February 18, 2004

Edwards Surprises, Dean Drops Out After Wisconsin Democratic Primary

John Kerry thanked Wisconsin voters Tuesday for moving his campaign forward, but Edwards slyly suggested that the state had sent a message to the senator from Massachusetts: "Objects in your mirror may be closer than they appear."

Edwards might have his wish for a one-on-one contest, but Kerry may already be out of reach. The challenger faces a tough Super Tuesday. "If Edwards actually wanted to compete for the nomination, he needed to start drawing a contrast with John Kerry a month ago," said Steve Murphy, campaign manager for Missouri Rep. Dick Gephardt, who quit the race after finishing fourth in Iowa's Jan. 19 caucuses. "Democrats are coalescing around John Kerry right now … and they are eager to get onto the task of beating George Bush."

His most obvious target would seem blue-collar, non-college-educated voters sympathetic to his tough-on-trade message. However, his biggest surprise came from crossover appeal with Republicans and Independents that find him a seductive alternative to Kerry, despite rumors that Republicans only voted for him to delay the de facto selection of Kerry as the nominee, months ahead of the Democratic Convention.

Wisconsin's open primary and high turnout produced what was the largest and arguably the broadest electorate of the Democratic campaign. That proved critical to Edwards' performance, exit polls of voters showed, and now supplies the North Carolina senator with important bragging rights as he makes the case that he can expand the party's appeal as nominee.

"I think it means I can beat George Bush," Edwards said on CNN. "If we're going to win the general election we're going to have to win independents."

In the election night interview, Edwards pointed to Sunday's presidential debate (the top-rated program in its time slot in Milwaukee) and the endorsement of the Journal Sentinel, the state's biggest newspaper. The Capital Times of Madison also endorsed Edwards.

He also pointed to the issues of jobs and trade, issues he hit hard in a state that has bled 80,000 manufacturing jobs in the last three years. In ads and in the debate, he stressed populist themes and his opposition to NAFTA - the free trade agreement with Canada and Mexico that Kerry voted for a decade ago.

Edwards did not attack Kerry directly on the issue, but the exit polls suggested the debate over trade and jobs had boosted him. About three-quarters of Democratic primary voters saw U.S. trade with other countries as costing Wisconsin jobs.

And jobs and the economy was the leading issue among voters, chosen by about four in 10. Those voters who cared most about jobs and economy favored Edwards over Kerry; voters who cared more about health care or the war in Iraq favored Kerry.

In his speech to supporters Tuesday night in Middleton, Kerry also dealt with trade issues, promising to push for new protections in trade agreements and give "that fair playing field to workers across our country."

"And I'll tell you what we will outsource," Kerry said in his victory speech, in a line similar to one Edwards has used here. "We will outsource the Bush tax cut for the wealthy. We will repeal it so we can invest in health care and the education of our children."

Altogether, around 800,000 Wisconsinites voted in the Democratic presidential primary. (Bush, the only name on the GOP ballot, drew more than 100,000 votes.) That means about 20% of voting-age citizens participated in the Democratic contest, topping the turnout in every contest so far except New Hampshire on Jan. 27, where about 23% turned out. So, in raw numbers, Wisconsin's turnout far outstripped any previous primary or caucus, something not lost on this Wisconsinite, as the state moved up its primary specifically to have more of a voice in picking a nominee.

And it set the stage for what Edwards said he had long wanted after trying to break through what was once a crowded field: a clear two-way race with Kerry, played out over a relatively long period, until the next big primary day, March 2nd.

Going into Wisconsin, Edwards’ strategists saw an opportunity. There would be a full week to campaign in just one state with a history of favoring populists, as he’d promoted himself, and an electorate stacked with independents who, polls in other states showed, Edwards was attracting.

Meanwhile, Howard Dean decided to essentially end his presidential bid Tuesday after he placed a distant third, his 17th straight loss at the polls.

Though Dean is not going to formally drop out of the race, he is going to stop campaigning. The move would allow his supporters to continue to vote for him in the upcoming primaries and have a say at the Democratic National Convention in July.

His loss in Wisconsin came after the former Vermont governor virtually camped out in the state for 10 days, pleading with voters to reignite his faltering candidacy. At one point, he lashed out at Kerry, accusing the Democratic front-runner of supporting corrupt fundraising tactics and describing him as little better than President Bush. Despite the attention Dean showered here, crowds at his events dwindled and his aides grew grim.

So, despite Edwards relatively strong showing, I think it’s still clear that Wisconsin voters are in the same pragmatic mood as voters in other states. One thing’s for sure – we certainly got more attention than we usually do in presidential politics.

