January 30, 2004

Madison: Presenting Lorman’s "Survival Skills for Turbulent Times" Competitive Intelligence & Security Workshop

I was in Madison today, presenting a half-day session called "Competitive Intelligence: Strategy, Structure, Applications & Leadership" for Lorman Education – starting and finishing, while my friend Tony Cooper took the mid-day session on "Competitive Security".

Although attendance was hurt by the severe cold – wind chills on the Capitol isthmus around 30 below zero – we still had some brave souls make it.

This was something of an experiment for me – teaming with Lorman that is – which is a more general education company that travels the country doing workshops and seminars for CEUs to engineers and lawyers who need to keep up their association memberships and that sort of thing. Lorman did the accreditation process with the respective associations whose members we were presenting to so there was no worrying about that.

All I had to do was show up and speak, which is par for the course. The biggest reason for doing it for me wasn’t the money – it was virtually non-existent – or the mind-share impact for consulting work later on with potential clients from the class – there were few of those sorts of possibilities either, as most of our clients tend to be Global 2000 and these were decidedly small businesses represented here. The best part was to spread the word about CI among small business – a pet initiative of mine this year – so, expect to hear more about these smallish events.

If you’re curious, my slides are (temporarily) available for download by clicking here.

- Arik

January 22, 2004

Philadelphia: Presenting at the Center for Business Intelligence’s 2nd Annual "Competitive Intelligence for Biotechnology & Pharmaceutical Companies" Conference

I was in Philadelphia today, presenting a 45-minute session called "Salesforce CI: Creating Dynamic Two-Way Intelligence Relationships with Sales" at the Center for Business Intelligence 2nd Annual CI for Bio/Pharmaceutical Companies conference. It was a fun event – and about 30% better-attended than last year’s while also housed in a much better venue at the Marriott downtown.

One interesting take-away was a follow-up discussion we had about FDA regulations about salesforce drug comparisons that I think is probably unique to pharma-salesforce-CI: that is, unless there’s been a head-to-head clinical trial to scientifically back up sales comparisons between competitive products (used in sell-against strategy apps and the like) it’s illegal to make comparisons between drugs at all – at least in the United States. We’ll see how that’s reflected in my research for the London version of this event in June, where I’ll give a similar presentation for a European Bio-Pharma audience.

Otherwise, content of the program was very good and the group itself was a lot more eclectic than in the past as well – representing more people from financial community and the generics side of the market – CBI’s really evolved this conference since the last one in January 2003.

My slides are temporarily available for download by clicking here.

- Arik

January 20, 2004

Iowa's 2004 Democratic Caucus Results: Dated Dean, Married Kerry

Kerry and Edwards came out of nowhere in the last couple of weeks or so, to eclipse former frontrunner Howard Dean in last night's Democratic Caucus in Iowa, to take most of the state's 45 delegates to the Democratic National Convention later this year. I think it's an interesting study in competition and how candidates differentiate themselves – with Gephardt dropping out entirely after a disappointing fourth place showing.

Dean was bloodied badly and that outcome doesn't necessarily bode well for their ultimate competitors in this march toward November - the Republicans. Widely considered unelectable by Republican intelligentsia, a Dean win in Iowa would have been music to Republican ears. A Kerry-Edwards win is decidedly more competitive to Bush-Cheney '04. Still, Dean’s surreal address following the results was decidedly un-presidential at best, and just plain weird at worst. It hearkened back to the infamous "Monkey Boy" dance of Microsoft’s CEO Steve Ballmer a few years ago.

On the bright side, Kerry’s going to have a lot to live up to in New Hampshire, where Dean can recast himself as a decidedly less-pressured underdog. But, the dark horse in this race is John Edwards – moving down south for primaries in coming weeks should demonstrate how badly we’ve all underestimated the North Carolina Democrat.

As for the media recaps, the LA Times' Ron Brownstein wonders why Dean got whupped and suggests he hurt himself by going negative while misjudging voters' ongoing anger about the war, most of which had already blown over in the wake of Saddam Hussein’s capture. Brownstein also says Kerry "displayed almost equal appeal to men and women, working class and more affluent voters, liberals and moderates" - suggesting very broad-ranging support among a cross-section of influential voters.

Slate's Will Saletan has similar thoughts and adds that the press killed Dean, and only somewhat undeservedly. But, Saletan's analysis of where this leaves Edwards and Clark in the race for second-place – that is, as running-mate – is more interesting:

-

The other significant thing for Edwards is that the winner tonight was Kerry, not Dean. Dean's logical running mate was Clark: the New England domestic policy expert and national security rookie, paired with the Arkansas national security expert and domestic policy rookie. Kerry could go with Clark, too. But Kerry doesn't have to, because he's already got the national security credentials as well as the domestic policy expertise. If the hole in Dean's doughnut, as he once called it, was military experience, the hole in Kerry's doughnut is vitality and a common touch, plus regional appeal in the South or Midwest. I could see a Kerry-Clark ticket (or the reverse), but a Kerry-Edwards ticket (or the reverse) is now conceivable. A Dean-Edwards ticket wasn't.

If I'm Clark in New Hampshire, my task just got more complicated. I'm not just fighting to stay above Kerry so I can have a shot at the presidency. I'm also fighting to stay above Edwards so I can have a shot at the vice presidency.

But, a New York Times news analysis warns not to read too much into the outcomes: of the 13 most recent competitive "nominating processes," 10 have had a different candidate win in New Hampshire than in Iowa. For example, one important candidate from years past who lost Iowa was Ronald Reagan.

There were a couple of other interesting recaps:

- Howard Kurtz: Media Notes - A Flood Of Analysis

- Massachusetts Senator Gets Lift for the Race in New Hampshire

So, it's starting to get a little more exciting with a tightening of the field of Democrats. I personally think Dean will still get the nomination in the end, as the "Democratic Establishment" continues to line up behind him - but, the Iowa loss was a major blow to a campaign that said today it's glad not to be the front-runner anymore.

- Arik

January 19, 2004

Innovation Powerhouse IBM Breaks U.S. Patent Record & Tops the USPTO List for 11th Consecutive Year

American technological competitiveness appears to be in good hands, despite six of the 10 top innovators being Asian rather than American. The 2003 preliminary patent results were reported a week ago by the United States Patent and Trademark Office. As you know, an agency of the U.S. Department of Commerce, the USPTO issues patents, administers the patent and trademark laws of the United States, and advises the administration on intellectual property policy.

IBM broke a record for the number of patents granted in a year with 3,415 in 2003 and the firm has led the U.S. Patent and Trademark Office annual list for the past 11 straight years, making it one tough act to follow.

IBM was far ahead of the number two firm, Canon, which had 1,893 last year. Companies that make IT products held all the top 10 spots; together, those firms acquired 18,121 patents. Besides IBM and Canon, the group includes Hitachi, Matsushita, Hewlett-Packard, Micron Technology, Intel, Philips, Samsung and Sony.

Making its debut on the top 10 list for 2003 was Intel, having jumped up from 15th place in 2002. The chip-maker landed in seventh place with 1,592 patents, compared with the No. 15 spot in 2002. Hewlett-Packard also made a notable rise, moving to the No. 5 position from No. 9 in 2002, recording 1,759 patents in 2003, 374 more than in the previous year.

Still, IBM is the "Innovation Powerhouse".

During the past eleven years, IBM innovations have generated more than 25,000 U.S. patents - nearly triple the total of any U.S. IT competitor during this time and surpassing the combined totals for Hewlett-Packard, Dell, Microsoft, Sun, Oracle, Intel, Apple, EMC, Accenture and EDS.

"IBM's commitment to research and development has driven more than a decade's worth of patent leadership and is a major factor in our emergence as the world's leading IT, services and consulting company," said Nick Donofrio, IBM senior vice president, technology and manufacturing. "That said, we consider patents a starting point on the path to true innovation. What differentiates IBM from other companies is our ability to rapidly apply these inventions to new products and offerings that solve the most pressing business challenges of our clients."

Meanwhile, some of the biggest innovators of years past that no longer appear in the Top 10 include American business titans like Xerox, Lucent, Motorola, Eastman Kodak and General Electric - all firms that have had their share of business problems recently. If you're as curious about prior years as I was, check out the list of Top 10 patent recipients since 1995 below - it's fascinating to see how standings can change so rapidly.

