December 31, 2003

Forbes 400 Best Managed Big Companies 2004

Since it’s New Year’s Eve and all, I decided to mooch off Forbes and supply the supreme list of companies to be admired – Best Buy tops the list this year and duly-so. Check ‘em all out for yourself.

Here’s hoping everyone had as blessed a 2003 as I did and I wish you a very Happy and Prosperous New Year in 2004.

- Arik

December 30, 2003

FedEx Acquiring Kinko’s to Compete with UPS and Mail Boxes Etc Stores

Just when you thought the holiday madness was over, FedEx announced today it’s paying $2.4 billion in cash to buy privately held business services provider Kinko's in a deal set to close in the first quarter of 2004. Of course, they’re a little late the party after the 2001 acquisition by top competitor UPS of Mail Boxes Etc. franchise operations, successfully rebranded as UPS Stores just this past April. But, it’s a step in the right direction, if FedEx hopes to keep a part of the retail interface to foot-traffic looking to ship from a local storefront. In the Motley Fool excerpt below, some of the logic (and competitive desperation) of the deal gets explained:

-

Soon, FedEx will offer its shipping options in 1,200 Kinko's stores (it currently has outlets in 134 Kinko's stores through a pre-existing agreement). The acquisition will help FedEx grab shipping business from the small- and medium-sized business market as well as from consumers who have fulfilled their other document needs in the stores.

Kinko's has been branching out from its humble beginnings as a copy center. It's no longer just about producing brochures, manuals, and business cards. Now, it offers its business customers some pretty fancy solutions in many of its locations, including Wi-Fi Internet hot spots and videoconferencing. For 2003, Kinko's expects to report $2 billion in revenues (though the acquisition won't add to FedEx's earnings until fiscal 2005).

With the high price tag comes the expanded retail presence and high-profile name brand that seems sure to usher in some built-in customers for FedEx. Over the last several years, the delivery company has suffered from a sluggish shipping business as the economy took a nosedive, and from heated competition from rival UPS and even the U.S. Postal Service.

Earlier this month, Fool LouAnn Lofton reported on FedEx's lackluster second quarter. A higher-than-expected number of employees jumped at the chance to take FedEx up on its early retirement package, resulting in a charge.

While the Kinko's acquisition might be a good idea, it's not original. In 2001, UPS bought Mail Boxes Etc. for about $185 million, a franchise that currently has 4,000 locations. With the possibility that UPS is indeed winning the market-share battle, one might wonder what took FedEx so long to tap into this market. However, by capitalizing on Kinko's well-known brand and non-franchise stores, the deal could deliver some excitement to FedEx shareholders.

What took so long indeed?! And why wait until after Christmas? Time to absorb and assimilate, I imagine. I looked back at what UPS had to say about the MBE deal, following April’s successful rebranding:

-

"The UPS Store is a significant step in UPS's strategy to strengthen its brand presence and expand access to our services for small businesses and individual consumers throughout the U.S.," said Rocky Romanella, vice president of UPS retail services. "The UPS Store extends competitive UPS pricing along with the outstanding customer service that has become synonymous with MBE franchisees over the past 20 years."

"This is an unrivaled combination of convenience, reliability and price," added Mathis. "We feel The UPS Store will transform the retail shipping industry."

"The franchising sector has never seen re-branding on this scale," said Don DeBolt, president of the International Franchise Association. "To see one of the world's largest companies working alongside a leading franchiser is historic on its own."

There are no plans to change the trade name of MBE's international locations. Currently, MBE has more than 1,000 units outside the U.S.

The UPS Store and Mail Boxes Etc. together comprise the world's largest franchise network of retail shipping, postal and business service centers, with more than 4,000 locations around the world. Mail Boxes Etc., Inc., a UPS company, franchises The UPS Store and MBE retail locations. In the United States, The UPS Store and MBE locations are independently owned and operated by licensed franchisees of Mail Boxes Etc., Inc. Outside the United States, locations are owned and operated by MBE master licensees or their franchisees.

So, what the UPS deal a better bet than FedEx’ Kinko’s move? It was certainly cheaper, even if they don’t have the asset base, due to the franchising model. This should be interesting to see who grows revenue more quickly… and retail outlets!

- Arik

December 29, 2003

Toilet Paper Wars: Charmin vs. Quilted Northern vs. Cottonelle

Going "head-to-head" (get it?) in the bathroom tissue business, we’ve got P&G versus Kimberly-Clark versus Georgia-Pacific in a new promotional war of international proportions, with P&G’s Charmin taking it up a notch. This isn’t Mr. Whipple’s TP business, as the New York Times excerpt that follows describes:

-

In the $4.7 billion business that is bathroom tissue, there is not a whole lot that separates one toilet paper from another. Since toilet paper is a commodity we all must buy - and do so, often without much brand loyalty - companies go to unusual lengths to get their messages across.

Procter & Gamble, to promote its Charmin brand, has begun showing up at state fairs to encourage people to use special "Charminized" rest rooms, which are not only clean but stocked with P.& G. products. Outside the restrooms, the Charmin bear dances and mugs to entertain the crowd.

And there's Georgia-Pacific, which this month weaved its Quilted Northern bathroom tissue into the regular programming of "The View," the morning gab fest on ABC.

Next up, on Jan. 5, Georgia-Pacific will introduce a $10 million campaign, created by DDB Worldwide in New York for Angel Soft tissue, including commercials introducing David and Larry, "bathroom angels" who perform such good deeds as restocking depleted toilet paper rolls. The company is the largest bathroom tissue marketer in the country, with a 38.9 percent volume share, according to Nielsen data provided by Georgia-Pacific.

But Quilted Northern - the company's biggest brand, with about a 21.5 percent share of the total market - still trails the category leader, Charmin, by about three percentage points. Cottonelle from Kimberly-Clark has about a 12.7 percent share.

The commonplace nature of toilet paper results in widespread discounting and promotional activity among manufacturers and retailers. That tends to erode brand image in a category where the last really notable advertising icon was Charmin's Mr. Whipple, who last appeared regularly in the 1980's.

"It's one of those categories where retailers will football on price, so it's been very difficult for true product benefits - making a better toilet paper - to translate into higher prices," said Paul Crnkovich, partner at Cannondale Associates, of Evanston, Ill. "The ultimate definition of brand equity is how much more you'll spend for Product A than Product B."

After P.& G. retired Mr. Whipple, the company spent years searching for an effective strategy that would differentiate Charmin. The company even brought Mr. Whipple out of retirement in 1999, but that did not last.

Several years ago, P.& G.'s longtime agency, D'Arcy Masius Benton & Bowles, turned to an animated bear to restore some pride to the Charmin franchise. (P.& G. last year moved the Charmin account to Publicis Worldwide, part of the Publicis Groupe.) The Charmin bear originally appeared in broadcast spots but has more recently been seen at state fairs and festivals, alongside the Potty Palooza, a 32-foot truck with 12 fully outfitted rest rooms, featuring hardwood floors, sinks, floral scents - and Charmin tissue, of course. P.& G. provides the truck as an alternative to portable latrines. While people line up to use the Potty Palooza, the Charmin bear dances and entertains the crowd.

In this case, the bear is extending the message of Charmin's broadcast commercials, in which he does the "Cha-cha-cha Charmin" dance.

"It gets people interested in the bath tissue category," a P.& G. spokeswoman, Celeste Kuta, said. "It's usually a low-involvement category." The bear, she added, "does it in a way you couldn't do with real people."

If Charmin's message remains playful, Quilted Northern opts for a somewhat more earnest approach, with the slogan, "It's Quilted Because We Care." A spot currently in rotation features a cartoon character named Wanda who doesn't care about quilting and, indeed, blows her nose into the quilt stitched together by the other characters, horrifying everyone. In the end, though, Wanda was just a nightmare conjured up by one of the quilters. DDB Worldwide, a New York agency that is part of the Omnicom Group, has the Quilted Northern account.

Kimberly-Clark's Cottonelle brand also stakes out a claim to caring in its marketing, via the slogan, "Looking Out for the Family." The company uses a Labrador retriever puppy to convey that small dogs, like families, need to be treated gently, a company spokesman said. J. Walter Thompson in New York, part of the WPP Group, has the Cottonelle account.

