September 21, 2004

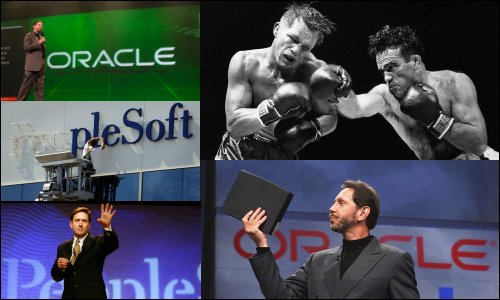

Oracle vs. PeopleSoft: The Final Round

Despite potential European regulatory challenges and the poison pill of a customer loyalty program ($2 billion in rebates worth a $5 a share premium over the current $21 asking price in a valuation on the company) that Oracle is challenging in a few days in Delaware, significant obstacles remain to Oracle's success. However, I believe that, not only will PeopleSoft fail in its defense, I think the time has come to acquiesce and make the most of of a rotten situation... oh, and, Conway has got to go, and soon.

The timing of the Justice Department ruling could not have been worse for PeopleSoft - nearing the end of its fiscal third quarter when a lot of deals get signed - getting any kind of traction in a market that thinks your company has no future will be tricky. Still there was a bright spot in August when PeopleSoft announced a $50 million contract, its largest ever, with Mexico's Tax Administration Service to modernize Mexico's tax system. The two-year contract - which PeopleSoft won after beating Oracle - aims to cut tax evasion and improve tax collection in Mexico.

But Oracle now cannot let this thing die - they need to win it... Oracle last week reported first-quarter earnings that, while exceeding estimates, were dragged down by disappointing applications sales, highlighting the strategic importance of its acquisition.

Their shared competitors are cetainly enjoying all of the uncertainty in the marketplace, and, if the sweetener added to the executive comp mix is any indication, it would appear PeopleSoft's management would agree with me that their chances of success are dim. However, Oracle said speculation that increases in executive pay at PeopleSoft would raise the purchase price of PeopleSoft were not at all true. "But this necessarily lowers the value of PeopleSoft and is just the latest in a long string of measures that takes value away from PeopleSoft shareholders," Oracle vice president Jim Finn said in a statement. Oracle Chairman Jeff Henley spoke to a Banc of America securities conference in San Francisco today regarding PeopleSoft's poison pill, which effectively makes a takeover impossible, saying PeopleSoft's shareholders need to speak up if they believe management isn't working on their behalf. "At some point the shareholders may stand up and say enough is enough."

The company said these changes address concerns employees had regarding their "long-term employment prospects" and only apply if there's a change in control of the company and a worker is terminated involuntarily. An Oracle executive testified during this summer's antitrust trial that the company plans on getting rid of at least 6,000 PeopleSoft staff, or almost 80 percent of the company, if it succeeds in its takeover. Still it seems pretty sweet: PeopleSoft said all employees will get a minimum of 12 weeks of base salary and payments for up to 12 weeks of health coverage, instead of a minimum of two weeks of base salary for each year of service up to a maximum of three months base salary. Executive officers besides the chief executive (who got his parachute a while back) will get between 1.5 times and 2.0 times their annual base salaries and target bonus payments for up to 24 months of health coverage. The executive officers were to get 0.75 and 1.0 times their annual base and target bonus. PeopleSoft has also provided for the accelerated vesting of all employee stock options if a takeover occurs.

It is in this climate that PeopleSoft started the week at Connect 2004 - its customer cheerleading event where spirits were high with record turnout, making it the biggest in the industry. "More than 15,000 attendees from the Americas, Japan, and Asia Pacific will convene at the conference being held September 20-24 at The Moscone Center in San Francisco. Just one year after the acquisition of former J.D. Edwards, PeopleSoft President and CEO Craig Conway, PeopleSoft Executive Vice President of Products and Technology Ram Gupta, and PeopleSoft Chief Technology Officer Rick Bergquist will deliver keynotes highlighting significant merger milestones, product roadmaps, and technology strategy. Other featured speakers include Intel CEO Craig Barrett and television host and author Bill O'Reilly."