Notably, two Xerox Corporation scientists, Raj Patel and Robert Yu, were awarded their 100th U.S. patents last month. That rare accomplishment capped a year in which Xerox and its subsidiaries earned 628 U.S. utility patents on new materials, new technologies and new ways of processing documents, bringing its total U.S. patents earned to nearly 16,000 - a sum matched by only a handful of the nation's most creative companies.

- Arik

January 18, 2004

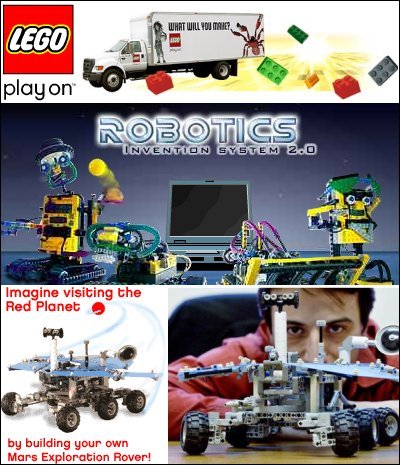

Trouble in LEGO-Land: Playing Well, but Not Putting It Together

The name LEGO comes from the Danish words "Leg Godt", which means "Play well". In Latin it means "I put together" or "I assemble". The Danish toy maker, founded in 1932 and whose colored plastic building blocks have been favorite children's toys for decades (including my own), said last week it was expecting a $240 million pretax loss, the worst in the privately held company's 72-year history.

The company fired EVP and COO Poul Plougmann over failed marketing strategies and also dismissed Francesco Ciccolella, who was responsible for product development. The company said it might also lay off some of its 8,000 workers worldwide.

Kjeld Kirk Kristiansen, chief executive and grandson of the company's founder, said Lego's push to develop new products did not generate the results it wanted. Last year was "very, very bad," he said.

Since it reported its first loss of $47.8 million in 1998, Lego has been hit hard by increasing competition from the makers of electronic toys. Under Plougmann, the company reacted by expanding its electronic offerings, including making high-profile deals to use characters from Disney, the Star Wars films and Harry Potter books in its toys. It also developed popular CD-ROM games and its cool Mindstorms series of high-tech robots made of building blocks but programmed with a PC, in effect turning children in programmers plugging in reusable OOP code to control robot activity.

As a result, sales rose but profits stagnated because of the higher cost of producing the new products. The company now plans to stop making the electronics and movie tie-in products and return to its core mission of producing plastic building blocks primarily for pre-school children. "We would rather be in control of our own products, the things that we can decide," Kristiansen said. "We want to go back to our core products, and that is a key part of our future strategy."

Figures for 2003 were not released, but in 2002, Lego posted a 7% increase in sales, to $1.9 billion and a 1% gain in its net profit to $72.5 million. Until 1997, Lego did not release its financial results. The global toy market came to a near standstill in 2003 and caused a deleterious 25 percent sales drop for the company.

It's a real question whether a company like Lego can compete in the high-tech game world kids have become accustomed to. An excerpt from one story explains Lego’s dilemma:

-

[Kristiansen] said the company would now go back to its roots, focusing on building blocks and abandoning its forays into multimedia and film products. "We are returning to Lego's former concept. We're going to focus on building bricks as our main product, concentrating on little kids' eagerness to assemble," he said. "That's why we're pursuing much more aggressive marketing for building bricks, leaving products linked to films such as Star Wars on the back burner," he said.

One key factor for the weak result this year was the poor sales of games based on the Star Wars and Harry Potter films in 2002. Kristiansen acknowledged that Lego's recent attempts to diversify had been a catastrophe. "We tried to follow trends, to have toys that were in fashion, that are 'in' one year and 'out' the next. But it didn't work," he said. "In our efforts to follow the trend, we forgot about our traditional, basic products - the plastic building bricks - and we spent all our efforts on new toys that we launched together with films like Star Wars and Harry Potter".

Other forays included Lego theme parks in England, the United States and Germany, collaboration with the Formula 1 Williams car racing team to get children interested in the sport, and a clothing line bearing the Lego brand.

Facing tough competition from electronic games, Lego also jumped into the fray and began producing in 2002 videos and animated films based on its hugely successful Bionicle series, signing contracts with U.S. companies Creative Capers Entertainment and Miramax Films. Its film "Bionicle Mask and Light", produced in DVD and VHS formats, got off to a strong start when it was launched in the United States and Canada on September 16. Lego is still hoping for similar success in Europe and in the rest of the world.

Children's toy researcher Joern Martin Steenhold said there were several reasons for Lego's poor health. "Lego was not able to follow up on the success it had on its new products. There was a void after the Bionicle, Harry Potter and Star War series," he said. "In addition, Lego was not skillful enough to exploit its 'smart building brick' with an electronic chip, a super product with enormous potential," he added.

Making matters worse, Lego has been hit hard by the weak U.S. dollar. Some 40 percent of its sales are in the United States.

Danish PR guru Martin Lindstroem agreed with Lego chief Kristiansen, saying he believed the company's future lay not in multimedia products, but in the bricks. But he stressed that it "still has a lot of potential, it has one of the best brandnames, recognized in 90 percent of the western world."

Toy researcher Steenhold also said Lego was making the right move by targetting pre-school children. "All research, including my own, shows that computer games and other electronic games take up only 20 to 30 percent of children's play time. Boys play with traditional toys up until the age of eight or 10, and it is in the zero to seven age range that Lego has its niche," he said.

Personally, I think it takes a lot of guts for a company to take risks on product innovations as Lego has, fail miserably, then be able to admit it, dust itself off and take steps to move forward. One bright spot is its new $90 Mars "Spirit" rover 858-piece play set of building blocks – thanks to the successful touchdown of the NASA exploratory space mission, another risky proposition if the mission had failed. "It's on the high end of challenging to put together," said Jeff James, of Lego's community development office in Connecticut.

- Arik

January 17, 2004

The National Hockey League Catastrophe: Will there Be a Season Next Year?

In the how-to-wreck-a-market department, I noticed an article today describing how the National Hockey League is finding itself in the midst of a financial collapse. Starting 13 years ago the league, then 21 teams, expanded geographically - with nine new franchises, many in the Sun Belt - in order to win a lucrative national TV contract. The resulting broadcast deal pays only $4 million per team annually (compared to the NFL's $80 million per), and ratings are poor. Here's an excerpt from the Washington Post:

-

As the all-star break approaches, the league's six Canadian franchises are healthier than in recent years, thanks to an improved Canadian dollar. Dallas, Boston, Toronto, Detroit, Philadelphia, Chicago, Minnesota and the Rangers are believed to be profitable or close to it. Columbus is apparently well run and profitable.

But the vast majority of teams are sick.

Case in point is Tampa Bay, which has lost $50 million in the past four years, according to team officials. The Lightning, with one of the best young teams in the league, has a payroll at $33 million, which is in the bottom half of the league. The team saw a rapid spike in attendance during last year's playoff run in which it got knocked out in the second round.

But Lightning President Ron Campbell said the club would be better off financially if next season is cancelled. He said that from an operations standpoint, it would be the best year since his boss, industrialist Bill Davidson, bought the franchise in 1999.

"No one wants a work stoppage," Campbell said. "We just want a system that will allow us to operate with a small margin of profit. At the end of the day, we are still a business. And as much as you want to win, it's not much fun to win when it costs you millions of dollars."

Meanwhile, the expansion diluted talent, reduced goals-per-game, and left a larger percentage of the league out of the lucrative playoff season. Profits declined - two thirds of teams are losing money - while player salaries skyrocketed. The only solution is to bind salaries to league revenue. (The NBA caps salaries at 57 percent of revenue; NHL salaries consume 76 percent.) But doing this will force a lockout for most, if not all, of next season, which could bankrupt a quarter of the league.

But then, sometimes consolidation isn’t such a bad thing.

- Arik

January 16, 2004

Merger of JP Morgan Chase & Bank One Puts New Pressure on Competitors Large & Small

The wave of consolidation in the U.S. financial services industry has given birth to another mega-bank - and the new team of J.P. Morgan Chase & Co. and Bank One Corp. already is talking about getting bigger.

The nation's third- and sixth-largest banks announced plans for a merger after markets closed Wednesday, a deal that leapfrogs last fall's Bank of America-FleetBoston hook-up to become number two behind Citigroup, assuming both transactions are approved.