What can I say? Since I’m the grocery buyer in our house, I tend to get whatever’s cheaper and I don’t clip coupons, but that puppy is a lot cuter than the bear in my opinion… or Mr. Whipple.

- Arik

December 28, 2003

Green Bay Packers Keeping Playoff Hopes Alive

In what proved to be a pretty unlikely, but very exciting turn of events (assuming you’re a Packer fan… but then, who isn’t?), the Packers made the playoffs to represent for the NFC North! After a week in which quarterback Brett Favre’s father passed away, people are talking about their less-important win over the Broncos, while the Vikings lost a heartbreaker in Arizona, as if it’s Super Bowl destiny… but then, a lot of other teams will stand in Green Bay’s path on the way to Houston.

I found the perfect recap of the playoff weekend from none-other-than Boomer Esiason, posted on the Packers’ Web site, reminding us all that, not only did the Packers need to win, the Vikings needed to lose:

-

Watching the Vikings lose to the Cardinals Sunday wore me out - and I didn't even play. What a wild day for the NFL. Wasn't it Mike Holmgren who asked for divine intervention after his Seahawks beat the 49ers a day earlier? Well, guess what? The unexpected actually did happen. The Seahawks have Saints to thank; the Packers can thank the Cardinals.

There were smiles and cheers in Green Bay, while tears were shed in Minnesota. This season-ending loss to the Cardinals will be hard to forget for the Vikings' faithful and will be forever remembered in the annals of team history. If you watched the Vikings-Cardinals game from start to finish, you probably could never have predicted the outcome.

With a series of events that started to unfold last Monday night in Oakland, events too unbelievable to explain, it is now the Green Bay Packers who represent the NFC North in the playoffs. As the Packers were crushing the Broncos in Green Bay on the final day of the regular season, the lowly Cardinals were inflicting a final mighty blow to the Vikings in Arizona. What a way for Dave McGinnis to go out. With his career in Arizona finished, McGinnis is able to savor a memorable final victory over a heavy favorite that needed a win to make the playoffs.

What in the world was going on Sunday? It's hard to explain. My initial thought was that there's definitely a guardian angel flying over the Green Bay Packers and their quarterback, Brett Favre.

How else can we explain what happened in Arizona? These things just don't happen - a fourth-down, game-winning 24-yard touchdown pass on the game's final play by the Arizona Cardinals? Are you kidding me? Quickly, answer this: Who threw the pass and caught it? Answer: Josh McCown to Nate Poole. Now see if you remember that next year at this time.

As Vikings players fell to the ground in complete disbelief in Arizona, pandemonium erupted at Lambeau Field. News of the Cardinals' game-winning touchdown spread like wildfire through the stadium as Packers fans gripped their portable radios and watched the luxury box televisions to confirm what they had just heard. Packers players got the sense that something must have happened in Arizona, as they could not understand why their fans were cheering so loudly for the two-minute warning. Let the postseason party begin in Green Bay.

Uh-oh! Wait a minute! The final play is under review in Arizona. They're waiting in Green Bay for final word from Arizona ... and finally, the ruling stands: touchdown. I wonder how many people thought of Irvin Favre, Brett's father, at that moment. I know I did.

It has been an awfully tough week for Favre, except for maybe the football game Monday night against Oakland and the scrimmage against Denver on Sunday - at least that is how the Denver Broncos viewed the game against the Packers. It was what took place between these two games that tested Favre.

And, in fitting post-win gloating, a friend sent me the following poem:

The Last Week of Football

‘Twas the last week of football, and all through the game,

The Packers were winning, the Broncos were lame.

The Vikings were playing the Cards without care,

In hopes that the post-season soon would be there.

The NFC North they had all but wrapped up,

An eleven point lead should have been quite enough.

I still watched the Packers, but to my dismay,

What a shame that another game they would not play.

At the two-minute warning there arose such a chatter,

I quickly switched channels to see what was the matter.

From CBS to Fox, I used the remote,

And saw that game end on this wonderful note:

The Cards had just scored with two minutes to go,

It seemed that the lead, the Vikings might blow.

Then what to my wondering eyes might appear,

But a recovered on-side kick, one more thing to cheer.

The seconds ticked by as I started to wheeze,

The Vikings’ defense looked a lot like Swiss cheese.

And then on the very last play of the game,

Came a miracle touchdown, Lambeau Field was on flame!

You see, our own fans had now heard of that score,

As the shock did wear off, they started to roar.

It began to sink in as to what this did mean,

The Vikings had lost, eighteen – seventeen.

The coach who had blown a six-and-oh start,

Was whining and wailing and eating his chart.

When it became clear that he’d brought on more shame,

His thoughts turned to whom could he possibly blame?

Was it Culpepper, Kleinsasser, Hovan, or Moss?

Or was it McCombs, the team’s arrogant boss?

He looked at his list, and was checking it twice,

But the obvious choice was himself, Mike Tice.

So the Packers did clinch the NFC North,

And into the playoffs they would venture forth.

And Packer fans cheer with this holiday cry,

Happy Christmas to all, but to the Vikings Good-Bye!

Bravo! Now, they have to beat the Seahawks under their old (Super Bowl winning) coach Mike Holmgren… At least it’s at home in Title Town.

- Arik

December 27, 2003

Chinese Firms Buying Up Trademark Brands to Compete for Premium Prices

The move by Chinese firms to "go premium" and capture prestige brands and the awareness and loyalty they convey has long been a goal of a country most commonly thought of as the low-cost-producer, but recent moves by some firms to buy up everything from Dirt Devil to Revlon remind us of their rather more upscale aspirations. Here’s a few choice excerpts from the San Francisco Chronicle:

-

In 1905, in a backyard factory in Cleveland, workers began making vacuum cleaners for a company that became known as Royal Appliance Manufacturing Co. Almost a century later, Royal, which established the popular Dirt Devil brand, stopped making almost all of its vacuums in Cleveland because it realized it was cheaper to pay a Chinese company to do it.

Dirt Devil's departure would have been a relatively minor chapter in the grand exodus of American manufacturing to China. But this year the Chinese company that got the contract to make Royal's vacuums acquired something potentially even more valuable: It bought Royal and the Dirt Devil brand name, too.

Other Chinese manufacturing companies are also starting to buy the brand names of products that they formerly only produced. In some cases, they acquire the company, as with Nakamichi stereo gear, in others they get an exclusive licensing deal, as with Benetton eyeglass frames.

Hong Kong-based Techtronic Industries Co., the company that bought Royal and Dirt Devil, also grabbed the Ryobi tool brand from the parent company, Ryobi Ltd., in every market but Japan. As with Royal, Techtronic had been making Ryobi products for years. The Hong Kong company also bought two brands with products similar to ones Techtronic already made: the Homelite outdoor-products brand from Deere & Co. of Moline, Ill.; and the VAX brand of floor-care products, formerly owned by England's VAX International Ltd.

The purchase by Chinese manufacturing companies of Western and other foreign brands signals an important shift in the supply chain forged during the past three decades between the West and Asia. While such deals so far aren't numerous, conditions are ripe for many more, pointing to what may well be the next major phase in China's industrial evolution. Instead of constantly trying to lower their production costs to increase margins, Chinese companies are now trying to capture brand value - the ability to sell their products at a higher price directly to consumers who are willing to pay for a recognized label. If this trend continues, it means more dollars paid for brand-name products will wind up in China.

Several factors are responsible for the increasing Chinese purchases of American brands. Many U.S. companies - particularly those that own midsize brands such as Dirt Devil - have been under pressure as Asia's cheaper, no-brand goods flooded into the U.S. and competed directly with American brands. Major U.S. retail chains have played these weaker brands against each other, demanding bigger discounts, faster delivery and lower inventories.

In addition, Chinese factories themselves are feeling the trickle-down effect of this pressure. The country's rapid development has produced an oversupply of factories, forcing Chinese manufacturers to vie with one another to produce the same goods for the American and European markets. The intense competition has driven down prices and made their margins razor thin.

"We looked at our product lineup and we saw this trend of shrinking margins, greater competition," says Christopher Ho, chairman of Grande Holdings Ltd., a Hong Kong-listed consumer-electronics manufacturer, which supplied Sony, Pioneer, JVC and others.