Still there's that elephant in the room: "This conference is taking place under an enormously dark cloud," said Joshua Greenbaum, a Berkeley consultant who has closely followed PeopleSoft and Oracle for years. "It's got to be one of the more uncomfortable moments we have seen in a while." And, JD Edwards customers are probably the ones with the most to worry about. "It's kind of awkward," said Terrance Hauser, who helps oversee PeopleSoft applications as an information technology manager for the University of Michigan. "I think the question on everyone's mind is what is going to happen next for PeopleSoft, and I'm not sure we are going to get a lot of answers."

"Have you ever had a bad dream that just didn't seem to end?" Conway asked the crowd. "We have, and it's been going on for 15 months." Despite the judge's ruling, Conway said, that "does not mean PeopleSoft will be acquired by Oracle," a vow that drew loud applause.

Conway, himself a former Oracle executive, also announced an alliance with IBM. PeopleSoft will bundle its software with IBM's WebSphere, and the two companies said they'll spend more than $1 billion over five years on shared development and sales. The deal marks PeopleSoft's biggest-ever partnership... Huh? Doesn't it also seems just a little less than realistic. And, what's IBM think will happen in all of this?

Conway in his speech also noted the birthday of company founder and Chairman David Duffield, who was seated in the front row of the audience. Drawing a sharp contrast to Larry Ellison, Conway cited Duffield's reputation as an honest, humble leader. That legacy, Conway said, helped carry PeopleSoft through its ongoing battle with Oracle.

"We had a year that tested our resolve, stretched our resources and challenged our values," Conway said. "But we didn't blink, and we're not going to blink."

Showing their support, some employees stretched a large banner across the convention center's ceiling. It read "see you next year in Las Vegas," which is the site of PeopleSoft's 2005 users' conference. Customers, though, are cautious. "We're taking a wait-and-see approach," said Norm Wold of tech services company Oracular, an 18-month PeopleSoft customer. "We expect a long process of appeals and other events, but there is a definite amount of uncertainty."

And, a start date for PeopleSoft's billion dollar damages lawsuit against Oracle in a California state court has been pushed back to January 10 from November 1, after Oracle requested additional time to prepare, a move that might delay access to a potentially important defensive weapon for PeopleSoft’s fight. "Clearly, we want to get on with the case as soon as possible, but we're pleased that the judge moved it only to January and not any later," PeopleSoft PR chief Swasey said. PeopleSoft sued Oracle alleging unfair business practices as it pressed ahead with its bid. The case will be tried in front of a jury and PeopleSoft claims damages exceeding $1 billion and is requesting the takeover bid be halted.

Oracle said it needed more time because PeopleSoft didn't produce for the court a list of transactions central to the case until earlier this month and that wasn't enough time to conduct proper discovery. "The court recognized that this late disclosure was meaningful to the case and that it would deny Oracle its due process," said Oracle spokeswoman Deborah Lilienthal.

The question is, is there any real victory for Ellison's hopes of a tactical advantage over an otherwise threatening rival? Having scuttled the benefits of the JDE deal and hurting it with customers by injecting FUD (fear, uncertainty and doubt) into any software investments they might consider with PeopleSoft, Oracle’s bid had the unintended effect of strengthening otherwise less likely rivals, particularly a delighted SAP, especially in fast growing markets like China:

-

Germany's software maker SAP AG said on Monday PeopleSoft and Oracle had disappeared as major rivals in the Chinese market due to their messy takeover battle and that SAP was growing at least twice as fast as the market.

"Oracle has disintegrated. They have no people on the ground," SAP's head of greater China, Klaus Zimmer, said at the Reuters Asia Technology Summit in Shanghai. At the same time, Oracle's hostile bid "destroyed PeopleSoft's business in China".

The Chinese market is rapidly emerging as the most important market in the Asia Pacific region for SAP, the world's biggest producer of enterprise planning software. SAP's Chinese business overtook India and Korea last year, is on a par with Australia and aiming to exceed its Japan business, Zimmer said.

The growth is fuelled by local Chinese companies, many of them state-owned, which need business planning software to evolve from centrally planned behemoths to market-driven enterprises.