- Arik

February 17, 2004

Cingular Wins AT&T Wireless Competition: Vodafone Withdraws Amid Verizon Complexities

Vodafone ran up the bidding in a stroke of competitive gamesmanship unlike any in recent memory. I think it was a strategic masterpiece that will leave a pair of global competitors – SBC and BellSouth – trying to recover for years to come. Cingular thought it had to convince Vodafone that to beat them, they would have to vastly overpay. I really don’t think Vodafone was ever serious about a bid for AT&T Wireless; it was a ruse to make Cingular overpay instead.

But maybe in doing so, according to a false report in the early edition of the New York Times claiming Vodafone had won the competition to acquire AT&T Wireless, perhaps Cingular paid a bit more than it should have. Still, it clearly wasn’t in Vodafone shareholders’ best interest to win, what with a necessary exit from its Verizon Wireless partnership leaving a tax liability of $4 billion, beside the fact that Cingular has the best operating synergies, particularly in terms of technologies – a fact which essentially escaped most analysts looking at the situation.

No doubt, when Cingular Wireless on Tuesday won an auction for smaller rival AT&T Wireless Services with a late-night $41 billion offer that edged out Britain's Vodafone Group, it created the new U.S. wireless leader. The deal, worth $15 per share, was the largest all-cash offer in history and marked a 37 percent increase over Cingular's initial offer made last month. AT&T Wireless was an attractive target as the third-largest U.S. mobile phone operator with the second-highest revenue per customer, with a 17 percent marketshare. NTT DoCoMo had invested $10 billion in AT&T Wireless - although that investment was trading lately with a value about half that.

Another big advantage for Vodafone entering the race, whether they bought them or not, was the peek they got under the hood of a major competitor.

"I don't think they overpaid. It's definitely a bet for their future," said one telecom banker, who was not involved in the deal. "It's a huge wireless hedge. It will be the basis for more bundling (of other services) with the parent companies."

The combined company leapfrogs current U.S. market leader Verizon Wireless, giving it 46 million customers, annual revenues of more than $32 billion and a presence in 97 of the top 100 U.S. markets. Cingular's parents, Baby Bells SBC and BellSouth, see the growing wireless market as a key to offsetting the decline of their core local telephone operations.

The deal also marked the start of long-awaited consolidation in the crowded U.S. wireless market where six national brands and a handful of regional players are battling for market share as subscriber growth slows. As the Consumers Union slammed the deal, saying the merger would lead to higher wireless-calling rates and poorer service. I disagree.

Although the merger would shrink the number of national carriers to five companies, I personally doubt the deal would ease the industry's intense competition and price wars since each new subscriber becomes more difficult to find with half the country already owning a wireless phone.

"We think that the price we paid is a fair price. Yes, AT&T Wireless has some issues ... but we think the company was sound before those problems and we view the problems as being temporary in nature," Cingular COO Ralph De La Vega said.

In the fourth quarter, AT&T Wireless said it lost customers and missed out on several hundred thousand potential new subscribers due to technical and customer-service problems. Analysts expect other carriers to prey on AT&T Wireless's recent operational woes and possible distractions during the merger, before its close at year-end.

Cingular CEO Stan Sigman will run the combined company, while AT&T Wireless Chairman John Zeglis, who took the company public in 2001 when it was spun off from former parent AT&T Corp., said he would leave once the deal closed.

SBC and BellSouth plan to finance the deal with a bridge loan, which is a temporary loan used until long-term financing is secured, but Cingular said it was not considering an IPO, despite a probable divestiture of some of the parent companies’ operating assets, in order to raise cash.

As we all know by now, Cingular won the auction after it sweetened its offer at the 11th hour to clinch a deal it feared was slipping away to Britain’s Vodafone, the world's largest wireless carrier. Vodafone was pleased the company did not compete more aggressively for a deal that would have hurt its earnings and shares of Vodafone rose five percent in London. "The markets think it's a good thing that Vodafone hasn't overpaid, although in the long term, of course, it does leave them with a strategic problem in the United States," said global equity strategist Patrik Schowitz at HSBC.

Vodafone said it remained committed to its minority stake in Verizon Wireless, the largest U.S. wireless carrier. Its partner, Verizon Communications, said, "We've worked together well in the past and we will continue to work well together."

Japan's NTT DoCoMo, decided on Friday against bidding for AT&T Wireless, said it would weigh its options in the wake of the Cingular deal, which will give it cash in exchange for its 16 percent stake in the company. SBC and BellSouth said the deal would hurt their earnings through 2006. But a merged Cingular expects to save billions of dollars by cutting overlapping staff and assets, and it expects to generate positive free cashflow in 2005. De Le Vega also said Cingular did not believe it should be required to exit any markets to appease any regulatory concerns about its new size. "We don't think there should be any divestitures, with the number of competitors we have, we don't see why that would be a requirement," De La Vega said.

