groove and the latter's innovative offline, peer-to-peer (P2P) and authentication capabilities, which enable ad hoc workgroups across firms to collaborate with outside partners, suppliers and customers.

Gates formally announced the agreement to acquire Groove on Thursday, saying that the Beverly, Mass.-based company's technology would be tightly integrated with Microsoft's next generation of Windows, code-named Longhorn, and Microsoft Office 12, including SharePoint. Other company executives said the "trifecta" of Office/SharePoint, Microsoft's Live Communications Server 2005 realtime platform and Groove's Virtual Office will extend Microsoft's lead in the collaboration space. They also hinted that Groove's technology would be integrated with Microsoft Business Solutions (MBS) offerings that support customer business processes.

"The way people work across locations and different organizations requires new technologies, and the Groove product has fantastic and unique features we want to fit into the Office system," Gates said in a conference call Thursday from Microsoft's Redmond, Wash., headquarters. "The P2P and authentication capabilities Groove built into their apps, we want to take the equivalent things we've been incubating at Microsoft and bring them in to strengthen the platform. One big thing about Longhorn will be its peer-to-peer capabilities."

Microsoft has long struggled with P2P technology and had invested in a Windows XP P2P development kit, but little became of that effort. Besides giving Microsoft's collaboration strategy a boost, Gates said the company's deal to buy Groove also fulfills a longtime dream of hiring Lotus Notes creator Ray Ozzie, the chairman, CEO and founder of Groove. Ozzie will serve as one of Microsoft's three CTOs, reporting directly Gates.

Ozzie's contributions as one of the early application developers on DOS and Windows and later on Lotus Notes and Groove's Virtual Office make him an ideal candidate for Microsoft's senior leadership team, according to Gates. "For me, I've thought about hiring Ray and his team for a long time. It's a big day for me that is finally taking place," he said.

The Groove acquisition will accelerate Microsoft's ambitions in the collaboration space, especially against rival IBM, said David Via, CEO of Wolcott Systems Group, a Fairlawn, Ohio-based solution provider. "It's a huge coup for Microsoft. Ray [Ozzie] is one of the most respected figures in the industry," Via said. "It could be to Groove what IBM's acquisition of Lotus was back in '95, a huge accelerator."

Other Microsoft partners also expressed enthusiasm, noting that Groove's software fills a big hole in Microsoft's collaboration lineup. The deal is plus for all partners in Microsoft's Information Worker division, noted Ted Dinsmore, president of Conchango, a New York-based solution provider.

"This fills in a hole in the office to back-office position for Microsoft. The offline feature is the hole, and Groove's peer-to-peer [software] allows better fits between Windows SharePoint Services and SharePoint Portal Server [SPS]," Dinsmore said. "With this acquisition, there are no competitors that have this depth, a full suite of collaborative [applications]. The question then becomes, what will IBM do now?"

Another Microsoft partner agreed. "We love it," said Ken Winell, managing executive at Vis.align, a West Chester, Pa.-based solution provider that recently acquired collaboration services provider Econium. "[The Groove deal] gives Microsoft the ability to tackle the offline and mobility piece of collaboration that has been missing in their stack. One of the key issues that enterprises encounter with SharePoint is the ability to move and work on documents while not connected. Users can check documents out; however, the extra steps required are not as intuitive as the Groove Mobility workspace for SPS. It allows me to select which documents and folders I want to bring with me, and then when I connect it seamlessly syncs."

Groove's technology also will integrate with and leverage Microsoft's instant-messaging and realtime communication platforms, Winell added.

Gates said the ability for Microsoft customers to immediately build on their current investment in SharePoint with Virtual Office--and enhance that later--made Groove a compelling buy for Microsoft. Groove's file-sharing technology, for example, lets users insert sharing, synchronization and conversation icons directly into Windows Explorer. That enables every Windows folder to have an attached Groove button that can turn the folder into a SharePoint workspace, allowing users to share the folder with people inside or outside the company and have chats and conversations within that folder. Groove's Virtual Office 3 upgrade, announced last summer, for the first time targeted the company's software at small and midsize businesses, extending the vendor's traditional base of enterprise and government customers.

Michael Cocanower, president of ITSynergy, a Phoenix-based SMB solution provider, said he currently doesn't deploy Groove software but held a seminar this week about SharePoint's value to lower-midmarket customers. The integration of Groove's technology and Microsoft's collaboration platform and SharePoint Workspaces can only be a good thing for the SMB space, he said.