"State-owned companies need to become cost-efficient modern enterprises," he said. After two years of roughly doubling sales in China, SAP expected in excess of 60 percent growth this year.

"This year we will more than double the (expected) market growth of 32 percent," Zimmer said.

In that fertile market, its two main international competitors were fading to the background, Zimmer said.

"PeopleSoft were trying to come up last year. They gave us a hard time at banking, trying to penetrate through human resources (software). But the shadow of Oracle behind it scared the banks away. Banks are very conservative."

PeopleSoft is trying to fight off a hostile takeover by Oracle. A U.S. judge ruled earlier this month that Oracle could pursue its takeover attempts.

"Perhaps I should send Larry Ellison a thank-you note. PeopleSoft is now out of the picture. It's non-existent."

SAP's market share in China, as measured in May 2003 by market research firm IDC, was 28.7 percent. Oracle then measured nearly 10 percent, but has experienced setbacks in the region since, Zimmer said.

In head-to-head contract battles against Oracle, SAP was winning 95 percent of the time, he said.

Zimmer said his counterpart at Oracle had left, the third time he had witnessed a switch at his rival during his eight year tenure in China.

"When the head leaves, his allies in the company leave."

Oracle's Asia Pacific technology officer, Kevin Walsh, said at the summit that China was one of the fastest growing areas for the company, but declined to give details.

Zimmer said he was winning back business from Oracle, such as from electronics manufacturer TCL Corp.

"The struggle was four years ago. Oracle started (with planning software in China) five years ago. In database (software) they have 80 to 90 percent of the market, so they had a very strong name. It was tough to fight against them."

"The market wasn't educated by then. The story was that SAP's system were rigid and painful and Oracle said it didn't have to be. And they were very cheap. In one of the deals we won back recently, Oracle's price was substantially lower than ours."

Local Chinese software makers posed no serious threat for SAP when bidding for big customers, he said. In fact, many of the major utilities, banks and industry companies owned by governments were ditching local software, despite efforts by the central government to use home-grown solutions.

"At all the state-owned companies we displaced local players. I see less obedience to this (government) request."

As for what Conway should do next, I agree with the BusinessWeek recommendation:

-

It's time for Conway to give up the fight. True, doing so will mark an ignominious defeat for a talented leader who helped turn PeopleSoft around in the late '90s. A takeover also will mean painful layoffs. But if Conway soldiers on, his company's prospects -- already made worse by the protracted fight -- will turn dire. Ellison, who badly needs PeopleSoft to shore up his sagging applications business, isn't going away. Says Addison L. "Tad" Piper, vice-chairman at investment firm Piper Jaffray: "Stretching this out hasn't helped anyone."

When Ellison first made his bid in June, 2003, it made sense for Conway to test his resolve. Over the years, PeopleSoft had built an enviable relationship with its corporate customers. What's more, the company had a reputation for being more innovative than Oracle in applications. Conway argued, not without merit, that being taken over by Oracle, led by the famously abrasive Ellison, would undermine both of those strengths.

But that was then. PeopleSoft's business, troubled for two years, is crumbling. For a while customers kept the faith, but in recent months growing concerns about the takeover fight have eroded their confidence. What's more, corporate spending has not revived as strongly as projected. The combination means companies that are buying software these days are consolidating around fewer suppliers -- and PeopleSoft isn't on the short list. While PeopleSoft has been forced to discount heavily to keep many customers, German giant SAP has emerged the big winner, with a 23% gain in U.S. software sales for the second quarter. PeopleSoft's second-quarter net income fell 69% from a year earlier, to $10.98 million, while sales of $647 million fell well short of analysts' expectations.

Still, Ellison badly needs PeopleSoft. Thanks to Oracle's strong database unit, fiscal first-quarter earnings jumped 16%, to $509 million, on sales of $2.22 billion.

But its application sales plunged 36%. Eager to get his hands on PeopleSoft's customers, Ellison has guaranteed to support its software for up to 10 years to ease their fears. That's better than PeopleSoft's existing maintenance contracts.