Grande snapped up three Japanese electronics brands in bankruptcy proceedings. Its margins on those lines are between 8 percent and 10 percent, compared with 3 percent to 4 percent on the products it makes for others.

Similarly, Hong Kong firm Moulin International Holdings Ltd. in 2001 bought the licenses to a portfolio of brands including Benetton, Revlon and Sisley, from three European companies that were struggling.

In general, the Chinese companies acquiring foreign brands have been focused on making products, not marketing them. And managing brands sometimes puts them in unfamiliar territory, as they must respond to the changing tastes of consumers half a world away.

In the course of its brand-buying spree, Techtronic has increasingly moved away from its roots as a no-name, low-cost Chinese manufacturer and toward an integrated marketing and sales company. It deals every day with major U.S. retailers such as Home Depot Inc. and Wal-Mart Stores Inc. as well as European retailers. Since its first acquisition in 1999, Techtronic's revenue has risen more than threefold to $1.2 billion last year; profit has almost tripled in the same period, to $53 million.

At this stage, Techtronic maintains the same close relations with its Royal unit that it developed as a supplier. The U.S. subsidiary, based in Glenwillow, Ohio, still handles much of the marketing for the Dirt Devil brand, although Techtronic has begun working in that area, too. Hong Kong staffers are more involved with retailers and have taken a bigger role in dealing with product design and presentation.

There a fascinating history of Techtronic also included in the article, so I’d encourage you read the whole thing. And, keep watching Asia for brand migration. Odds are, we’ll see more U.S. dollars flowing that direction in the future, especially if Beijing successfully resists Washington’s pressure to let their currency float, even as the U.S. continues to devalue the greenback in hopes of making America more competitive abroad.

- Arik

December 26, 2003

Barbie vs. Bratz: Dolls Battle for Marketshare ‘Neath the Christmas Tree

At one of my family Christmas get-togethers this holiday season, I noticed the presence of a new, funkier kind of doll for girls – the "Bratz" dolls and all their accompanying accoutrements. Intrigued, I did a bit of research and found out they’re taking a king-sized bite out of a market ordinarily served by an older forebear, Barbie. Here’s an excerpt from an article that sums up the phenomena:

-

For the first time in Ken Grow's 27 years as a toy retailer, Barbie lost ground to a rival fashion doll during the holiday season.

"The best doll this year . . . has been the Bratz doll," said Grow, owner of Gregory's Toys, an independent store in Encino. "Barbie has lost a lot of steam."

Mattel, the world's largest toy maker, is not accustomed to seeing its flagship fashion doll face such stiff competition. Its line of electronic learning toys also is faltering in what has become a tight market for toy producers.

"Those are two key categories for us," said Robert Eckert, chairman and chief executive of Mattel. "We had been gaining market share for the last several years, and in fact we lost market share in the first part of this year."

Sean McGowan, a toy industry analyst at Harris Nesbitt Gerard, estimated that Mattel's share of the fashion doll market has dropped from 75 percent to about 60 percent since 2000.

The toymaker has other problems. Along with increasing competition, Mattel has been weathering the fallout of 2002's dismal holiday season that led to a surplus of inventory and tighter spending by retailers. And it has seen its profit margins weaken amid pricing pressure from Wal-Mart and other discounters.

Eckert took over as CEO three years ago as Mattel struggled to overcome the ill-fated $3.5 billion acquisition of software maker Learning Co. As he focused on building the company's core brands like Barbie and Hot Wheels, Mattel stock bounced back and international sales increased.

But domestic sales lagged during the first three quarters of this year. "We did spend the first part of this year working off those inventories," Eckert said. "On top of that, our own product line was not doing particularly well in the first part of this year."

Through August, Bratz dolls topped the fashion doll market, according to the NPD Group, a marketing firm. The line produced by MGA Entertainment sports a sexy, urban look that embodies contemporary teen fashion.

"Right now, there's nothing but the Bratz dolls," said consumer Jennifer Joyce of La Crescenta, whose 10-year-old daughter used to collect Barbies but has moved on to Bratz.

Mattel has tried to keep Barbie edgy by marketing the My Scene Barbie, which sports a youthful, contemporary style, and the hip-hop-inspired Flava doll line.

Grow, the Encino toy-shop owner, said his customers haven't shown much interest in the My Scene dolls, which hit stores last year, or the Flava dolls, which debuted during the summer. Chain stores such as Wal-Mart and Target have discounted the dolls, trying to move them off the shelves.

In toys for boys, Mattel still leads the die-cast car market with its Hot Wheels and Matchbox brands. But some of its action figures haven't sold well, McGowan said.

Jill Krutick, an analyst with Citigroup Smith Barney, believes Mattel is well-positioned heading into 2004 because of ongoing product innovations.

The company is counting on a new race track called T-Wrecks that features a dinosaur that swallows and then spits out toy cars. To keep the interest of older kids who played with Barbies and Hot Wheels as children, Mattel has started marketing tie-in videos, clothing, cameras and electronic games.

Mattel's main competitor, Hasbro, has gained momentum in recent years with popular brands such as Transformers and Beyblade, a line of shooting toys.

In the past 12 months, Hasbro stock has gone from just under $12 to its current $21. Mattel's stock is hovering near $19 -- the same level it traded a year ago.

I found another couple of excerpts from BrandChannel.com, with a decidedly more positive opinion:

-

Mattel’s popular icon has weathered many political, cultural and social storms since her introduction in 1959, but in the end she remains a plastic doll with a cheery smile and a perfect figure, a woman many little girls admire even when they realize that Barbie’s proportions don’t match reality. Billed as "a shapely teenage fashion model," Barbie made her first appearance at the American Toy Fair in New York City and soon became a hit. Her abrupt departure from traditional baby-faced dolls, however, drew criticism that has never stopped even though the nature of the complaints has changed.

Mattel did its best to satisfy both the critics and fans of Barbie, reshaping her face early on to give her a softer look and even trying in recent years to make her body more closely match that of an average woman. The doll’s ubiquitous fashion accessories have also changed with the times, although Mattel made sure that there was nothing salacious about Barbie wearing a mini-skirt in the 60s or a tube top in the 80s, despite her popularity in a culture that has become increasingly open about sexuality.

The company also began rolling out Barbie’s supporting cast in the early 60s, starting with Ken. (Mattel should abandon attempts to quell rumors that Ken is gay and Barbie is really in love with G.I. Joe; the speculation helps keep the brand in the public’s mind.) Barbie’s best friend Midge and her little sister Skipper followed soon after, and the subsequent 30-plus years have seen the addition of a black doll named Christie, an "artsy bohemian" named Chelsea, and others.

Mattel’s response to feminists include Astronaut Barbie and Doctor Barbie, which debuted in 1986 and 1988, respectively. Day to Night Barbie (1985) reflected the yuppie lifestyle of the 80s, complete with an executive’s outfit for Barbie’s 9-to-5 office job and evening wear for a night on the town. She even came with a small calculator, perfect for crunching the numbers needed for financial reports.

In 1992, the Barbie Liberation Organization became upset when a Talking Barbie included the phrase "Math class is tough." The group switched her mechanisms with G.I. Joe’s, creating homemade Barbies that yelled "Vengeance is mine!" While the incident was amusing, and it did successfully spread the group’s message, it did little to harm the brand. In fact, Mattel’s strategy in this area is to ignore the critics, as many of them will be unhappy with the doll no matter what the company does. If a mother is truly unhappy with the image Barbie projects, there’s little Mattel can do that it hasn’t done already.

But while the critics have done little damage to the brand, competitors continue to search for ways to cut into Barbie’s market and mind-share. From cheap knock-offs sold in dollar stores to upstarts like MGA Entertainment’s Bratz, which tries to cash in on current American youth culture with a brash image, Barbie faces many threats within the market niche. In response, Mattel created the "My Scene" line, which features similar fashions without the "in your face" attitude.

Brand consultancy Interbrand ranked Barbie 97th with a value of US$ 1.87 billion, down three percent from the year before, in its 2003 Best Global Brands report with BusinessWeek. While a loss of brand worth is never good, Mattel doesn’t need to panic. It has spent more than three decades building a brand that includes not only toys but also videogames, board games, comic books, cartoons, and other spin-offs that constantly keep Barbie in the public eye.