I think Vodafone made Cingular flinch.

Fears that mobile phone giant Vodafone could be dragged into a costly and protracted bidding war for AT&T Wireless appeared to be on the horizon when Cingular, their $35 billion bid. As a result, AT&T Wireless asked for higher bids from both companies, after Cingular last week opened the bidding at $30 billion. To compound the pressure, sources close to the bidding said AT&T Wireless wanted a quick deal.

Why my belief in the ruse? Vodafone had no chance of making similar cost savings to Cingular and it surely would have overpaid. Its only U.S. presence is the 45 percent stake in Verizon Wireless, which it would have to sell if it bought AT&T Wireless. Plus, investors were not convinced that the purchase made sense for Vodafone, especially if it has to get rid of its highly profitable Verizon stake. The real question was, were investors resigned to the likelihood that Vodafone CEO Arun Sarin was determined to buy AT&T Wireless to gain complete control of a U.S. operation?

Plus, in contrast to Verizon, the AT&T Wireless business is losing customers and money and would almost certainly require substantial investment by whomever buys them to put it back on a competitive footing, synergies with Cingular or no. AT&T lost 4 percent of its customer base in January alone, and operating income dropped by 20 percent compared with the same time last year, as the company reported a loss in the fourth quarter of 2003.

In the end, I think Cingular – and its shareholders – probably paid more than they had to; and Vodafone had a larger strategically-adverse impact on two global competitors – SBC and BellSouth – that will put it on stronger footing elsewhere in the world telecom market.

- Arik

February 12, 2004

Disney & Comcast: House of Mouse Under Siege in Cable Bid to Reshape Media Landscape

The Walt Disney Company kicked off a two-day analyst meeting yesterday at Disney World, just minutes before an impeccably-timed Comcast Corporation rolled out an unsolicited $54.1 billion takeover offer, sending Disney's stock up almost 15 percent by day's end, a level sure to continue for the foreseeable future.

Comcast took everybody by surprise - not least of which Disney itself, which never saw itself nearly as vulnerable as its amorous suitor seems to find it. We'll see what happens when Disney's board travels to Comcast's headquarters town of Philadelphia in March for its board meeting.

In the meantime, as Disney responded to the Comcast offer by politely patting them on the head and saying their board would consider the proposal, behind the curtains Disney was scrambling to plot a defensive strategy, get investment bankers hired and try to fend off what is likely to become a hostile suitor. Tactically, the quarterly earnings announcement, demonstrating much improved results, was moved up to try and blunt the impact of Comcast's own news conference.

It was an audacious move by Comcast in attempt to create what would become the world's largest media and entertainment company, leapfrogging more sizeable competitors Time Warner and Rupert Murdoch's News Corporation, both of whom have said they're not interested in competing (so far) with Comcast for Disney... However, I think it's safe to assume other suitors would emerge to either block the combination of Comcast's distribution channel with more than 21 million cable subscribers and Disney's TV and film franchises, including the ABC television network, ESPN and other cable networks, the Disney and Miramax movie studios, and Disney theme parks around the world. (That’s why Bill Gates appears in both photos above.)

But Comcast's bid won't come easily, if embattled CEO Michael Eisner has anything to say about it - and the likelihood of a takeover battle is largely responsible for Disney's stock move yesterday. Comcast is two-thirds Disney's revenue and owns or controls entertainment properties of its own, with cable channels such as E!, the Golf Channel and Outdoor Life Network, as well as its cable systems, and such a bid by the company for Disney really shouldn't have been such a big surprise. CEO Brian Roberts, son of the company's founder (both pictured with Gates above), nearly went after Vivendi Universal's TV and motion picture assets before they were sold to General Electric to be merged with NBC.

Its peers in the industry seem to approve. Viacom Chairman Sumner Redstone said the combination "would be a transforming event for Comcast, which would elevate it from a cable company to a media giant, and Brian is undoubtedly on the right track." He added, "But, for Disney, Eisner might justifiably take the position that the company is doing better, the earnings and stock are rising and that he does not need a merger partner."

But the key to understanding the deal is to first realize the new environment and competitive dynamics first established by Rupert Murdoch and News Corp.

In the future, media and communications will be dominated by hybrids such as News Corp., which recently acquired satellite-TV operator DirecTV, and Comcast has embraced this future as one where Disney and other programmers no longer hold the balance of power in distribution deals. The cable-TV business isn't just a collection of small family companies running regional outfits anymore and it has to compete with satellite-distribution companies (like DirecTV) that are also national in scope and with DirecTV under Murdoch's control, Disney simply can no longer compete without a distribution partner of comparable stature - a partner like Comcast.