Oracle's bid has plenty of upside for investors, too. The cash offer of $21 a share values PeopleSoft at $7.7 billion, plenty for a company with just $2.3 billion in yearly sales. The bid is also about 26 times PeopleSoft's earnings; big software deals usually don't go for more than 20 times earnings. PeopleSoft is now trading at about $19, but only because a takeover appears probable. It is unlikely to get near $21 on its own. Conway would do better negotiating the best price he can before its fortunes decline even further.

Why won't Conway give up? He's eager to protect his legacy. PeopleSoft's employee-empowerment plans and dedication to customer needs are widely admired. Analysts figure over half of the company's 12,000 employees will lose their jobs. And he still argues that PeopleSoft will make better software alone.

But consider one alternative scenario: Oracle launches a proxy fight and takes control of the board after another year of decline. Everyone at PeopleSoft would lose -- shareholders, execs, and employees. That's not a fitting legacy for a leader who, up to this point, has always done right by his company.

Others in attendance at the IBM press conference think Conway’s showing signs of stress:

-

While Conway and other PeopleSoft execs have been directed not to say much about the Oracle takeover bid because of ongoing legal proceedings, sometimes saying less is more. In the case of Conway, his few words on the topic spoke volumes. He referred to Oracle’s unwanted overtures as a “bad dream that wouldn’t end” and made numerous subtle references to the situation being a distraction for the company. He said the past year had challenged PeopleSoft’s resolve. And he insisted that the company was not interested in being acquired, and that it was not seeking a “White Knight.”

Then, during a subsequent press conference at which PeopleSoft and IBM execs provided details of a huge alliance between the companies, Conway called the agreement “perhaps the most ambitious announcement in the history of enterprise applications.” In quickly surveying the gathered journalists and analysts immediately after that remark, I spotted eyebrows raising and heads shaking at the unexpected and largely preposterous claim. Wall Street analyst Charlie Di Bona found it to be a head-scratcher, saying that PeopleSoft’s newfound focus on service-oriented architectures placed it well behind its competition.

So what did I take from all of this? That Conway may be a CEO in denial, not only about his company’s future, but also about the impact the Oracle advances are having on its present. I'm not the first to suggest this--numerous analysts have suggested as much to me and other journalists. Unquestionably, the situation is taking its toll on Conway, who may ultimately find that shareholders can only stand firm for so long—eventually, if the deal clears all its regulatory and legal hurdles, Oracle’s offer may become too sweet to pass on.

So what’s the deal with IBM? Conway mulled the idea of trying to sell out to IBM last summer as a way to thwart Oracle's bid, according to evidence that emerged during a June trial on the antitrust challenge. According to internal company documents, IBM was also worried about Oracle's bid that it would lose millions of dollars in sales if Oracle gained more market power in a PeopleSoft takeover. But, the deal announced Tuesday doesn't necessarily mean IBM is taking sides in the takeover battle, said Steve Mills, who heads up the company's software group. "What you see is what you get," Mills said Tuesday. "We are not making any declarations about events outside our control."

But analyst Di Bona also predicted the IBM partnership won't sway PeopleSoft shareholders who are weighing the merits of Oracle's $21-per-share bid. "If PeopleSoft wanted to do shareholders a favor, they would take the $21," said Di Bona, who believe PeopleSoft's shares would be trading around $15.50, if not for the takeover offer. For the propeller-heads in the audience, the details are pretty interesting, even if they do confirm PeopleSoft's relative competitive weakness in middleware technology:

-

Conway and IBM Senior Vice President Steve Mills refused to comment on whether the alliance was a stepping stone toward IBM possibly buying PeopleSoft. Some analysts have speculated that such a "white knight" offer for PeopleSoft could not be ruled out despite Oracle's takeover effort.

Mills later told reporters the alliance would result in a boost in head count that could reach the "multi-100s" over time, though he did not elaborate.

Conway said the IBM alliance was aimed at giving customers Web-enabled access to PeopleSoft's software applications - allowing them to make changes in their business processes more quickly - through the use of IBM "middleware" products, which allow different programs to work together.

PeopleSoft will bundle IBM's WebSphere middleware products with its applications free of charge, and the two companies will invest $1 billion during the next five years to jointly develop industry-specific software that will capitalize on IBM's WebSphere products. The two also will jointly establish what they say is the first business-process-interoperability lab to test and certify application interoperability.