So, good luck Barbie – this battle with the Bratz is one fight where it looks as if you’ll need all the luck you can get.

- Arik

December 25, 2003

U.S. Mad Cow Discovery Promises to Rein-In Recent Gains for the Beef Industry

This isn’t very Christmas-y but it’s sure to affect a few different players in the food business, so here goes…

The first case of mad cow disease in the U.S., revealed on 23 December 2003, is likely to have a devastating impact on U.S. cattle and beef prices and could pummel the shares of companies like meat packer Tyson Foods and hamburger chain McDonald's.

The disease warning signs showed up when the infected dairy cow was sent to slaughter on 9 December. Inspectors described the cow as a "downer" before it was killed, meaning that it was unable to move on its own. Officials wouldn't comment on exactly why the animal wasn't mobile, but experts say there could be any number of reasons, including old age, injuries or disease.

By law, inspectors at slaughterhouses are supposed to reject cattle that have trouble walking and rule cows with supposed brain disorders unfit for human consumption. Sick cows are then be sent to a rendering plant, which is what appears to have happened here. Apparently, scientists took samples of the infected cow's tissue, to test for disease, while its brain and spinal cord, described as the "infectious" parts by Ag Secretary Ann Veneman, were sent on to be turned into protein feed and oil. As a result, "we believe the risk to human health is very low," Veneman said. As for the other animals that'll eat the protein feed, who knows?

Thanks to the Atkins Diet, beef prices have risen to where producers are finally able to turn a decent buck. All good things must come to an end, eh? For hamburger chains the concern is whether consumers will cut back on eating beef – a consumer backlash hurt McDonald's sales in both Europe and Japan after they reported mad cow cases in recent years.

Then 24 December, Japan, the world’s top importer of U.S. beef, blocked imports and imposed an indefinite ban on U.S. and recalled other meat products already on the market. South Korea suspended inspections of U.S. beef, and suspended sales of meat already on supermarket shelves. Hong Kong, Australia, Taiwan, Singapore, Thailand and Malaysia followed suit. Russia also issued a temporary ban, while in Brussels, the European Union, which already bans much U.S. beef because of fears about growth hormones, said it would not take any additional measures against U.S. beef.

So really, how big a deal is this for the U.S. beef industry? Here’s an excerpt on the impact from AP:

-

Antonia Mochan, a spokeswoman at the EU's executive Commission, said the United States was already classified as an "at-risk country" as part of the sweeping EU measures adopted following Britain's mad cow crisis, which began in the late 1980s and spread across western Europe. Under those restrictions, imports of specific risk products, such as brains, are banned.

The moves came after the U.S. government announced that a Holstein cow on a Washington state farm tested positive for mad cow disease, marking the disease's first suspected appearance in the United States.

British experts said the United States must seek out the help of countries that have experience dealing with the disease and must take swift action to restore consumer confidence in its beef stocks.

"The key here is to restore confidence quickly, not to allow it to drag out," Sean Ricard, former chief economist of Britain's National Farmers' Union, told British Broadcasting Corp. radio. "What I hope America will do is take rapid action, perhaps slaughter the herd that animal came from."

Ricard predicted a short-term slide in the price of beef in the United States.

U.S. Agriculture Secretary Ann Veneman said the risk to human health in this U.S. case was "extremely low." Parts of the cow that would be infected - the brain, the spinal cord and the lower part of the small intestine - were removed before the animal went to a meat processing plant.

The immediate reaction also reflected the widespread consumption of U.S. beef in Asia, where American eating habits have gained tremendous popularity in recent decades, as evidenced by the proliferation of fast-food outlets.

Australia - a major beef exporter that stands to gain economically from a bans on U.S. imports - placed a temporary hold on American beef, Agriculture Minister Warren Truss said Wednesday.

In Canada, where a single case of the disease was found in May, federal officials said late Tuesday that imports wouldn't be banned unless the suspected case was confirmed.

Japan's Agriculture Ministry said its ban applied to beef and beef products and took effect immediately.

"We must ban beef imports from the United States for the time being," said Health Minister Chikara Sakaguchi. "We must recall products that include so-called 'dangerous parts,'" such as brains and spinal cords.

Japan is the largest overseas market in value terms for U.S. beef. Exports totaled $842 million in 2002, accounting for 32 percent of the market for U.S. exports, according to the U.S. Meat Export Federation. South Korea is No. 2 in value, with $610 million. Mexico, the top importer of U.S. beef in volume terms, was third in value in 2002, a federation official in Seoul said.

Japanese authorities have been especially leery about mad cow disease since the nation's herds suffered the first recorded outbreak of the disease in Asia in September 2001, causing meat consumption to plunge. Consumption, however, has since rebounded.

While fresh imports to Japan have been banned, there was no widespread rush to pull American beef from supermarket shelves. A spokesman at Ito-Yokado, Japan's largest supermarket chain, said the retailer had faith in the safety of the beef already on its shelves and would sell its stocks.

The Aeon chain, however, said it was going to pull American beef from its shelves.

Ito-Yokado imports its U.S. beef from herds in the midwest, far from where the infected Holstein was discovered in Washington state, the spokesman said, speaking on condition of anonymity.

The United States supplied 46.5 percent of Japan's beef imports in 2002, or 226,524 tons, second only to Australia. There was speculation in Japan that the ban would cause major bottlenecks for restaurants as they scrambled to find other suppliers.

The mad cow scare already took a toll on restaurant stocks in Japan. Shares of Yoshinoya, a "gyu-don" meat and rice restaurant chain where 99 percent of the beef is American, plunged 9.4 percent, and stocks of McDonald's Japan, which said it exclusively serves Australian beef, lost 3.1 percent.

In Hong Kong, the territory's government said in a statement that the temporary ban is a precaution, saying "there is no evidence to suggest that U.S. beef on the market is unsafe."

In Singapore, the Agri-Food and Veterinary Authority said that if the mad cow disease case is confirmed in the United States, the country will not import American beef again until Washington certifies that it has been free of the disease for six years.

Taiwan said U.S. beef could face a seven-year export ban.

Mad cow disease, known also as bovine spongiform encephalopathy, eats holes in the brains of cattle. It sprang up in Britain in 1986 and spread through countries in Europe and Asia, prompting massive destruction of herds and decimating the European beef industry.

People can contract a form of mad cow disease if they eat infected beef or nerve tissue, and possibly through blood transfusions. The human form of mad cow disease so far has killed 143 people in Britain and 10 elsewhere, none in the United States.

Secretary Veneman mentioned she's serving beef at her place Christmas Day... but this makes me want to reconsider vegetarianism.

Merry Christmas Everyone,

- Arik

December 24, 2003

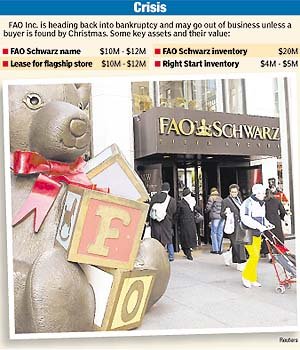

Christmas Toy Wars

As Christmas Eve dawns, we see the end of the Toy Wars that have eroded a lot of the profit out of being in the toy business. Wal-Mart's price war has impacted toy-specific retailers the most - KB and Toys-R-Us - but KMart, Target and others are also feeling the heat.

Here's an excerpt from the San Diego Daily Transcript, that I think offers a good summary macro-view of take-aways similar to many local toy markets across the country:

-

FAO Schwarz's Zany Brainy children's toy stores are liquidating in what could be the beginning of meltdown in the toy industry. Zany Brainy, scheduled to have closed all its stores by the end of January, has numerous locations in San Diego, including a store in Fashion Valley, on Westview Parkway in Mira Mesa, and on Grossmont Center Drive.

FAO Schwarz, a toy retailer in danger of going out of existence, also once had a store in Horton Plaza. FAO Inc., the toy retailer's parent, filed for Chapter 11 bankruptcy for the second time in a year earlier this month.

On Nov. 17, as noted by Bloomberg News, New Jersey-based Toys "R" Us Inc., the second-largest U.S. toy retailer behind Wal-Mart, announced it would close 182 Kids "R" Us and Imaginarium stores.