The nation's third- and sixth-largest banks announced plans for a merger after markets closed Wednesday, a deal that leapfrogs last fall's Bank of America-FleetBoston hook-up to become number two behind Citigroup, assuming both transactions are approved.

For $58 billion, J.P. Morgan Chase acquires Bank One's Midwest banking strength, $290 billion in assets and 1,800 branches in 14 states while keeping its name and New York headquarters status intact. It also gets a successor to 60-year-old chief executive William B. Harrison Jr., who agreed to give up that post in 2006 to Jamie Dimon, a Wall Street darling since before his four-year stint as Bank One's CEO, Dimon kept his Manhattan apartment before taking to the CEO’s office in Chicago. Dimon will be president and chief operating officer in the interim.

The banking acquisitions may not stop there, as Harrison and Dimon acknowledged they will have an eye on possible future deals once this one is completed, which they expect by mid-2004. "We're well-positioned if the right opportunity is there," Harrison said in a Wednesday evening conference call with reporters. "If the right situation comes along, we'll look at it."

This merger would create a company with assets of $1.1 trillion — a powerhouse in corporate and retail banking with 2,300 branches that trails only Citigroup's $1.19 trillion. It's the third largest U.S. banking deal ever, with the two bigger combinations the Travelers Group-Citicorp merger in 1998 that created Citigroup and the NationsBank-BankAmerica combo the same year that created the Bank of America.

In a Thursday morning meeting with Wall Street analysts, Harrison emphasized that integration of Bank One's retail operations with J.P. Morgan's commercial and investment banking prowess would create "a balanced model" that should lead to less-volatile earnings and a higher market valuation. Harrison also disclosed that he and Dimon "had talked over the years about strategic options" but that negotiations toward a merger became serious last November. The New York bank at that point had completed the integration of the J.P. Morgan investment house and Chase Manhattan bank that had begun in 2000. "And then the financials began to come around," Harrison said, referring to writedowns of troubled commercial loans and settlements on Enron regulatory issues.

Dimon called the J.P. Morgan-Bank One combination "the perfect fit" and added: "The reason to do this is because it's great for shareholders ... and right for the company."

J.P. Morgan gets diversification out of capital markets into retail banking, and Dimon gets to run the combined company with the brokerage capability he was coveting. But, the deal will come at a steep price for the as many as 10,000 employees who will lose their jobs when the companies' operations are integrated. Harrison, who will retain the chairman's title after he gives way to Dimon, said the companies were still identifying overlapping jobs to be cut. That number of job cuts would amount to 7 percent of the combined work force of 145,000, but the agreement was unanimously approved by the boards of directors of both companies.

"This landmark transaction will create one of the world's great financial services companies - a powerful enterprise well-positioned to generate significant value for our shareholders, customers and communities," Harrison said.

Dimon said the merger "makes tremendous sense strategically, operationally and financially." Asked about the possibility of future retail bank acquisitions, Harrison said they would be considered but, as a strong force in wholesale and retail banking, "we don't have to do another merger to be successful.

Bank One shareholders would receive 1.32 J.P. Morgan shares for each share they own. Based on J.P. Morgan's closing price of $39.22 on Wednesday, the transaction would have a value of about $51.77 for each of the 1.12 billion outstanding shares of Bank One stock - a total of $58 billion - and create an enterprise with a combined market capitalization of about $130 billion. The premium paid for Bank One amounts to about 14 percent based on closing market prices.

The retail financial services business will be based in Chicago, as will its middle market business, which includes the consumer banking, small business banking and consumer lending activities except for the credit-card business.

Losing a Fortune 100 company to New York is a blow to Chicago, which has lost the top billing for numbers of large corporations through mergers or closure in recent years, although it did add Boeing in 2001. It also takes away the company that was its sole candidate to be a national bank. Bank One had been based in Columbus, Ohio, before moving its headquarters to Chicago in 1998. Dimon said the merged bank is making a "major commitment" to Chicago by keeping much of its business there. He also said that contrary to widespread industry talk, he hadn't been "dying to get back to New York" and may even commute from his Chicago home if his family wants to stay here.

Analyst Reilly Tierney praised the deal for not being overly expensive and because "it gives Jamie Dimon a platform to build a serious global investment bank" and also answers the succession issues at J.P. Morgan. He said the combination will be especially potent in auto finance and credit cards. "They're going to be as big as Citi in the United States," he said.

In terms of the effects on competitors, Wachovia said the merger wouldn’t force their hand, but looking at the relative scale of competitors in this market following the consolidation in these past few years – the top three are all within about 20 percent of one another’s size, but number four is less than half the size of number three – we can expect to see even fewer banks out there than we have today.

There was a nice competitive and market effects overview at The Deal that puts it all in perspective:

-

It's the second 11-figure bank deal in the U.S. in three months. And whereas Bank of America Corp.'s $47 billion purchase of FleetBoston Financial Corp. in October precipitated a wave of small bank deals (and may have helped push the J.P. Morgan deal), the acquisition of Bank One is seen as heralding a wave of big deals — really big deals.

Statistics from SNL Financial show that once the J.P. Morgan, Bank One and BofA-Fleet deals close, there will be three massive American banks: New York-based Citigroup Inc., with $1.2 trillion in assets; J.P. Morgan, with $1.08 trillion; and Charlotte, N.C.-based Bank of America with $933 billion.

But the No. 4 bank, Wells Fargo & Co. of San Francisco, is less than half the size of Bank of America with $394 billion in assets. Analysts and bankers believe that 2004 will be highlighted by the race to make up ground between the big three and the rest of the pack.

The banks analysts say are now in the spotlight are: Wells Fargo; No. 5 Wachovia Corp. of Charlotte; No. 6 U.S. Bancorp of Minneapolis; No. 8 Sun Trust Banks Inc. of Atlanta; and No. 20 Comerica Inc. of Detroit.

"We believe the end game is now being played, and that the pressure for banks to pick their partners will only intensify as the number of both large potential suitors and truly difference-making targets shrinks," said Michael A. Plodwick and Richard Erin Caddell of Blaylock & Partners in a note to clients on Thursday, which predicted consolidation among the top 10 banks. "Also, that BAC [BofA] has recovered nearly all of the value it lost following the Fleet announcement should provide further incentive for potential buyers and sellers."

One banker said Wachovia in particular is worth watching because chairman and chief executive Ken Thompson will feel pressure in his core East Coast retail network now that the three mega-banks are concentrated in this market.

Overlapping the basic need to bulk up will be the need to find partners that are complementary to each bank's existing business. A West Coast bank like Wells Fargo will probably want an eastern partner like Bank of New York or Wachovia. A corporate bank like U.S. Bancorp will probably want to increase its retail business, so a partner like Winston-Salem, N.C.-based BB&T Corp. may be suitable.

Meanwhile, the middle market will feel the effects of the J.P. Morgan-Bank One deal, especially in the Midwest. After BofA announced the FleetBoston deal, banks in the Northeast scrambled to merge so they would have a larger network with which to poach disgruntled customers of the enlarged bank. And bankers foresee a similar pattern occurring now in the Midwest.

"The movement at the top of the industry only encourages that hope among the smaller players," said Ted Peters, president and chief executive of Bryn Mawr Trust Co. of Philadelphia. "We're sure to see more action among the local banks in 2004."

SNL said there were 68 U.S. bank deals in the fourth quarter with a total value of $57.3 billion. That means that excluding the Bank of America deal, the average value of the other 67 deals was a mere $163 million, showing the prevalence of small deals in the quarter.

Three foreign banks may also be drawn into the consolidation if it rapidly gains pace. ABN Amro Holdings NV of the Netherlands has the seventh-largest banking presence in the U.S. and could expand its Chicago-based network further. London-based HSBC Holdings plc has a New York franchise and is still integrating its Household International acquisition of last year, but certainly has the capital to expand further. And Royal Bank of Scotland plc has built its Citizens Financial unit into the 17th-largest U.S. bank mainly through small purchases, and may now be ready for a bigger acquisition, possibly Sovereign Bancorp. Inc. of Pennsylvania.

Yet the recent spate of mergers has also driven up the cost of U.S. banks, and another banker said that could prove a barrier to foreign banks that have been talking about entering the U.S. market, such as Barclays plc and Lloyds TSB Group plc of Britain.

Indeed, this puts new pressure on Citibank to expand its domestic retail footprint, and they have another capital markets competitor with an even larger low-cost deposit base to leverage. The chess board has shifted and banks with strong, but not dominant, deposit franchises will be rethinking their strategy.