The expanded relationship with IBM is key to a strategy Conway outlined in his keynote address: Over the next 12 months, PeopleSoft will deliver more adaptable applications to let customers use Web services to build service-oriented architectures. Both IBM and PeopleSoft are committed to helping customers better link applications to create smoother business processes, executives from the companies said at a press conference detailing the alliance. "There's not a company anywhere in the world that isn't talking about horizontal integration," said Steve Mills, senior VP of IBM Software Group.

IBM is deploying teams to PeopleSoft's Pleasanton, Calif., headquarters and will make additional resources available as needed. "This is a very important strategic investment from IBM's perspective, and we're going to back that up," Mills said.

But Charles Di Bona, an analyst with Sanford C. Bernstein & Sons, wasn't impressed with the announcement or PeopleSoft's message about Web services and service-oriented architectures. "I don't think it makes that big a difference," he says. "It's kind of embarrassing that they're just talking about this now. They're so far behind." The alliance is similar to relationships IBM has with many other vendors, and PeopleSoft had to establish a middleware partner if it's not going to market its own infrastructure products, Di Bona says. (PeopleSoft sells an application server, though it trails offerings from IBM, BEA Systems, and others by a large margin.) The primary impact will be on BEA, which was thought to be PeopleSoft's primary middleware partner, he says.

Conway also highlighted PeopleSoft's accomplishments over the past year, most notably the rollout of the company's Total Ownership Experience, a program designed to lower the time and costs related to product rollouts and upgrades. The marriage of J.D. Edwards' manufacturing applications - inherited when PeopleSoft bought the smaller competitor in July 2003 - with PeopleSoft's product roster has created the world's most integrated manufacturing system, he said. In the past 12 months, 140 enhancements and 110 regulatory updates were added to PeopleSoft World, and 300 enhancements were added to PeopleSoft EnterpriseOne, including support for radio-frequency identification technology, Conway said. Some 250 additional enhancements are planned for EnterpriseOne by the end of the year.

Sure, IBM doesn't want to see its biggest database competitor - Oracle - strengthened in a growth business while IBM suffers the pain of losing an independent PeopleSoft as a sales channel. But, IBM's made a strategic decision to stay out of enterprise applications so it doesn't alienate other players with more revenue potential like SAP or Siebel by becoming a direct competitor with its former partners - which is exactly what will prevent IBM from ever actually buying PeopleSoft.

In short, if IBM wanted PeopleSoft it would've bought them by now; rather the company made a statement in the $1 billion partnership - that this is it, and nothing more. Still, convenient timing has given PeopleSoft a modest bounce at its user convention - perhaps getting a few of the customers who were holding off on signing deals to move ahead with back-burnered plans... however, a lot like political conventions I think, any bounce in the polls should settle back to earth in short order... and this might just be one of the last cards PeopleSoft has left up its sleeve.

The silver lining to this story - and something Oracle is sure to point out to the Justice Department and European regulators moving forward - is how competitive vendors are getting in the enterprise applications business. In addition to SAP's success, smaller ERP vendors - from Microsoft to Ross - are benefiting from all the FUD.

Another Oracle/PeopleSoft competitor, Lawson Software, is trying to make sure the company's customers don't forget about the Oracle threat. St. Paul, Minnesota-based Lawson has launched an advertising blitz in San Francisco this week, with a billboard and ads on dozens of taxis: "There's nothing hostile about letting Lawson take over."

- Arik

Posted by Arik Johnson at September 21, 2004 06:56 PM | TrackBack "Competitive Intelligence applies the lessons of competition and principles of intelligence to the need for every business to gain awareness and predictability of market risk and opportunity. By doing so, CI has the power to transform an enterprise from also-ran into a real winner, with agility enough to create and maintain sustainable competitive advantage."

"Competitive Intelligence applies the lessons of competition and principles of intelligence to the need for every business to gain awareness and predictability of market risk and opportunity. By doing so, CI has the power to transform an enterprise from also-ran into a real winner, with agility enough to create and maintain sustainable competitive advantage."