Toys "R" Us closed its Imaginarium store in Horton Plaza after an unsuccessful run some years ago. A Kids "R" Us store that exists in La Mesa will be closed. While there are only a couple of Toys "R" Us-related stores that have or are scheduled to close in San Diego County, a look at the company's bottom line suggests that more closures could be on the way.

Toys "R" Us store locations in San Diego County include stores at 8181 Mira Mesa Blvd. in Mira Mesa; 1240 Morena Blvd. in Linda Vista; 1100 East 30th St. in National City; 1240 Auto Parkway South in Escondido; 2425 Vista Way in Oceanside; and 1008 A Industrial Blvd. in Chula Vista.

Toys "R" Us reported a net loss of $38 million, or 18 cents a share, in the quarter ended Nov. 1 compared to a net loss of $28 million, or 13 cents, for the like quarter a year earlier.

The Wayne, N.J.-based company had announced late last year it would be slashing 1,900 jobs and closing 64 stores as it continues a restructuring effort to focus on its core toy business, but the company hasn't been able to stop the bleeding. Pretax costs for the store closings are estimated to be about $280 million.

Toys "R" Us, like FAO Schwarz, is trying to keep Wal-Mart at bay. As noted by Bloomberg News, sales at Kids "R" Us stores opened at least a year dropped 11 percent, for the fifth straight decline.

A check of online prices at both Wal-Mart and Toy "R" Us revealed that the Swan Lake Beauty Castle that cost $109.99 at Toys "R" Us, cost just $98.97 at Wal-Mart.

Toys "R" Us is offering as much as 40 percent off merchandise such as Hot Wheels cars, but analysts wonder whether it will be enough.

"I can't really get comfortable about (Toys "R" Us) long-term competitive position," said Abhay Deshpande, a retail analyst at First Eagle Funds, whose $11 billion in assets don't include Toys "R" Us shares. Deshpande, who had personally owned the retailer's shares, dumped the Toys "R" Us portfolio in 2001.

While conceding it may not be able to compete with Wal-Mart on price, Toys "R" Us is hoping that specialized customer services, such as providing play areas with everything from play pens to jungle gyms, will help it regain its market share. "We have done a complete overhaul of all of our stores," said Toys "R" Us spokeswoman Susan McLaughlin. "They are brighter, cleaner and a lot more fun."

Karen Burk, a Wal-Mart spokeswoman, said the most popular items this year are the Barbie Swan Lake, Teenage Mutant Ninja Turtles and Leap Pad books.

Sometimes, the toys are a result of a partnership with another retailer. In a joint venture with Home Depot, Toys "R" Us is offering a toy animal collection known as "Barnyard in a Bag." Then there is "Go-Go, the Walking Puppy," a robotic dog for $35, that normally retails for $49.99.

Stores such as Toys "R" Us and KB Toy & Hobby of Massachusetts may have a difficult time competing head to head with Wal-Mart, because they carry many of the same items. There are four Geppetto stores in Fashion Valley, La Jolla, Bazaar del Mundo and at the Hotel del Coronado, and owner Brian Miller said the stores are doing fine.

"We're actually running a double digit increase, though I know that it's definitely not the trend," Miller said. Miller said there was what he referred to as "a bit of a shakeup in the toy industry," he responded with a blitz of newspaper and television advertising. The ads have paid off. "And we weren't afraid to buy inventory, so we're well stocked," Miller said. While admitting there are items that are sold in both stores, Miller said that Wal-Mart doesn't have the hand made items, nor the customer service.

Jules Martin, owner of Hobby Central, whose business is in the same shopping center as a Wal-Mart in Poway, said while there are a few things such as rocket motors that people might be able to get cheaper at Wal-Mart, they are not likely to find a person to give them chapter and verse about model rocketry.

There were a few other trend-pieces that I thought would make for good reading this holiday season:

- KB Toys Delays Payment to Some Suppliers

- Toy Giant FAO May Have Buyer in the Wings

- Fashion Dolls Fight It Out Between Wholesome and Trashy

- Knock-offs for the Toy Box?

Have a blessed holiday,

- Arik

December 23, 2003

Gift Cards & the Changing Face of Retail Revenues

Gift cards are taking over 8 percent of holiday retail sales this year, and the stuff they’ll be spent on will most likely be higher-margin, splurge goods. The trends affecting retail revenue are shifting profoundly past New Year’s, as shoppers play chicken with retailers hoping for inventory reduction sales after Christmas, and post-holiday merchandising becomes more important as gift-carded consumers return to stores feeling flush with cash that needs to be spent – and those dollars will be spent on products they’d be less likely to buy for themselves if it was their own money being spent.

I found a few excerpts describing the trend much better than I from various sources below:

-

Retailers - like consumers - are hooked on gift cards, despite their potential to mess up earnings.

Perhaps no retailer knows that better than Wal-Mart, where heavy demand for holiday gift cards is slamming December sales, currently hovering at the low end of its 3% to 5% growth forecast.

The problem: Strong gains in gift-card sales can threaten the bottom line if consumers delay redeeming them. That's because gift-card purchases can't immediately be counted as sales. The purchase is logged as a liability until the card is swapped for merchandise.

So, to benefit the 2003 sales year, most retailers are depending on millions of holiday gift-card recipients to spend by the time their fiscal year ends Jan. 31.

Still, retailers say that gift cards foster customer loyalty, help win new customers and often coax consumers into spending more than the value on the card. They are so popular this holiday shopping season that sales are expected to hit $17.2 billion, or 8% of all sales, according to the National Retail Federation.

"There is only a 5% incidence where someone doesn't redeem a gift card within the first 30 days of receiving it, and that gap has been closing over the years," says Mike Brewer of Stored Value Systems, which processes gift-card transactions.

Still, retailers that wrap up the year in December have a greater urgency for gift-card redemption.

Major retailers closing books in December:

- Sears: The department store operator sells 20% to 30% of gift cards during the holiday season and redeems a "significant" amount shortly after Christmas. "We look at it as a great way to merchandise our brand. It's a way to give someone everything from tires to ties to dressers to dresses," says Bill Kiss, general manager of Sears Promotions. Sears eliminated expiration dates on gift cards Dec. 17. Previously, its gift cards expired two years from the date of purchase.

- Office Depot: The office products retailer sells about 60% of holiday gift cards during the last two weeks of the season, and value amounts this year are "double" last year's sales.

- A.C. Moore Arts & Crafts: The chain sells a "substantial" amount of gift cards during the holiday but isn't bothered by redemption after Dec. 31. "The rationale for gift cards is customer loyalty," says CFO Les Gordon.

Gift-card redemption rates are highest Dec. 26 and soon after while many consumers still have a few days off work and continue to hunt bargains.

The seven family members and co-workers for whom Chinissa Sumpter bought gift cards may be among them. "They give the recipient an opportunity to buy what they want," says Sumpter of Detroit, who spent $40 on each.

Talbots expects gift-certificate holders at the kickoff of its semiannual sale Dec. 26. "About one-third of gift certificates sold during the year are redeemed between Christmas through January," says Ed Larsen, CFO at Talbots.

Retailers don't benefit when cards aren't redeemed. Regulations, called escheat laws, vary from state to state. Some call for retailers to give any remaining balance or abandoned amounts to the state as unclaimed property after a lapse of time, according to Pillsbury Winthrop, a law firm specializing in laws relating to gift cards.

But most major retailers avoid the rule by eliminating expiration dates on cards or giving the unused portion back to customers as a store credit or, sometimes, cash.

Still, frustration abounds over restrictive policies some retailers have in place causing many consumers to give up the gift concept already:

-

Like more and more holiday shoppers, Juliette Coulter of Dallas thinks the right gift for many friends and family members is plastic and fits in a wallet. She's spending $300 in all this season on gift cards from Target, Old Navy, Starbucks and other stores. It means no worrying, for example, about size or style for a pair of nephews age 9 and 14. "They have very specific tastes, and I don't want to get them the wrong thing," she said. "I want them to think I'm the cool aunt."

Gift cards are hotter than ever this season, with merchants expected to sell more than $17 billion worth during the holidays, or 8 percent of all business, according to the National Retail Federation.. It actually helps them extend the selling season, as shoppers flood the stores after the holidays to redeem their cards and, the stores hope, spend a little more.