But, I don't think consolidation will necessarily be a bad thing for consumers.

Now that U.S. banks are feeling a bit more confident about their borrower's health and some optimism has been reflected in equity markets, M&A activity will heat up after a couple of years' off and this should strengthen the U.S. banking market globally, which has historically been a fragmented one compared to other markets around the world. It's unusual that we don't have a bank that has more then 10 percent of market share of deposits in the U.S. Thanks to consolidation we're finally beginning to get banks with a nationwide franchise, so common elsewhere in the world.

- Arik

January 15, 2004

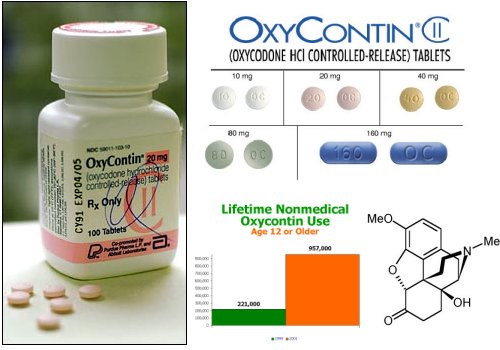

Fighting OxyContin: the Miracle Drug Turned Deadly, Purdue Pharma Seeks Delay of Rivals

OxyContin is an important pharmaceutical – to the terminal cancer patients and other chronic pain sufferers that use it, to its maker Purdue Pharma who generates more than a billion dollars in sales from it (despite a judge's ruling earlier this month that its patent was invalid), and to the junkies who can’t live without it. If you’re curious about that last angle, there’s a feature article you can read at CourtTV.com that samples the sort of turmoil and death OxyContin abuse has become.

But Purdue’s cash cow is also attractive to generic competitors – notably Endo Pharmaceuticals who is on the brink of introducing a generic alternative that will erode as much as 80 percent of Purdue’s market share in a matter of months – that is, if Purdue’s latest legal petition fails to prevent it, after Purdue was found to have misled the patent office to delay competitors in the past and lost its patent. Here’s a link to the story.

The active ingredient in OxyContin, Oxycodone, is a powerful opiate and has been present in many other pharmaceuticals for a long time, but what makes Purdue’s drug so dangerous and susceptible to abuse is the density of the ingredient in OxyContin's time-release delivery mechanism. It’s perfectly safe and effective when used as directed, but when crushed and snorted can deliver fatal doses of the drug with a euphoric kick - not to mention addictive qualities - to rival heroin. These days, an illicit OxyContin prescription goes for $4,000 on the street.

- Arik

January 14, 2004

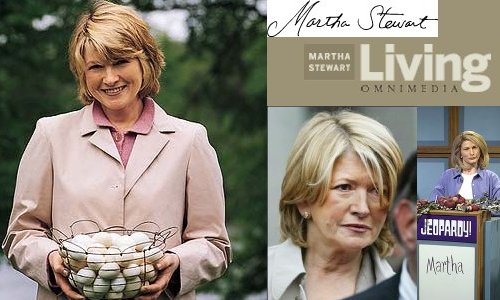

Martha Stewart’s Company Struggles as Obstruction-of-Justice Trial Looms

Even as lifestyle goddess Martha Stewart powers up her MarthaTalks.com Web site and readies her defense in an obstruction of justice trial related to the Imclone insider-trading scandal, her company is facing challenges of its own. Here’s an excerpt from a recent piece:

-

Martha Stewart Living Omnimedia Inc. faces a drooping stock price and sluggish advertising at its flagship magazine on the eve of its founder's high-profile trial. The company is not accused of any crimes, but analysts say its reputation could be on the line because it is so closely tied to Stewart's image as an icon of style and taste.

"Anything short of complete exoneration in this case will have some sort of negative impact on the business," said T.K. MacKay, an analyst at Morningstar Inc. in Chicago. "The evidence is already there that her marred reputation is having an impact."

Stewart, 62, who has advised millions in the arts of entertaining, gardening and decorating, goes on trial this month on federal charges stemming from her late 2001 sale of shares in drugmaker ImClone Systems Inc. She resigned as chief executive hours after her June 2003 indictment but remains a board member and was named chief creative officer.

Martha Stewart stock is down about 40 percent since the probe heated up in June 2002. But shares are up about 16 percent so far in January, closing at $11.35 on Friday on the New York Stock Exchange. The recent gains, analysts say, are a sign some traders think Stewart will be acquitted.

The company has acknowledged that business has been hurt by the scandal and recently cut guaranteed circulation to advertisers at Martha Stewart Living magazine because of readership declines. In late October, it posted a third-quarter loss, hurt by a 28 percent drop in revenues, and said it expects ad sales to remain depressed early this year.

The company's board likely is mulling several possibilities as it awaits the outcome of Stewart's trial, said management consultant Peter Cohan in Marlborough, Massachusetts.

"One scenario is where she manages to avoid going to jail, and she comes back" as CEO, he said. "The other scenario is where she does go to jail, and they end up selling the company."

Company spokeswoman Elizabeth Estroff declined comment about the trial's possible outcome. But she said the attitude at the New York-based company remains "business as usual" and that morale among its 550 employees is good.

"All of us at MSO stand squarely in support of Martha and hope for a positive resolution," she said. "As company founder and our chief creative officer, she is a continuing source of inspiration and creative direction to all of us..."

Regardless of the trial's outcome, the company must grapple with new competition, said Dennis McAlpine, an analyst at McAlpine Associates. Time Warner Inc.'s home magazine Real Simple and TV shows like "Queer Eye for the Straight Guy" and "Trading Spaces" have encroached onto Stewart's territory, he said.

The company, meanwhile, has been trying to distance itself from Stewart - a plan company executives say is unrelated to her legal plight. It launched a new magazine called Everyday Food that does not prominently bear her name and a program on caring for pets featuring a different TV personality.

If Stewart is acquitted, she likely will be back at the helm, Cohan said.

"The company's future depends on her getting back and showing the world that not only were they (her accusers) wrong but that she's still got it," he said.

So, a company’s chief asset – it’s namesake founder in this case – can also be its biggest liability. It should be interesting to see how the trial effects MSO’s fortunes going forward, despite all the exquisite schadenfreude we observers enjoy in the meantime.

- Arik

January 13, 2004

Nasdaq vs. NYSE: Dual Listings Gain Traction with New Nasdaq Lobbying Efforts, Even as NYSE Strengthens Marketshare

Just as a new competitive push by the Nasdaq threatens to weaken an already hard-hit institution, in a year-end statement released on the NYSE Web site, the world's largest exchange said its market capitalization increased to $16.8 trillion during 2003 from $13.4 trillion at the end of 2002. The NYSE said it maintained a market share of 81 percent in listed stocks traded during NYSE trading hours it garnered "the dominant share" of the market for initial public offerings during the year with 65 new offerings, while adding 106 new companies to its listings.

The exchange managed to divert business from its largest rivals, including among its 90 new domestic listings were 17 companies that transferred from the No. 2 Nasdaq Stock Market, and six firms which left the No. 3 American Stock Exchange.

But, as the Big Board is embroiled in a controversy stemming from the $188 million compensation package of former NYSE Chairman and Chief Executive Officer Richard Grasso, who was forced from his post by widespread criticism over the size of his pay package, the Nasdaq started a new lobbying effort directed at dual-listing many of the exchanges biggest listing stocks.

Following the scandal, interim chairman John Reed appointed a whole new board, splitting the oversight mechanism from its market functions. And, the sweeping governance changes altered the manner by which board members are selected and the functions they oversee.

On December 18, this new board named John Thain chief executive officer and separated the roles of chairman and CEO, but has yet to select a new chairman to manage the NYSE's regulatory arm.

The NYSE has also come under fire for a weak governance practices and the trading practices of its six specialist firms, which match buyers and sellers on the exchange's trading floor. Nasdaq’s new lobbying efforts are directed at pointing out the obsolescence and inherent conflicts of interest present in the so-called "specialist system".

Meanwhile, as the Reuters excerpt below explains, the Nasdaq’s "kick-em-while-they’re-down" attempt at a new round of dual-listing lobbying is an attempt to put more competitive pressure on the NYSE:

-

The Nasdaq Stock Market, seeking to capitalize on recent woes at the New York Stock Exchange, said on Monday six NYSE-listed blue-chip companies had agreed to have their shares also trade on Nasdaq.