"It seems to me that their product/feature set will ultimately become integrated in the SharePoint platform," Cocanower said. "This [acquisition] announcement seems to only enforce that making an investment in SharePoint is a good investment for the future."

Yet one Groove competitor in the SMB space disagreed. "By announcing its acquisition of Groove Networks, Microsoft has made a move but still finds itself with a complicated, peer-to-peer collaboration technology that does not address the massive SMB space," Rick Faulk, CEO of Intranets.com, said in a statement. "Unlike Groove's technology, we believe that professionally managed and hosted Web-based solutions--available from anywhere with an Internet connection--are the best way to serve this market.

Ozzie and Microsoft Information Worker Group Vice President Jeff Raikes also participated in the acquisition announcement from Groove's Beverly headquarters. "[Groove's software] will influence how collaborative technology can be broadly used across Microsoft applications and business proceses," Raikes said.

The integration of the two companies' platforms and peer-to-peer distributed capabilities will enable Microsoft to extend its lead in Office and SharePoint collaboration outside the firewall, Ozzie said. With the deal, Ozzie said he will "set up a life in Redmond" but also retain his home in the Boston area. "I'll be spending a lot of time on planes," he quipped. As a Microsoft CTO, Ozzie will serve alongside Craig Mundie, senior vice president and CTO of advanced strategies and policy, and David Vaskevitch, senior vice president and CTO of Microsoft's business platform.

After the announcement, Groove President and COO David Scult said there are no plans for any layoffs at Groove, which employs 200. He declined to comment on financial aspects of the deal, terms of which weren't disclosed. Microsoft already owns roughly 40 percent of privately held Groove in the wake of several investments since the collaboration software vendor's founding in 1997, including an initial $51 million funding in 2001.

The Groove operation will continue to be run out of Groove's Beverly headquarters, according to Microsoft. Though Ozzie will serve as a Microsoft CTO, he and Scult will continue to oversee the Groove operation, a Groove spokesman confirmed.

Groove runs a consulting services arm as a nonprofit support center for enterprise customers, and recently the company began developing a partner channel for the Virtual Office 3 upgrade, Scult said. The consulting unit serves as a "trusted adviser" to customers, Scult said. He declined to say if Groove's consultants will be folded into Microsoft Consulting Services or if Groove's handful of channel partners will be inducted into Microsoft's partner program.

News of the Groove acquisition comes on the heels of Microsoft's Convergence 2005 conference for the MBS division. At the event, Microsoft took the wraps off its next-gen, realtime collaboration suite, including the Office Communicator 2005 client--formerly code-named Istanbul--and Microsoft Office Live Communications Server 2005 Service Pack, as well as Microsoft Office Live Meeting 2005. Also this week, Groove announced the Virtual Office 3.1 update.

Of course, for a company who's biggest competitor seems lately to be itself, with its installed base of software users already on Office and Windows witnessing diminishing returns from the upgrade path coming up in 2006, the Groove acquisition provides a good reason to consider the upgrade, especially in the enterprise:

-

The deal poses some interesting questions for how both companies will weave in Groove's collaboration software with two critical releases expected from Microsoft in 2006, namely the long-awaited next version of Windows, code-named Longhorn, as well as the next version of Office designed to fully exploit Longhorn.

"Microsoft has two big releases coming next year in Longhorn and Office 12, which are radically different from their predecessors. They both have millions of lines of code, hundreds of developers, and programming teams well into their development phases. It is going to be hard to take a step back and stitch new technology and strategies into those products," said Nate Root, a vice president with Forrester Research, in Cambridge Mass.

Root and other analysts said they had been expecting the acquisition for some time, and generally think it makes strategic sense.

"Microsoft and Groove have been outstanding partners. Microsoft has been able to kick a lot of business Groove's way because Groove fills in a gap that Microsoft does not have any technology in, the off-line collaboration market. It is a smart move," Root said. "The one downside is, it might be a smart move that is happening a little later than what would have been ideal," he added.

The fact Microsoft is making Ozzie CTO is sending signals to some observers that the latter's role will be more than one of just shepherding the deal through to completion. Some believe Ozzie will play an integral role in shaping Microsoft's overall collaboration strategies with new products.

"It looks like they want Ray to be around for the long haul to make some other paradigm changing inventions like Notes and Groove. You can imagine some pretty far out conversation over a cup of coffee or a beet between those two," Root said.