Yet as the cards become more familiar, many recipients are grumbling about some headaches associated with them - fees that can erode their value if they are not used quickly, problems getting replacements if they are stolen or lost, what to do with that last few dollars or even cents of credit.

Aware of the issues, and fearful of losing what has become a key piece of business, some store chains are revising their policies or doing more to educate customers about how to get the most out of gift cards.

Coulter said she doesn't worry about card fees as her recipients use them quickly - which is often the only way to make sure you get full value. Dennis Fish, of Atlanta, learned that the hard way.

Fish purchased a $120 gift certificate from a spa for himself and his wife last year. They waited just over a year to use it - and were hit with a 20 percent "reactivation" charge. The card had a one-year expiration period.

"Never will I buy one again until I know the ins and outs of the policies," he said.

He complained, and got the charge lifted. But he's buying just two cards this year, compared to 10 last year.

Brad Ferris of Washington said the cards "drive me nuts."

"If you get a $300 card and you only purchase $250, you end up forking out more money to these stores because they don't refund the cash you don't spend," he said. "I always receive these cards, and they end up being more of an expense than a gift."

Besides reactiviation fees, some store cards carry a kind of reverse-interest that's charged over time. Bank-issued cards often have an initial charge.

"Consumers are going to find out that their gift cards are not worth as much as they thought they were worth," said Gail Hillebrand, senior attorney at consumer advocacy group Consumers Union of U.S.

Her group supported legislation passed in California eliminating virtually all gift card and gift certificate fees effective January 2004. That state already has a law that keep cards from having expiration dates. In New Hampshire, cards that have a $99 value or less can be used anytime, while in Massachusetts, any gift card is now valid for up to 7 years.

Retailers say reactivation and other fees help cover costs to maintain the systems that track card credits, and are fair because the costs thus are charged only to consumers who delay in using them. There can be accounting costs, since stores don't record gift card sales on their final books until the cards are redeemed, according to the National Retail Federation.

But they are sensitive to the growing chorus of complaints. Several major chains, including Sears, Roebuck and Co., Barnes & Noble Inc. and J.C. Penney Co. Inc. have eliminated fees in time for the holiday season. Back in February, 18 national retailers - including Bloomingdale's, Toys "R" Us and Target Corp. - agreed to replace customers' lost, stolen or damaged gift cards.

Still, there are plenty of companies that have charges or have some sort of restrictions. A sampling:

- Wal-Mart Stores Inc. charges $1 fee per month after 24 consecutive months of inactivity.

- Barnes & Noble Inc. will replace damaged cards, but not stolen or lost cards. In October, the retailer eliminated its $1.50 monthly fee that it charged after 12 months of inactivity.

- American Express's prepaid card charges $2 a month after 12 consecutive months of nonuse. There's a $3.95 initial fee, if purchased online at americanexpress.com, or a $7.95 charge - if purchased by phone. When purchased in person, fees vary from $3.95 to $9.95.

- Simon Properties-Visa gift card program - which is expected to be Visa's largest gift card program this year, has an initial fee of $1.50, and has a service fee of $2.50 per month beginning with the seventh month. The initial fee is still low compared to Visa's other members, which can go as high as $7.

Lucy Lazarony, a researcher at Bankrate.com, recently studied the gift card policies of major banks and retailers. For gift cards ordered online, she said, Lazarony many retailers charge a shipping and handling fee ranging from $1.95 to $8.95 for standard shipping.

Visa USA said that consumers are seeing the value of their gift cards because it has "universal acceptance" - they can be purchased at any store that accepts Visa - and they can be replaced if stolen or lost. But company officials acknowledge that consumers could use more education about the policies.

"We are working with our members to adequately overdislose information" to consumers, Kenny Thomas, a company spokesman. That includes spelling out policies right on the back of the card.

Still, the cards' popularity is expected to keep growing. C. Britt Beemer, chairman of America's Research Group, based in Charleston, S.C., said gift cards have become the "grand slam" of the 2003 holiday season.

According to Bain & Co., card sales for 2003 will total anywhere between $42 billion to $45 billion in sales this year, up from $36 billion to $38 billion in 2002. Exact figures are hard to determine.

Stores like gift cards because they cut down on returns - and about two-thirds of recipients spend more than the value of the cards, according to Rob Markey, a director at Bain.

They also increase sales of regular-price items, because shoppers using a card are less interested in getting a discount.

Michael Brown, a retail operations specialist at Kurt Salmon Associates, estimated that about 10 to 15 percent of the value of the cards are never used.

Hillebrand, at Consumers Union, knows how gift-givers can prevent that from happening.

"Write a check," she advised.

Here, here.

- Arik

December 22, 2003

Parker Brothers & the Monopoly® Monopoly

Having been an undergraduate history major, as well as someone interested in business and competition, I recently found an excerpt from a new business history on Parker Brothers, the board game company, on Harvard B-School’s "Working Knowledge" site. Even if you’re not buying board games for the family this Christmas, it’s a pretty interesting story:

Having been an undergraduate history major, as well as someone interested in business and competition, I recently found an excerpt from a new business history on Parker Brothers, the board game company, on Harvard B-School’s "Working Knowledge" site. Even if you’re not buying board games for the family this Christmas, it’s a pretty interesting story:

-

In 1883, George Parker was 16 years old, and he liked to play board games. But he and his friends were tired of the "heavy-handed moral lessons" of the typical board game, and George, an inventive young man, created his own game, called Banking (chartered banks were a relatively new thing in the U.S., and people were fascinated by the whole subject). It was a success, and soon George and his brother, Charles, formed their own company, Parker Brothers.

The Monopoly game, Trivial Pursuit, Clue, Boggle, and Risk are more than just games to us - they're part of America. All of these games were published by one company, Parker Brothers, which began as the dream of a sixteen-year-old boy, over one hundred years ago.

In "The Game Makers", industry expert Phil Orbanes reveals how, by adhering to the principles of its founder, Parker Brothers rose to prominence, overcame obstacles, and forged lasting success. Orbanes, a game historian and former executive at Parker Brothers, draws from company archives, interviews with surviving family members, and the newly discovered records of founder George Parker to tell a story rich in examples of business acumen that spans world wars, family tragedy, the Great Depression, and global competition.

That said, I also found a critique of George Parker’s claim to fame, called "The Billion Dollar Monopoly Swindle", which claims Parker wasn’t so original after all and should take his place among his turn-of-the-century-robber-baron-peers:

-

Part detective novel, part history, and part horror story, The Billion Dollar Monopoly® Swindle not only recounts the true history behind one of the world's most popular board games but also reveals a world where the law sometimes seems as arbitrary and unfair as a "Go directly to jail" card. When Ralph Anspach released his game Anti-Monopoly in 1973, he suddenly found himself in the crosshairs of the formidable Parker Brothers legal machine, which claimed that his use of the word monopoly violated copyright laws. While conducting research to gauge the strength of Parker Brothers' case, Anspach discovered that the corporate giant might not even have the rights to the game.

His investigation revealed the existence of a board game called the Landlord's Game that had been played at least 30 years before Parker Brothers published Monopoly in 1935. When Charles B. Darrow was introduced to this game by a group of Quakers, he copied their board and rules verbatim (even duplicating their misspelling of "Marvin Gardens"), then sold it as his own creation. Parker Brothers supported him, putting a copy of the "story of Monopoly" that cited him as creator in every box.

As for the Anti-Monopoly case, Anspach faced down the game moguls in a battle that went all the way to the Supreme Court (and included an unexpected appearance by future independent counsel Kenneth Starr). You can still play Anti-Monopoly today - and Anspach has even started packaging the original version in the game boxes as a bonus.

Sounds a little like revenge to me - Anspach's attempts to poke PB after getting waxed in court. Still, it's interesting how even a game company knows how to protect its competitive interests.