The six companies, from a variety of industries and with a combined market capitalization of about $156 billion, are Apache Corp. (NYSE:APA), Cadence Design Systems Inc. (NYSE:CDN), Charles Schwab Corp. (NYSE:SCH), Countrywide Financial Corp. (NYSE:CFC), Hewlett-Packard Co. (NYSE:HPQ) and Walgreen Co. (NYSE:WAG).

The six companies - the first to list on both markets - will not be required to pay Nasdaq's listing fees for the first year.

Nasdaq, whose list of traded companies is heavily weighted in technology, is trying to reinvigorate its business after suffering the implosion of the dot-com bubble in 2000 while facing a growing competitive threat from electronic-based trading platforms.

"It's certainly a public relations coup for the Nasdaq," said Matthew Andresen, head of global trading at Sanford C. Bernstein & Co. LLC in New York.

"This is an organization that has had an unending succession of negative news, and this is a piece of pretty good news," he said, though he added that the financial impact would be minimal for both the Nasdaq and the NYSE.

A spokesman for the NYSE declined to comment except to point to a statement the exchange made last week. That statement said the Big Board's studies showed "companies that transfer to the NYSE from Nasdaq experience higher-quality markets" as well as lower costs and volatility.

In fact, 680 companies have transferred from Nasdaq to the NYSE since 1990, according to the NYSE. During that time, only one company has defected from the Big Board to Nasdaq, it added.

Nasdaq's move comes as the Big Board, which controls about 80 percent of the U.S. market in listed stocks, is undergoing upheaval related to the ouster of former Chairman Richard Grasso over his $188 million pay package.

The NYSE is also now under regulatory scrutiny over its specialist-based open outcry system, which critics say is less efficient than Nasdaq's electronic trading system.

The revelation about Grasso's compensation set in motion a chain of events that led to the most extensive governance changes in the exchange's history.

Those developments have emboldened Nasdaq to become more aggressive in trying to lure business away from its largest rival as its listings have declined.

"This is the first time that companies on a manual floor-based market have endorsed and recognized the merits of an electronic market with multiple participants," Nasdaq Chief Executive Robert Greifeld told Reuters.

The decision by the companies to maintain dual listings, Greifeld said, "is stating that the performance they see as possible on the Nasdaq ... is a good outcome for their shareholders and investors."

Silvia Davi, a Nasdaq spokeswoman, said the new listings should begin trading on the market within the next few weeks - under the same three-letter trading symbol on both markets.

Nasdaq said any companies that wish to maintain dual listings must meet national market listing standards.

For their part, the companies involved expressed the desire to see more liquid trading in their stocks.

"In our belief, the more stock exchanges you are listed on, the greater the liquidity or the greater opportunity for volume of share trades," said Brian Humphries, a spokesman for Hewlett-Packard. "We believe there are many advantages to being on the Nasdaq, and it somewhat increases the choice or competition, which is always healthy in our view."

One industry official saw the Nasdaq move as a development in the ongoing fragmentation of stock trading that has accompanied the rise of electronic platforms.

"The world used to be divided into (the NYSE and Nasdaq) ... and now everyone's taking the gloves off," said Kevin O'Hara, chief administrative officer at Archipelago Holdings, an automated exchange.

Meanwhile, Pfizer, the world's largest drug company and a leader in U.S. corporate-governance reform, is evaluating Nasdaq's offer to have Pfizer trade its shares on the electronic exchange. At the end of 2003, Pfizer had the third-largest market capitalization of all New York Stock Exchange-listed companies - $345.26 billion, according to NYSE data.

"We met with Nasdaq officials in December at their request, and reviewed their dual listing proposal," Pfizer spokesman Paul Fitzhenry. "We made it clear in our meeting that we would not reach any conclusion in any particular time frame. We are evaluating the proposal."

If Pfizer makes the change, it could represent an intriguing new way the two markets compete for stock listings and orders – in the short run, Nasdaq wants primarily to change the rules of what used to be a decidedly zero-sum game, through persuading large NYSE-listed corporations not to abandon the NYSE entirely, but simply to dual-list their shares on Nasdaq. Reuters continues:

-

In a statement, the NYSE said that while it isn't familiar with Nasdaq's plan, the dual-listing concept "does nothing to serve the interests of shareholders." The NYSE also said that "there's nothing new" about the effects of dual listings.

Indeed, at first blush, not much would change if dual-listings were widely embraced among blue-chip NYSE stocks. After all, Nasdaq already has a system that trades NYSE stocks. But experts said Nasdaq's dual-listing threat may pack a powerful public-relations punch that could have negative consequences for the NYSE and the trading firms that do business there.

One trading executive, Matthew Andresen of Sanford C. Bernstein, said Nasdaq's move to dual-list companies would represent "a PR coup" that could nevertheless "muddy the franchise" of the NYSE. Having Hewlett-Packard agree to dual-list its shares is "saying that Nasdaq is real," Andresen said.

Though nothing has changed as far as what can trade where, such a stamp of approval could result in more trading volume in NYSE stocks going Nasdaq's way. The NYSE said it "continues to produce the best prices in our listed equities." But some observers said that dual listings could encourage market participants such as active traders to do more business on Nasdaq.

"I think it might draw more liquidity. More competition on price is a good thing for market participants," said Keith Keenan, head of institutional trading at Wall Street Access, a New York brokerage firm.

That could be a negative for the NYSE's floor-trading "specialists." These auctioneers oversee the trading in assigned stocks at the Big Board and therefore command an important part of the volume in those stocks. Hewlett-Packard's specialist, for example, is the specialist unit of Amsterdam-based Van der Moolen Holding NV.

In its statement, the NYSE said it is proud "that the best companies choose to list on the NYSE, which has the most stringent listing requirements of any market. The vast majority of U.S. companies that are eligible to list on NYSE have in fact done so, and as new firms grow and meet our demanding requirements, most eventually decide to make the investment in an NYSE listing because of the benefits to their shareholders."

The threat of dual listings could pressure the NYSE in other ways as Jefferies analyst Charlotte Chamberlain said last week, that this is really a "psychological fire-bombing by the Nasdaq of the NYSE to get them to get serious about merging with the Nasdaq."

I agree that Nasdaq’s success in dual listings will ultimately lead toward a merger, of interests if not companies, into a closer, one-market system. In December, the Wall Street Journal reported that Nasdaq had approached the NYSE about a possible merger of the organizations, but the NYSE has declined comment on the rumor, while Nasdaq denied talks ever having been underway.

- Arik

January 12, 2004

Monday Morning Quarterback: Green Bay Packers Lose "Destiny Bowl" to Philadelphia Eagles, 20-17 in OT

This is my second-to-last football quip until next season, commemorating a breathtaking playoff season for the Packers… the Super Bowl will finish it. It was good while it lasted, but alas… Green Bay’s Packers fell yesterday in what should’ve been a win – a dozen different times that I counted – to the Philadelphia Eagles 20-17 in overtime.

With seconds left in the fourth quarter, the defense allowed an Eagles’ first down on a 4th-and-26 possession into field goal range, tying the game at 17-all and forcing the OT. Favre tossed a baddie any freshman QB would’ve been ashamed of and the field goal kick was sudden-death, despite a last-minute attempt at a snap-ball time-out. What a way to end a season.

With seconds left in the fourth quarter, the defense allowed an Eagles’ first down on a 4th-and-26 possession into field goal range, tying the game at 17-all and forcing the OT. Favre tossed a baddie any freshman QB would’ve been ashamed of and the field goal kick was sudden-death, despite a last-minute attempt at a snap-ball time-out. What a way to end a season.

Yet, it somehow feels just – and it’s alright to have to the Eagles team that’d been in this spot twice before, only to walk away heartbroken, watching an ecstatic Tampa Bay leave the field and burning an indelible image onto the hearts and minds of fan and player alike. I sincerely wish them good fortune on the road to Houston – not only will they need it, they probably deserve it. So, they’d better win and win again.

There’s always next year and I’m grateful we’ll never see the Packers leave Green Bay, since Title Town technically owns the team Despite its unique ownership structure as a big differentiator in professional sports, I’m endlessly amused when the cameras pan the stands searching for team owners and their reaction to the game’s biggest plays. It’s never as much fun as when they show the green-and-gold Pack fandom freezing bravely in playoff bleachers... die-hard to the end.

