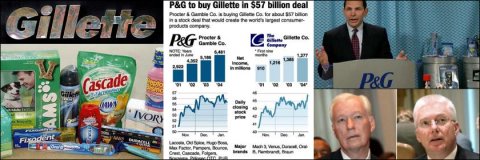

January 28, 2005

P&G + Gillette = One Winning Combination!

Under the terms of the agreement, P and G will issue 0.975 shares of its common stock for each share of Gillette common stock, putting an 18-percent premium on Gillette shares since closing prices on Thursday - this is not an insignificant consequence, especially for investor Buffett as BusinessWeek explains:

-

Now, with his Jan. 28 backing of Procter & Gamble Co's (PG ) novel two-step, tax-free deal for Gillette Co. (G ), Buffett is again seizing an opportunity to exit a position without triggering a giant tax bill. Berkshire's gain on the 96 million Gillette shares it has held since 1989: $4.3 billion. Yet because it is plowing all of that gain into shares of the new company, Uncle Sam will have to wait for his piece of the profits.

Exactly who suggested the deal structure is not clear. Neither Buffett, Gillette's largest shareholder, nor the investment bankers involved would comment. Given Buffett's well-known aversion to taxes, though, bankers most likely devised the structure to satisfy him while also preventing an all-stock deal from drastically watering down P&G's earnings. Just as important, the ingenious structure could become a Wall Street model for future mergers and acquisitions. At the same time it comes with a lesson about what investors can and can't learn from watching Buffett.

Think of the deal as a two-step jig: The first movement makes Buffett happy, while the unusual second step pleases P&G. First, P&G will pay for Gillette with nothing but stock, issuing 0.975 shares of its common stock for each Gillette share. Gillette investors will owe no tax since they're exchanging one stock for another. If, instead, P&G had paid for Gillette with cash, Berkshire alone would have faced a whopping $1.5 billion tax bill thanks to the 35% corporate rate it pays.

Problem is, all that new stock will dilute the value of the shares P&G's current investors hold and slash its earnings per share. So as part of the deal P&G announced that it will spend $18 billion to $22 billion over the next 12 to 18 months buying back some of the stock it just issued for Gillette. The result, says P&G, is the same as if it had paid for Gillette with a package of 60% stock and 40% cash.

This isn't the first time P&G's gone after Gillette - just five years back, a failed run during a very different market climate taught both firms a lesson - now the first of five business lessons of branding, "Innovate, Innovate, Innovate":

-

Why would P&G tinker with Tide? Long the detergent leader, Tide would seem best left alone, a profitable annuity on years of mass-market flogging in the '60s, '70s, and '80s. But P&G has tinkered nonetheless, combining strong technology and consumer research to push sales up 2.6% over the last year in a category that is growing less than 1%. The secret: a widening family of detergents and cleaners that now includes everything from Tide Coldwater, for cold-water washing, to Tide Kick, a combination measuring cup and stain penetrator.

Innovation isn't always built from scratch. P&G is a master at transferring technologies from one brand to another. Tide StainBrush, a new electric brush for removing stains, uses the same basic mechanism as the Crest Spinbrush Pro toothbrush -- also a P&G brand. Gillette, too, is adept at cross-pollination. Its latest winner is the battery-operated M3Power, the result of a collaboration between the company's razor, Duracell battery, and Braun small-appliance units. Despite a 50% price premium over what Gillette charged for its previous top-of-the-line razor, the M3Power has captured a 35% share of the U.S. razor market in seven months.

Overall thought, the best impact analysis was at CMO Magazine on the P&G Gillette deal, with a critique that the deal is a strong one and could inject considerable growth by consolidating a women's brand with a men's brand holding great promise for generating new demand in consumer products companies, which could even prove beneficial for their competitors in the long run:

-

Consumers yearn for the peace of mind and the feeling of security that a favored brand can give. They enjoy the sense of self-definition that comes from choosing and using products that reflect their personalities, and they crave a feeling of connection to others. Consumers also have budgets, schedules, and the need to juggle both in an increasingly complicated world. So consumers, like businesses, want more streamlining and ease of use in the products and services they buy.

Our research has documented at least a dozen patterns of demand innovation in consumer markets. One of them is what we call the "from professional to do-it-yourself" pattern. The penchant to do it yourself has swept through a variety of consumer sectors. Internet- and software-based technologies make it relatively easy to turn complex procedures and knowledge into easily used tools; hence, the success of Turbotax by Intuit and Photoshop by Adobe, which have provided tremendous value for consumers.

In the packaged goods world, this pattern has been deployed masterfully by P&G with its Crest Whitestrips. Teeth whitening was the fastest growing dental procedure during the 1990s and now represents the most common elective procedure. P&G's big idea was to commercialize a drapeable strip that could adhere to teeth and to put a proven bleaching agent like peroxide directly in contact with teeth—essentially bringing home for consumers at a much lower price what was previously available only through the dentist. As a result, Whitestrips helped Crest to replace Colgate as the leading oral care brand in North America.

P&G's success with Whitestrips lies not just in an excellent product, but also in how the company identified and deployed various intangible assets. For example, P&G found superior film and bonding technology hidden within another part of the organization. It also tapped its existing network of 45,000 dentists, selling Whitestrips through dental offices before the nationwide launch.

Identifying and leveraging intangible assets to create other new streams of growth like Whitestrips is the central challenge for a merged P&G and Gillette. For example, the new company could pursue the "integrated solutions" pattern - combining an array of goods and services into a bundle that solves a customer's problem. Kraft, building on its acquisition of Oscar Meyer, has done this admirably with its Lunchables line of meal kits, which addresses a daily hassle for time-pressed working parents. Kids love the convenience and recreational aspect of the tray of snacks, and the Lunchables line gave Kraft a highly profitable new stream of revenues.

With Gillette's shaving products added to the P&G mix, one can envision an integrated travel kit containing makeup, skin lotion, shaving accessories, and other travel essentials. And acquiring Gillette's solid Braun brand, which includes small kitchen appliances, hair dryers, and electric shavers, could lead to opportunities to create a kitchen management system as well as an integrated hair salon offering that combines Pantene and Wella hair products with Braun grooming appliances. P&G might even consider opening a chain of Braun salons or consult to existing salons.

Interestingly, BusinessWeek covered the gadgetizing of P&G's product line a scant couple of days before the merger was announced, which I thought prescient. Plus, it sets the combined company up for true dominance in FCMG. An interview with P&G CEO Lafley himself breaks it down.

- Arik

Posted by Arik Johnson at January 28, 2005 04:10 PM "Competitive Intelligence applies the lessons of competition and principles of intelligence to the need for every business to gain awareness and predictability of market risk and opportunity. By doing so, CI has the power to transform an enterprise from also-ran into a real winner, with agility enough to create and maintain sustainable competitive advantage."

"Competitive Intelligence applies the lessons of competition and principles of intelligence to the need for every business to gain awareness and predictability of market risk and opportunity. By doing so, CI has the power to transform an enterprise from also-ran into a real winner, with agility enough to create and maintain sustainable competitive advantage."