August 14, 2004

Heads Roll at HP as Fiorina Pink Slips Three Top Execs from Enterprise Server & Storage Business

Dell's server sales were the real boost, after introducing a new, eighth-generation of PowerEdge servers, which features stronger processors and enhanced systems-management software. Sales gained across the Americas, Europe, the Middle East and Africa and in Asia-Pacific and Japan. "Global product shipments increased 19 percent, sharply faster than for the rest of the industry," Dell said. Profitable growth in China during the period included a 41-percent jump in server shipments. Across the Americas, Dell's sales grew 16 percent and it added nearly two points to its leading United States market share, with shipments increasing at more than twice the average of other companies.

-

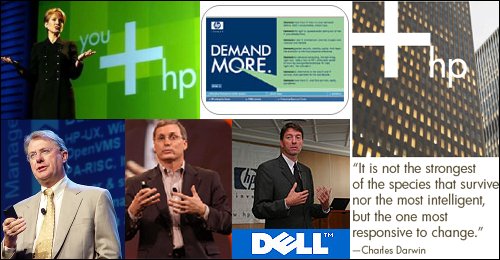

Chairman and CEO Carly Fiorina said Mike Winkler will replace Peter Blackmore as executive VP of the Customer Solutions Group; Jack Novia will replace Jim Milton as the group's senior VP and managing director for the Americas region; and Bernard Meric will replace Kasper Rorsted as the group's senior VP and managing director of Europe.

Winkler has served as chief marketing officer and will retain that role. Novia was senior VP and general manager of the HP Technology Solutions Group. Meric was senior VP of the Imaging and Printing Group for the Europe, Middle East, and Africa region. An HP spokesman said he wasn't aware of any other planned changes.

"It's pretty clear that heads will roll," says Jonathon Eunice, an analyst with Illuminata. "If you're a customer with certain personal relationships with some of the people inside that organization, you'd better brace for change. Anyone with responsibility within that organization is at risk."

Executives on the hot seat could include Ann Livermore, an executive VP who earlier this year was placed in charge of the Technology Solutions Group, which includes Enterprise Servers and Storage, and Bob Shultz, senior VP and general manager of the Network Storage Solutions business unit, Eunice says.

"Execution issues cost us, and we are therefore making immediate management changes," Fiorina said in the statement.

Solid results by the company overall "were overshadowed" by the Enterprise Servers and Storage Group's performance, where revenue was down 5% year to year and down about 15% compared with the second quarter, she said. The segment suffered an operating loss of $208 million, after revenue declines of 8% year over year in its Business Critical Server business and 15% in its storage business.

Fiorina pointed to three issues that led to problems, resulting in shortfalls in revenue of about $400 million and operating profit of about $270 million. The company "executed poorly" on the migration to a new order-processing and supply-chain system, which led to missing some sales opportunities. The problems also required the company to take special measures to ensure deliveries, including fulfilling some direct orders by its channel partners and expediting orders with air shipment, which led to erosion of gross margins.

Second, there were channel-management issues in Europe, including overly aggressive discounting and a transition to centralized claims process. The channel claims process has been resolved, Fiorina said.

The company also experienced declines in average selling prices in its storage business.

New introductions within HP's storage business in May, as well as those planned for September, are expected to strengthen the company's position in that business, Fiorina said.

Overall, the Enterprise Servers and Storage unit should return to profitability in the fourth quarter, she said.

The company reported earnings of $586 million, or 19 cents per share, on revenue of $18.9 billion in the quarter ended July 31. That compares with earnings of $884 million, or 29 cents per share, on revenue of $20.1 billion in the previous quarter, and earnings of $297 million, or 10 cents per share, on revenue of $17.3 billion in same quarter a year ago.

The company said revenue in personal systems grew 19 percent year-over-year, and sales in imaging and printing rose 8 percent. The company's enterprise servers and storage posted a 5 percent revenue decline, but sales in HP services and software grew 12 percent and 17 percent, respectively.

"Although we are satisfied with our performance in Personal Systems, Imaging and Printing, Software and Services, these solid results were overshadowed by unacceptable execution in Enterprise Servers and Storage. We therefore are making immediate management changes. We are also accelerating our margin improvement plans in this business. With these changes, we expect our server and storage business to return to profitability in the fourth quarter," said Fiorina.

So, where's the problem - can we blame it on logistics (e.g., the SAP implementation)? Or culture...?

Chuck Kokoska, president of The Computer Specialists (TCS), a Whitesboro, New York-based HP Gold partner, said he has seen a number of problems with shipping delays for a wide range of products, including servers and storage. "I don't know if this will solve the problem," Kokoska said. "There seems to be a major gap between the direction from upper management and the implementation at middle management. The problem pervades the entire organization. There has to be a fundamental change to move back toward the Compaq spirit of 'can-do' vs. the HP spirit of 'we'll think about it.' "

The irony of HP's computer woes was not lost on analysts. HP prides itself on its consulting services division, which helps businesses deploy technology and had third-quarter sales of $3.5 billion, a 12 percent increase over last year.

"HP likes to promote its own internal IT environment and execution as an example of what's possible with customers using their own technology," said Frank Gillett, a Forrester Research analyst. "The bottom line is, yes, it is embarrassing."

HP faces competitive pressure at both the high and low ends of its lines of business. In PCs and inexpensive servers, it competes against Dell and its efficient manufacturing and direct distribution. In larger systems, it competes against IBM's full line of products and its massive consulting business. And top storage competitor EMC saw its earnings rise 33 percent in its most recent quarter. "The industry rap about HP is that they're stuck in a difficult spot," Gillett said. And, in a slow growth market with so many different wars to fight, companies like Dell will continue to take share away from companies like HP.

Hopefully everyone's philosophical about it. I found this presentation of Blackmore's from a year ago introducing the "Darwin" reference architecture, alongside the company's new "Demand More Accountability" ad campaign featuring the Charles Darwin quote below:

-

It is not the strongest of the species that survive nor the most intelligent, but the one most responsive to change.

- Arik

Posted by Arik Johnson at August 14, 2004 10:55 AM | TrackBack "Competitive Intelligence applies the lessons of competition and principles of intelligence to the need for every business to gain awareness and predictability of market risk and opportunity. By doing so, CI has the power to transform an enterprise from also-ran into a real winner, with agility enough to create and maintain sustainable competitive advantage."

"Competitive Intelligence applies the lessons of competition and principles of intelligence to the need for every business to gain awareness and predictability of market risk and opportunity. By doing so, CI has the power to transform an enterprise from also-ran into a real winner, with agility enough to create and maintain sustainable competitive advantage."