- Arik

January 11, 2004

Two-Buck Chuck: Charles Shaw vs. Napa Valley

Friday night’s 20/20 TV newsmagazine on ABC featured a great piece on the effect Charles Shaw – aka, "Two-Buck Chuck" – is having on the wine marketplace… especially Napa Valley vintners. So much so, they’re suing to get the winery barred from using the very word "Napa" on its label.

Friday night’s 20/20 TV newsmagazine on ABC featured a great piece on the effect Charles Shaw – aka, "Two-Buck Chuck" – is having on the wine marketplace… especially Napa Valley vintners. So much so, they’re suing to get the winery barred from using the very word "Napa" on its label.

Still, the company took advantage of a micro-economic climate – that is, an oversupply glut of cheap grapes – in California’s wine country to change the rules and fans are buying the stuff by the case.

Still, the company took advantage of a micro-economic climate – that is, an oversupply glut of cheap grapes – in California’s wine country to change the rules and fans are buying the stuff by the case.

There are a couple of articles on the ABCNEWS.com Web site that recap the 20/20 feature and it’s worth a read:

-

To wine traditionalists, California's Napa Valley is hallowed ground, and a $2-per-bottle upstart wine commonly known as "Two Buck Chuck" is stomping all over it.

Though the label of the $2 wine reads "Charles Shaw," it was not the brainchild of anyone named Charles. The wine, which sells exclusively at Trader Joe's stores, was created by Fred Franzia, who prefers to call his product a "super value wine," rather than a "cheap" one.

But Napa winemakers claim it's not the price of the wine that has them teed off. Rather, for one ex-winery owner, it's the name "Charles Shaw." For others, it's the claim "Two Buck Chuck" makes to a Napa Valley origin.

"I like the guy; I just despise his business practices," said Tom Shelton, the CEO of a Napa Valley-based premium label, Joseph Phelps, and part of a group of Napa winemakers suing Franzia to protect the "Napa Valley" name.

"I don't have a real argument with … the existence of Two Buck Chuck," Shelton said. "My argument really is when producers like two buck chuck try to pass themselves off as Napa Valley wines."

The label reads "cellared and bottled in Napa" which is true, but Shelton says Franzia doesn't make Two Buck Chuck with Napa-grown grapes, and that's misleading to consumers.

Shelton says Franzia doesn't make Two Buck Chuck or any of his 32 wines with Napa-grown grapes. His labels read "cellared and bottled" in Napa, which is true. But, even so, Shelton says, it's misleading to consumers.

"This really represents consumer fraud. It would be as if I were trying to pass off a Volkswagen as a Porsche." Franzia says it's all just sour grapes and snobbery, and he's won so far in court. "We'll take them on," Franzia said. "And I'm sure we will prevail legally on this topic."

Maybe so, but Franzia does have a reputation for pushing the legal envelope to the limit. He admits he was convicted of a felony a decade ago, but told ABCNEWS it was "history, about some grapes that got mislabeled," and involved "a small percentage of wine."

But the percentage was not small enough to escape a fine of $3 million and a felony conviction.

A couple years later, in 1995, Franzia bounced back to buy the Charles Shaw label for about $18,000. He has made millions with the label, which racked up $150 million in sales last year.

Still, according to Franzia, "The name is just another name."

However, it's not just another name to one former winery owner — Charles F. Shaw.

"I just want my vintner friends in Napa Valley to know I didn't sell this name to these folks," Shaw said.

The real Charles Shaw lost his vineyard and the Charles Shaw label to his wife in a painful divorce. When she went bankrupt, Franzia snapped it up. Now, Shaw loathes having his name on a $2 bottle of wine that, he says, has forced his friends in the industry to suffer losses and layoffs, even closures.

"I'm very uncomfortable about it, and I'm upset about it, and I think it's wrong," Shaw said. What does Franzia have to say to Shaw?

"I don't have to say anything to it," Franzia told ABCNEWS. "I own it."

And, it tastes good too - the graphic below shows how Shaw rates versus its pricier competitors. Excerpted from the part of the story on quality for the price:

-

Five years ago, Franzia's nose for business told him California was growing more wine grapes than people could drink. And he was right. When the grape glut came, Franzia bought up tons of cheap grapes all over California to create his rock-bottom priced wine.

Now, "super value wine" is a whole new industry category, with about a dozen labels selling for $3 or less.

"There are a lot wines that are coming down in price," said the economist Robert Smiley, a professor at the University of California at Davis and a leading consultant to the wine industry. "This is a great time to be a wine drinker."

"Everybody in the industry is talking about Two Buck Chuck," Smiley said. "There are few wineries in the very high end who think they're immune and they probably are if they're selling in three digits, over a hundred dollars a bottle. But virtually everybody else is affected one way or another."

And what has winemakers running scared is that Trader Joe's, which has exclusive rights to carry the label Charles Shaw, can't keep it on the shelf.

"You've got the people who buy one or two bottles," says Trader Joe's wine captain Alan McTaggart. "Then, you get the people who buy a case. Then you get the four or five cases."

When stacked up against the competition — red or white — "Two Buck Chuck" held its own, even inching ahead of the $50 Chardonnay.

"These wines don't taste bad," admitted Jess Jackson, the founder of the wine label Kendall Jackson, whose wine was part of the ABCNEWS taste test. "They're thinner. They have less character, less focus … and less heart in the bottle."

Ann Noble, a professor at the University of California at Davis, the country's top school for winemaking, said it's all about expectations, and that knowing the price can influence your taste buds.

"It's cheaper wine, that's the expectation for the Charles Shaw," Noble said. "You have an expectation the cheaper wine isn't going to be as good. I tell you it's a cheaper wine, what do you do? You look for flaws. I tell you this is a good wine, you don't look for flaws, you look for good things."

- Arik

January 10, 2004

The BBC: an Alternative for the American Public's Media Attention-Span

In the wake of what many Americans feel has been a pandering patriotism to the U.S. invasion/liberation of Iraq, the American media establishment seems to have a new competitor to deal with these days – the BBC.

After discovering BBC programming available overnight on public broadcasting and on demand through the Internet, many of our more urbane citizenry are finding the less patronizing and far more venerable British media icon a better truth-teller than our own broadcast news sources. But, who could blame them… there’s just something about that British accent that lends itself to severe credibility.

I found an interesting article in the December/January issue of the American Journalism Review that speaks to the subject of "the Beeb’s" newfound American admiration - read the whole piece, but here's an excerpt:

-

The British Broadcasting Corp. can certainly relate to American media outlets in one stark way: The radio and television behemoth has been embroiled in a journalistic controversy that threatens to damage its credibility, change the way it does business and, most likely, result in the ouster of a few employees.

For media buffs, the New York Times' springtime of discontent segued nicely into the BBC's summer of the same. A governmental inquiry led by Lord Hutton explored the events surrounding the suicide of David Kelly, a weapons expert who was an anonymous source for an explosive BBC report on the British government's claims about Iraq's weapons of mass destruction. The radio segment, by correspondent Andrew Gilligan, charged the government with "sexing up" a September 2002 dossier and further alleged 10 Downing Street knowingly inserted a false claim that Iraq could launch its WMD in 45 minutes.

Soon Kelly was identified as the source of that report. Shortly thereafter, he told his wife he was going for a walk and never returned. His body was found the morning of July 18.

While American news audiences didn't see much coverage of the inquiry, the British press was full of front-page stories, loads of commentary and, in the broadcast media, reenactments of the proceedings. Internal e-mails, reporters' notes and the diary of Alastair Campbell, Prime Minister Tony Blair's director of communications and strategy, were brought forth as so much dirty laundry, and neither the government nor the BBC came off looking particularly good. The Hutton inquiry even set up its own Web site, www.the-hutton-inquiry.org.uk, to give the public a look at the mounds of testimony.

Says John Tusa, former managing director of the BBC World Service: It "made the summer riveting."

Hutton's final report won't be released until late December or January, providing more time for speculation on how badly it will criticize the BBC's journalism and the government's political maneuverings.

But beyond the shared experience of having its credibility on the line, the BBC is quite different from the American networks. There's the sheer size - 41 overseas bureaus, 3,700 news employees. There's the public confidence - yes, confidence. The British tend to trust the BBC more than the government, not less. They reserve the bulk of their cynicism for politicians instead of reporters. The BBC even has not one, but two cute little nicknames--Auntie, or more commonly, the Beeb.