- Arik

December 21, 2003

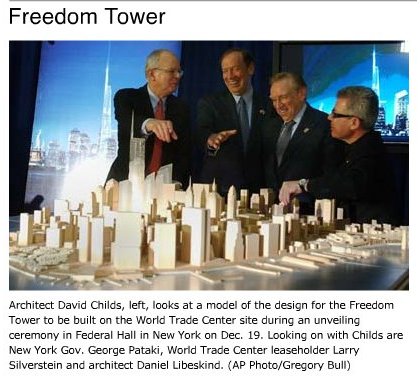

New York’s Planned "Freedom Tower" Unveiled Amid Uncertainties Over Tallest Building Designation

This week’s unveiling of the 1,776-foot-tall "Freedom Tower" called into question the designation process for whether the proposed tower really will be the world's tallest, assuming it’s ever built. Despite repeated claims yesterday that it would be, the New York Times speculates the organization that bestows that honor might not think the latticework wind farm on top counts as part of a "habitable building." That’s got a few people annoyed: "The world's tallest building moniker is a shibboleth of feel-good boosterism perpetrated by rebuilding officials who have nothing else to offer the public but a P.R. campaign."

-

New York officials Friday unveiled final plans for the Freedom Tower, a shimmering skyscraper of glass, cable and steel rising over the World Trade Center site that will be the world's tallest building.

Gov. George E. Pataki hailed the sleek, twisting structure - whose angular, upward slope echoes the Statue of Liberty - as "a major step forward in the rebuilding of New York" after the Sept. 11, 2001, terrorist attack. He also praised the blueprint as a "stirring collaboration" between two prestigious architects who, until recently, had been feuding over their roles in the project.

Plans for the new commercial building were revealed during a brief ceremony at Federal Hall in Lower Manhattan, where George Washington was first sworn in as president and where the first U.S. Congress met. Officials repeatedly invoked the symbolism of the building, noting that the Freedom Tower would soar 1,776 feet into the air.

The building, which will sit at the northwest corner of the 16-acre World Trade Center site, will "dramatically reclaim a part of the New York skyline that we all lost on 9/11," Mayor Michael R. Bloomberg said. He suggested that the five-building complex planned for the site could be completed in 10 years.

Although officials selected a plan in February to develop the site, it has since undergone some crucial modifications - most notably the construction of a glass-and-concrete addition above the tower's commercial floors. The winning design for a memorial to victims of the terrorist attack will be announced separately next month.

Architects Daniel Libeskind and David M. Childs, who designed the Freedom Tower, described it Friday as an expression of public art that, like the memorial to be built at Ground Zero, would send a message about American freedom to future generations. The crucial element, they said, was building something that would stand the test of time.

"To join the vision of this structure to the image of the Statue of Liberty is quite a statement," said Libeskind, who as a child of immigrant parents sailed into New York Harbor years ago. "This building will rise to the height of 1,776 feet and it must never be surpassed, because that number truly means something to us all."

But developer Larry Silverstein - who holds a lease to operate the World Trade Center - said the thing that mattered most to him was that the Freedom Tower work economically, spurring development throughout Lower Manhattan.

He voiced confidence that the new building would lure a multitude of tenants back to the area, and said he had promised Pataki that the cornerstone for the Freedom Tower would be laid next year before the third anniversary of the attack.

"What we see here today is beautiful and spectacular, something to be very proud of," Silverstein said. "But I am happy to say that it is also very practical."

Silverstein, who previously had expressed unhappiness with what he called commercially unrealistic plans to redevelop the site, said the Freedom Tower's safety measures would vastly outpace those of the original twin towers and would include better-protected stairwells, blast-resistant glaze on lobby glass and better interior alarm systems.

The design calls for 70 commercial stories with 2.6 million square feet of office space, plus an underground regional transit hub, garages and several retail shopping centers. There also will be a public observation deck and a rebuilt Windows on the World, the restaurant that once sat atop the north tower. In the attack on the World Trade Center, 11 million square feet of office space was lost.

Although the previous World Trade Center buildings each had 110 stories, the Freedom Tower will rise higher because of a large glass structure and 276-foot spire topping off the building. Childs noted that special wind turbines would be constructed, allowing the building to generate 20% of its own energy needs.

The upbeat mood of Friday's unveiling belied months of behind-the-scenes disputes, both artistic and political.

Although Libeskind's master plan was selected this year to guide overall development of the site, Silverstein and others brought in Childs, a consulting design partner at Skidmore, Owings & Merrill, to help sharpen Libeskind's blueprint and turn his vision into a concrete plan.

The two architects reportedly clashed during recent months over issues involving the building's height and overall design, causing Libeskind to complain that he had been pressured into a "forced marriage." Pataki, who was determined to meet a December deadline for the unveiling, brokered a compromise that retained key elements of both plans and kept the work on schedule.

There also have been tensions between Pataki and Bloomberg over who should control the city's biggest public works project since the end of World War II. When the moment came Friday to pull the drawstrings on a white curtain and reveal the Freedom Tower design, the governor and the mayor reached awkwardly over each other to grab the cord, along with Childs, Libeskind and Silverstein.

"That's collaboration for you," the mayor said dryly.

There was little official disagreement, however, over the Freedom Tower's design.

Libeskind's trademark spire, reaching into space and topping off the building at 1,776 feet, was retained in the final blueprint; Childs' key contribution was the cabled glass and steel section atop the commercial floors that is meant to recall the design of the Brooklyn Bridge and serve as a symbol of American energy and ingenuity.

Officials said the building would stand directly opposite a memorial to victims of the terrorist attack and complement it in subtle ways. A key feature of the Freedom Tower, Childs said, was that its design would "split and confuse" the strong winds that often blow through the area from the Hudson River, thus offering "protection" from the elements to millions of people visiting the memorial.

As for whether it’s the tallest building in the world, there are plenty of people who might argue with the designation. Just take a look at the graphic below that compares various designs.

Another piece in the New York Times discusses the politics of highest-building designations:

-

It will certainly be the world's tallest cable-framed, open-air, windmill-filled, spire-studded superstructure, rising atop 70 stories of offices, restaurants, a broadcast center and an observation deck.

Whether that makes it the world's tallest building is another matter. No fewer than a half-dozen times at the unveiling yesterday, the Freedom Tower at the World Trade Center site was called the world's tallest building.

But the Council on Tall Buildings and Urban Habitat, a recognized arbiter, has not yet ruled. And it may be a tough group to persuade. That is because the Freedom Tower will be a hybrid structure with several pinnacles: the top of its enclosed, occupied space is to be at about 1,150 feet; the top of the superstructure at 1,500 feet; and the top of its slender spire at 1,776 feet.

In other words, about one-third of the Freedom Tower will be more of a structural framework than a habitable building. "There are strong feelings on both sides of this," said Ron Klemencic, a structural engineer in Seattle and the chairman of the tall buildings council, which is affiliated with the Illinois Institute of Technology in Chicago. "There's a camp that would say that since so much of the structure is not available to be occupied, it should not be considered the tallest building in the world," he said in a telephone interview on Thursday.

Never mind the Freedom Tower - you can get an argument today about just what is the world's tallest building, even after disallowing cable-supported broadcast towers and agreeing not to count rooftop antennas.

The CN Tower in Toronto unhesitatingly describes itself as the world's tallest building, at 1,815 feet. But some see it is as more of a mast, with a relatively small amount of occupied space. To the council, it is the tallest free-standing structure in the world.

Then comes Taipei 101, a 101-story tower nearing completion in Taiwan, at 1,667 feet, with the top occupied floor at 1,470 feet. The council is inclined to award it the tallest designation, Mr. Klemencic said, but not until it is available for occupancy sometime in late 2004.

That leaves as the reigning champion the 88-story twin Petronas Towers in Kuala Lumpur, Malaysia, which measure 1,483 feet at the top of their spires but only 1,229 feet at their top occupied floors.

The fact that the bulk of these towers is lower than the Sears Tower in Chicago (1,450 feet over all but occupied to 1,431 feet) gave the council pause.

But it decided to recognize spires as the "top of the architecture"; that is, a feature without which the building would look fundamentally different.

Paradoxically, Mr. Klemencic said, the "top of the architecture" criterion had been proposed by an earlier council chairman, Fazlur R. Khan, the engineer at Skidmore, Owings & Merrill who was largely responsible for the Sears Tower. The Skidmore firm is in competition with itself in the perpetual world's-tallest race, since it is also designing a project known as Burj Dubai in Dubai.

Another contender is the Shanghai World Financial Center by Kohn Pedersen Fox Associates of New York.