During the war in Iraq, reportorial differences became distinctly recognizable. The BBC was more likely to be accused of being an enemy of the state than a patriotic cheerleader. A number of American viewers and listeners, dissatisfied with what they saw on the U.S. networks, tuned in or logged on to the BBC Web site in search of a different journalistic tack. Viewership of the BBC World News bulletins, aired on public broadcasting stations in the U.S., rose 28 percent during the early weeks of the war.

But, it’s not just the cosmopolitan accents; many BBC fans cite the World Service as a more reliable – and more objective – source of opinion in what many feel has become a near completely entertainment-oriented broadcast news culture from homegrown sources.

Maybe American news media should consider their most sophisticated demographics a bit more deeply. We certainly don’t get the same global feel here in the States that Brits and others enjoy on BBC and I think an important demographic defection is underway when one’s most important news consumers find European opinions more compelling than the ones at home.

- Arik

January 09, 2004

Wheels & Gadgets: 2004 Consumer Electronics Show Hits Las Vegas & 2004 North American Auto Show Wraps in Detroit

Another week of gadget porn is underway as the 2004 Consumer Electronics Show in Las Vegas gets going, even as the 2004 North American Auto Show in Detroit rolls on. Both exhibitions highlight the renewal of hypercompetitive strategy reminiscent of the pre-bubble 90’s, where product design is once again the key differentiator among a crowded field of competitors.

Another week of gadget porn is underway as the 2004 Consumer Electronics Show in Las Vegas gets going, even as the 2004 North American Auto Show in Detroit rolls on. Both exhibitions highlight the renewal of hypercompetitive strategy reminiscent of the pre-bubble 90’s, where product design is once again the key differentiator among a crowded field of competitors.

While the coolest of technologies bubble over in Vegas, it seems the cutthroat market for television sets has been renewed, fueled by the hottest Christmas season in recent memory squarely focused on a new class of thin, low-cost plasma and LCD TVs from fresh competitors like Gateway, HP, Dell and other computer firms. Even chip giants like Texas Instruments and Intel are pushing DLP and LCOS technologies as next-generation solutions for the converged and connected home.

Bill Gates’ opening keynote, punctuated by his first pairing with surprise guest Jay Leno since the Windows 95 launch "back in the day", introduced the first new breed of SPOT watches in what one observer commented:

-

Watches say something about us. Rolex says power, Hamilton says suave, Seiko says thrifty. SPOT says stupid.

Panasonic launched a new line of plasma TVs with HDTV included (finally), while Sharp announced plans to add Wi-Fi to its line of LCD TVs and Thomson rolled out an amazingly cool looking 70" DLP that's less than 7" thin.

Toshiba introduced the world’s smallest hard drive, delivering multi-gigabyte capacities for mobile devices. Acer America sped past the competition with its stunning Ferrari 3000 Notebook entry. Netscape launched a new low-cost Internet service and Canon introduced everything from new multifunction printers to camcorders.

WHEW! For more, read these recaps from PC Magazine or from USAToday.com

Meanwhile, in Detroit, competition is heating up over an ever-more-demanding car market that needs to keep growing even as the taste for used cars is the worst in recent memory. Low-interest financing keeps driving ever-bigger SUVs alongside cutting-edge hybrid gas-electric vehicles from Honda and Toyota to hit a more mature North American market.

The model year 2005 promises to be the year of the muscle car, with horsepower taking over the spotlight at 2004’s NAIAS. Ford appears to be back with a vengeance with new cars from Aston Martin, Volvo, Jaguar and Land Rover as well as the new "Project Daisy" initiative to create a new high-performance sports coupe to rival the Mustang – there’s a good video on all of the details. And, the Ford F-150 took top honors as 2004’s North American Truck of the Year. Meanwhile, Infiniti added to its All-Wheel Drive lineup with a new Full-Size QX56 Luxury SUV and G35 Sedan AWD, and Toyota launched a hybrid SUV.

Here are a few more links I found interesting:

- General Motors: Driving Away the Competition

- New York Times Auto Show Coverage

- Automakers Go All Out in Search for New Look

- Hyundai Targeting U.S. Growth

- Hip-Hop Style Mixes with Hot-Rod Culture

- Nissan: U.S. Crucial to Future Success

I really wish I had business in the Motor City this month (instead I'm visiting lovely Philly, the week after the Eagles beat my beloved Packers).

CES in Vegas is always too short in my opinion and NAIAS can seem too long, but it was definitely a treat a couple of years ago when I was in Detroit for a conference and got to see both production and concept models adorning the exhibitions – truly, a beautiful thing.

- Arik

January 08, 2004

Yahoo! vs. Google: Round One in the New Search Engine Wars

Yahoo! is ditching Google as its main search engine "perhaps as early as the first quarter", the WSJ reports. The paper's sources are an unnamed marketing outfit who says they have been briefed on the switch by Yahoo!

This will come as little surprise to anyone. The only question was when the contractual agreements between the two companies would end.

While Yahoo! is a shareholder in privately-held Google, it owns its own search engine technology, courtesy of the acquisitions of Inktomi and the consumer business of FAST. It also owns the world's biggest paid-for search listings business, Overture. All three were bought over the last year or so.

Google is becoming a serious rival to Yahoo!, as a portal in its own right, and as the purveyor of Adwords, Overture's most formidable competitor by far. :

But what’s the impact of the switch on the searching public - and more importantly for the companies, those wishing to be found? In an article I found on the Jupiter Web site Clickz:

-

The impact: SEM [search engine marketing] just got much more expensive for anyone using Inktomi's (Yahoo's) CPC-based program. Companies using Search Submit could reap huge rewards without incremental costs... if Inktomi allows Search Submit customers entry into Yahoo! when the change is made. But don't bank on it.

If you're a marketer whose not paying to submit your site to Inktomi and whose site isn't found in MSN or HotBot, over the next three months whatever traffic you enjoyed from Yahoo! (via Google) will disappear.

For some, this is great news. It means new, increased traffic from Yahoo! for many who never ranked well in Google. For others, Yahoo! just got too expensive.

Yahoo! and MSN combined drive roughly 45 percent of all search referral traffic, according to StatMarket. Google and those powered by Google drive another 45 percent.

Inktomi will be as important as Google for many marketers, at least for a few months.

We believe there's a strong likelihood MSN will launch its own search engine and drop Inktomi in the fourth quarter of this year. Rumors are circulating MSN may not offer a paid-inclusion program (though that may change), so organic MSN traffic may no longer cost per click come year's end.

There’s even been speculation Microsoft might buy Google, and with a likely IPO in the not-too-distant future, priced at estimates as high as a $15 billion market cap, Microsoft might be the only one who can afford it with the mountain of billions Gates & Co. are sitting on now.

- Arik

January 07, 2004

TiVo Defends Against DVR Competitor EchoStar by Suing Over "Time Warp" IP

It would appear TiVo is serious about protecting its rapidly eroding monopoly in the DVR market from cable and satellite companies using DVR as a differentiating feature for their services. They’ve decided to sue EchoStar, the satellite company that seems to be growing most quickly in the DVR category, even as TiVo’s DirecTV goes head-to-head with EchoStar’s Dish Network.

Both TiVo and Dish hit the one millionth subscriber mark recently, so TiVo’s growth has slowed by comparison with EchoStar’s in the category. Here’s a excerpted backgrounder and deeper dive from CNET on the subject:

-

San Jose-based TiVo said EchoStar's technology violates its "multimedia time warping system" patent, which it received in May 2001 from the U.S. Patent and Trademark Office. Some set-top boxes used with EchoStar's satellite service come with DVR capabilities.

Defending its patents are crucial to TiVo, which has been emphasizing its licensing business as a complement to its services operations. The company counts major consumer electronics makers such as Pioneer, Sony and Toshiba as licensees.

"We've invested in building a comprehensive patent portfolio to protect our intellectual property, and as the DVR category grows, we will be aggressive in protecting those assets," TiVo CEO Mike Ramsay said in a statement. "The success of our licensing business clearly demonstrates the value the industry has placed on TiVo's technology. It's important that we protect our IP for TiVo and our licensees."

TiVo is seeking monetary awards and an injunction against future sales of DVRs by EchoStar. EchoStar representatives declined to comment Monday and said they had not seen the suit. TiVo has a partnership agreement with EchoStar rival DirecTV, a deal that contributes significantly to TiVo's revenue.

The patent in question, which TiVo filed for in 1998, is described by the company as an "invention allowing the user to store selected television broadcast programs while the user is simultaneously watching or reviewing another program." TiVo has been awarded 40 patents and has more than 100 applications pending, according to the company. The suit was filed in a federal district court in Texas.

TiVo may also be experiencing competition in the DVR market from cable provider Comcast, which in early December said it planned to add TiVo-like features to its service by the end of 2004, using Motorola set-top boxes.

TiVo filed a patent infringement suit against EchoStar Communications Corporation in the federal district court of Texas, alleging that the satellite television service provider is violating TiVo's "Time Warp" patent, which was issued in May 2001.

Key TiVo inventions protected by the Time Warp patent include a method for recording one program while playing back another, watching a program as it is recording, and a storage format that supports advanced TrickPlay capabilities. TrickPlay allows live television broadcasts to be paused, fast-forwarded, rewound, replayed or shown in slow motion.

"We take great pride in the fact that TiVo has created and developed the technology that revolutionises the way people watch television," said Mike Ramsay, CEO of TiVo. "We've invested in building a comprehensive patent portfolio to protect our intellectual property and as the DVR category grows, we will be aggressive in protecting those assets."

"The success of our licensing business clearly demonstrates the value the industry has placed on TiVo's technology. It's important that we protect our IP for TiVo and our licensees," continued Ramsay.

In the late 1990s, TiVo innovated digital video recording, or DVR, technology, which pretty much out-does anything your old VCR can do. Although the TiVo brand, like Kleenex and Xerox, has become synonymous with the product category, other versions of the DVR have been developed by ReplayTV, EchoStar and some cable services. And, many analysts even think TiVo will be outflanked by its competitors.

Still, the DVR revolution that many thought would happen by now really hasn't. It is estimated that DVRs are in fewer than 3 million homes. And, with about 110 million TV homes in the United States, TiVo and its rivals obviously still have a long way to go.

The suit comes several months after EchoStar's Dish Network service introduced a new version of its digital video recorder that allows its subscribers to record one program while playing another.

The market is "growing rapidly and growth is accelerating," said TiVo chief executive Mike Ramsay. "We're very concerned that competitors like EchoStar might use our technology against us."

TiVo has been awarded 49 patents and has more than 100 patents pending, the company said. TiVo said it registered the patent in July 1998, and the government awarded it in 2001.

"If it's determined that people are infringing on our property, we will protect it," Ramsay said. "We really picked our timing to coincide with the growth of this market."

DVRs contain a computer hard drive enabling television viewers to record programs and watch them later or to pause, rewind and slow down live programs. They provide more viewing options and easier interaction than traditional videocassette tape recorders. Forrester Research of Cambridge, Mass., says nearly 3 million American homes have DVRs, a number the firm estimates will grow to more than 40 million in four years.

EchoStar is the largest provider, with more than 1 million subscribers using its DVRs. TiVo reached the 1 million subscriber mark in November, but many of those customers subscribe to EchoStar competitor DirecTV, which has a licensing agreement with TiVo. Cable companies have sold roughly 500,000 DVRs, according to Forrester.

"We're at a moment when this is about to really take off," said Forrester analyst Josh Bernoff. "It's the perfect time to sue. If they waited much longer, it would be too late."

Bernoff said TiVo may be hoping to extract a per-box fee of $1 or $2 from EchoStar. Whether it can depends on the court, which will determine if EchoStar borrowed heavily from TiVo's innovations or developed the technology on its own, he said.

Most analysts, however, are dubious about TiVo's chances of fighting off a rising tide of similar technologies being deployed by both satellite and cable operators. Skeptics also note that lawsuits rarely work as a revenue stream, as Gemstar-TV Guide discovered to its chagrin over the past few years of failed patent suits for its onscreen TV program guide.

TiVo is struggling to maintain its brand lead as it faces increasing competition from cable operators that are rolling out integrated DVRs built by set-top makers Scientific Atlanta and Motorola. TiVo's lucrative distribution deal with satellite leader DirecTV is also in jeopardy as new owner News Corp. is widely expected to start pushing its own DVR box while marginalizing or reducing the royalty rate it pays to TiVo. Currently, some 709,000 DirecTV subs have a TiVo box.

The future of TiVo may be uncertain, but the "TiVolution" has never been more accessible than it was this holiday season. TiVo once required an upfront investment of hundreds of dollars. But, as new competitors continue to emerge, most people can now try the new way of watching and recording television for far less.

In late December, ReplayTV lowered the price on its cheapest machine to $149 and stopped forcing consumers to buy three years of service upfront, cutting the initial cost by more than $300. Time Warner Cable this year began rolling-out of a service that has a TiVo-like DVR built into the cable box and costs less than $10 a month. Some of Cox Communications' customers already have cable DVR service, and Comcast plans to roll it out to all of its subscribers next year.

But even satisfied early adopters have learned not to expect the world. Changing channels can be slow and most machines can't record on one channel while you're watching another. When the hard drive fills up, the systems make up their own minds about what to delete, usually the oldest recordings.

Why has the TiVo concept taken so long to take hold? Like a lot of cool-yet-cutting-edge technology, it can be hard to understand how useful the service is until you actually try it or see it in action. There's also uncertainty over whether start-up services such as ReplayTV, owned by D&M Holdings, and TiVo will survive over the long haul - or whether cable and satellite versions will ultimately corner the market.

So, in months ahead it's sure to be interesting to see how this fight shakes out and whether TiVo can leverage its patent portfolio to discourage other competitors from eating their lunch.

- Arik

January 06, 2004

Agri-Trust: Did Monsanto & Pioneer Hi-Bred Collude to Illegally Fix Genetically Modified Seed Prices?

According to sources at Monsanto and Pioneer Hi-Bred, senior executives from both companies met repeatedly in the mid- to late-1990’s and agreed to charge higher prices for GM seeds. The companies responded to charges of illegal price fixing by acknowledging the meetings but saying they were engaged in negotiations about legitimate changes to an existing licensing agreement. Here’s an long excerpt from the New York Times that explains the situation more completely:

-

Interviews with former and current executives of major seed companies, along with company documents, however, show that through much of the 1990's Monsanto tried to control the market for genetically altered corn and soybean seeds. Monsanto spent billions in the 1980's to invent specialized seeds and sold the rights to make them to big seed companies like Pioneer.

More than a dozen legal experts contacted by The New York Times say that if the goal of the talks between the rivals was to limit competition on prices, they would have violated antitrust laws.

The talks, which occurred from 1995 to 1999, involved licenses that let Pioneer sell altered seeds developed by Monsanto, which is based here. In those talks, according to interviews with dozens of executives and court and other documents, the companies discussed prices, swapped profit projections and even talked about cooperating to keep the prices of genetically modified seeds high.

The talks involved top executives at both companies, including Robert B. Shapiro, then Monsanto's chief executive, and Charles S. Johnson, then Pioneer's chief executive, as well as Richard McConnell, now president of Pioneer, and Robert T. Fraley, now Monsanto's chief technology officer, according to company officials and documents. Together, Pioneer and Monsanto control about 60 percent of the nation's $5 billion market for corn and soybean seeds.

Also in the late 1990's, Monsanto pressured at least two other big seed companies to coordinate their retail pricing strategies with Monsanto's, former chief executives at those companies said. The executives, who ran Novartis Seeds and Mycogen, said they rejected Monsanto's entreaties as anticompetitive and potentially illegal.

Analysts estimate that more than $10 billion worth of genetically altered seeds have been sold in the United States since they were commercialized in 1996. Monsanto and Pioneer did not have to succeed in actually raising retail seed prices to have violated the Sherman Antitrust Act, legal and economic experts say; just agreeing to coordinate prices is against the law.

Companies found to have violated federal antitrust law could be subject to criminal fines and civil class-action litigation. In the civil lawsuits, courts can award triple monetary damages.

"If they're talking to Pioneer about raising the ultimate price to the farmers, that's illegal," said Austan Goolsbee, a professor of economics at the University of Chicago and a former Justice Department consultant on antitrust issues. "Monsanto shouldn't care about the final price. They should only care about the royalty payments they receive from Pioneer."

Royalty payments were at the heart of the matter. Before it realized how successful altered seeds would be, Monsanto sold the technology to some companies, including Pioneer, for relatively modest sums. When the seeds proved to be a hit, Monsanto tried to renegotiate many of those deals to ensure that the seeds sold for higher prices, executives and records show.