Whatever it is that Freedom Tower turns out to be the tallest of, in other words, it may not be for long.

- Arik

December 20, 2003

RIAA Dealt a Blow in Verizon Decision

The Recording Industry Association of America was dealt a major setback in the U.S. Court of Appeals for the D.C. Circuit this week, curbing its ability to sue file-sharers who trade pirated songs.

The Recording Industry Association of America was dealt a major setback in the U.S. Court of Appeals for the D.C. Circuit this week, curbing its ability to sue file-sharers who trade pirated songs.

The court decided that the industry could not force Internet service providers to turn over names of subscribers who trade music because the current law, written in 1998, only allows the industry to request information about subscribers who keep copyrighted material on their ISP's servers, something present-day peer-to-peer file-sharing programs do not do. "It is not the province of the courts ... to rewrite the [law] in order to make it fit a new and unforeseen Internet architecture, no matter how damaging that development has been to the music industry," the author of the majority opinion wrote. The music industry will now have to go through the more cumbersome process of actually initiating lawsuits against anonymous users before the courts can force their identities to be revealed.

Here’s an excerpt from the New York Times:

-

The sharply worded ruling, which underscored the role of judges in protecting privacy and civil rights, is a major setback to the record companies in their efforts to stamp out the sharing of copyrighted songs through the Internet. It overturns a decision in a federal district court that allowed the music industry to force the disclosure of individuals simply by submitting subpoenas to a court clerk without winning a judge's approval.

Until yesterday's ruling, the industry could seek information on file traders without filing a lawsuit or even appearing before a judge, a streamlined procedure that opponents of the industry said did not protect Internet users' rights.

"It's a huge victory for all Internet users," said Sarah Deutsch, vice president and associate general counsel for Verizon Communications, which brought the suit against the Recording Industry Association of America to protect the identities of its Internet customers. "The court today has knocked down a very dangerous procedure that threatens Americans' traditional legal guarantees and violates their constitutional rights."

The appeals court did not directly raise those constitutional issues in its decision. The judges said they were "not unsympathetic" to the industry's troubles in limiting music piracy "or to the need for legal tools to protect those rights." But in a decision that focused narrowly on the nuts and bolts of copyright law, they said that the music industry had gone too far.

Cary Sherman, the president of the recording association, said that the case "is inconsistent with both the views of Congress and the findings of the district court." Mr. Sherman said that his organization would continue to sue those who violate copyrights. It "doesn't change the law, or our right to sue," he said. "It just changes the way we get the information."

The decision is online and is pretty interesting reading. Verizon deserves a few words of thanks from the general public, in my opinion, not because songs will go unprotected, but because Verizon saw how slippery a slope the RIAA’s policy could really be.

- Arik

December 19, 2003

RealNetworks Sues Microsoft for Unfair Competition

RealNetworks said yesterday it’s suing longtime rival Microsoft, accusing the software titan of unfairly promoting its own software for playing audio and video on computers and over the Internet.

-

In an antitrust complaint filed in federal court in San Jose, California, RealNetworks claimed that Microsoft "pursued a broad course of predatory conduct over a period of years by abusing its monopoly power, resulting in substantial lost revenue and business for RealNetworks." RealNetworks is seeking more than one billion dollars in damages and unspecified injunctive relief measures. "We believe that we have a very strong case against Microsoft," RealNetworks Chief Executive Rob Glaser told reporters on a conference call.

Microsoft rejected RealNetworks claims, saying that there was "vibrant competition" in the digital media player marketplace and that it would respond forcefully to RealNetworks' allegations in court. "Real(Networks) claims to be the No. 1 provider of digital media solutions, with massive distribution of its software and more than 1 million player downloads a week," said Microsoft spokesman Jim Desler, "Thus, this is a case where a leading firm is seeking to use the antitrust laws to protect and increase its marketplace share and to limit the competition it must face."

Seattle-based RealNetworks said that its lawsuit was complementary to an ongoing European Commission investigation into Microsoft's activity involving media-playing software and that it was cooperating with the EC. European Union regulators are wrapping up a five-year probe to determine whether Redmond, Washington-based Microsoft used its monopoly position to boost its share of the media player market. RealNetworks has testified in recent EC hearings.

The two companies, based in the Seattle area, have met frequently in courtrooms over the last five years. Glaser, a former Microsoft executive, founded RealNetworks nearly a decade ago to sell software that allows users to listen to audio and video content on their personal computers.

The two companies were once on good terms, with Microsoft making a $30 million investment in RealNetworks in 1997, but the relationship turned sour after Glaser testified against Microsoft in the U.S. government's antitrust case.

In Thursday's filing, RealNetworks said Microsoft used its monopoly power, which was recognized by the U.S. courts, to force "every Windows user to take Microsoft's media player, whether they want it or not."

RealNetworks, which has been branching out into online content subscription services, sells its media player as a downloadable software product or with a monthly subscription.

RealNetworks said its its complaint that Microsoft went from having no presence in the streaming media business in 1997 to surpassing RealNetworks' digital media player market and usage in the United States in 2002.

Bob Kimball, RealNetworks' vice president and general counsel, said his legal team chose to file its suit in San Jose, California, the heart of Silicon Valley where most of Microsoft's competitors are based, because many of the witnesses are nearby. RealNetworks said it had already spent more than $1.5 million on the litigation during the current quarter and expects to spend $12 million next year.

Meanwhile, Microsoft defended its business practices in the multimedia market:

-

"There is vibrant competition in this marketplace and Real Networks' own reported growth shows that they have thrived on Windows and many other operating platforms," Microsoft said in a statement.

Part of Real Networks' case is based on business conduct similar to what U.S. courts have declared illegal in other Microsoft antitrust cases, such as failure to disclose interface information and placing restrictions on PC manufacturers, said Bob Kimball, Real Networks vice president and general counsel, in the statement.

Such antitrust litigation typically takes about three years with a trial, Real Networks said. Microsoft, for its part, said that computer makers can install and promote any media player on their PCs and that it does not restrict consumers from using any media player. The company called Real Networks' move "rear-view mirror litigation."

"These issues are a rehash of the same issues that have already been the subject of extensive litigation and a tough but fair resolution of the government antitrust lawsuit," Microsoft said in the statement, in turn accusing Real Networks of using antitrust laws "to protect and increase its market share and limit the competition it must face."

Attorneys who have been involved in other legal action against Microsoft said they could see Real Networks' lawsuit coming given its involvement in advising the Department of Justice and the various states in their antitrust cases against Microsoft. "It's not a surprise at all," said Richard Grossman, a partner at Townsend and Townsend and Crew LLP, in San Francisco, and co-lead counsel in a California class-action case that led to a $1.1 billion settlement with Microsoft. "Certainly Real Networks has been at the forefront of those concerned about Microsoft's anti-competitive conduct."

In browsing Real’s Web site today just to re-familiarize myself with a company that had, to be honest, dropped off my radar awhile ago, I found a solid explanation of their competitive advantage over Microsoft, which it seems to consider weaker in many areas than RealNetworks own products. That said, given such an unfair competitive advantage over Microsoft, it might leave some wondering what Real’s lawsuit is really arguing. Here's their top 10 list of advantages:

-

HELIX VS. MICROSOFT: YOU DECIDE

RealNetworks® pioneered streaming media on the Internet in 1995 and has been the leader in technology and business innovations ever since. Today, thousands of the world's leading enterprises, infrastructure service providers, and media companies manage media creation, delivery, security and playback with RealNetworks' end-to-end systems technology.

Why do these companies continue to select solutions from RealNetworks rather than using bundled media software from Microsoft? Review the facts below and decide for yourself whether RealNetworks or Microsoft creates more revenue and cost savings opportunities for your organization.

1. RealNetworks Helix Universal Servers deliver four times more Windows Media streams than Windows Media Servers

In June of 2002, RealNetworks contracted an independent testing facility to benchmark our Helix Universal Server against the Windows Media Technology 4.1 Server. The results were dramatic — Helix Universal Server serves Windows Media better than Windows Media Server. In addition, if you take into account Microsoft's claims regarding performance improvements in their Windows Media 9 Series Beta, RealNetworks Helix Universal Server still delivers nearly double the performance and is shipping commercially today.

2. Is "free" really free?