Comcast's studio acquisition is designed to counter the competitive threat posed by News Corp., which controls both satellite television services around the world, 20th Century Fox Studio and the Fox News and Sports networks. Cable companies worry that Murdoch will develop exclusive Fox entertainment and sports content for its satellite operations, putting local cable services at a major disadvantage. But buying Disney gives Comcast a nice hedge against Murdoch, while positioning Comcast to offer advanced products, such as improved on-demand movie service to exclusive shows in the new high-definition television format.

Indeed, buying Disney would give Comcast a rich source of programming for video on demand and establish Comcast as the premiere company in the rapidly converging markets for delivering broadband Internet and video entertainment to households. That will help it fend off competition from other telecommunications and satellite companies that are vying for the same consumers.

Industry insiders commented that Time Warner was scheduled to hold a conference call with investment bankers yesterday afternoon to discuss the possibility of making a run at Disney, while Pixar Animation Studios' Steve Jobs was thought to be in active discussions with a range of parties, including cable operators and others, about putting together an alliance to grab Disney.

A Disney-Comcast combination touches virtually every aspect of a rapidly converging media and Internet landscape, from range and control of programming to cable-television rates to online services to concerns about indecent content. By acquiring Disney's ABC network, Comcast, with 22 million television subscribers, would in several U.S. cities operate the only cable system while also owning one or more of the local broadcast stations. The FCC used to bar firms from operating cable and broadcast facilities in the same market, but those rules were thrown out by a federal court in 2002 and the FCC decided not to rewrite them.

The possibility of a recapitalization could preserve Disney's independence by recruiting a partner like Microsoft or John Malone's Liberty Media to inject some cash into the company, but however remote a recapitalization seems, the perception of one is likely to be good enough to achieve the desired effect - that is to get Comcast to increase its bid.

Indeed, Comcast both expects and welcomes an auction process: "We encourage them to run an open process," said Dennis Hersch, Comcast's attorney at Davis Polk & Wardwell. "We feel pretty confident and think this is a great, logical combination." Comcast's confidence comes from a reputation for being a disciplined buyer unafraid to walk away from unreasonable expectations or too-rich prices, regardless of how logical or great the combination may be, having done so with both MediaOne and VUE.

At Comcast's crowded New York news conference yesterday announcing the offer, CEO Roberts said he'd approached Disney's Eisner on Monday about a merger of the companies, but that Mr. Eisner, without consulting Disney's board, had told him, "It was not of immediate interest to put this together." Roberts wrote to Disney's board yesterday that, "Given this, the only way for us to proceed is to make a public proposal directly to you and your board."

But, Comcast's initial bid will not be enough to draw Disney in to negotiate, as the all-stock offer values Disney's shares at $26.47 apiece, just a 10 percent premium over Disney's closing price of $24.08 on Tuesday. Disney's stock leapt up 14.6 percent yesterday, to $27.60, already putting it out of reach of Comcast's opening offer. Disney reported first-quarter earnings of 33 cents a share, which beat analyst mean expectations of 23 cents, as revenues rose 19% to $8.5 billion from $7.2 billion with parks and resorts, studio entertainment and media networks all making contributions. Indeed, I'd put fair value for Disney way above $30 a share, maybe as high as $35 - if Comcast closes this deal for anything less, it's getting a bargain.

Clearly, one of the biggest challenges to completing this deal will be public outcry against media consolidation. Here's an excerpt from the Washington Post that describes how the deal would likely be received by regulators and consumer groups:

-

Like other mega-mergers of media companies, the Comcast-Disney deal "may well pose a risk to competition in the marketplace of ideas and the diversity of news, information and entertainment available to the American public," Sens. Mike DeWine (R-Ohio) and Herb Kohl (D-Wis.) said in a joint statement. The two men head the Senate Judiciary subcommittee on antitrust.

Consumer advocates and many in Congress fear that such continuing consolidation will result in four or five companies gaining the ability to keep out competition and diversity while stifling localism.

Mark Cooper, research director of the Consumer Federation of America, said it is inevitable that media companies will race to get as big as possible as they are freed from ownership limits and rules that force them to share their networks. "This is the merger that the industrial policy of the [Bush] administration wanted," he said. "You get outrageous sameness" of programming.

Cooper and others say that cable rates have risen as much as 50 percent in the past 10 years and that Comcast's market power would only increase.

Regulators did attach several conditions to the DirecTV acquisition, including requiring News Corp. to provide local channels in DirecTV's top 210 markets by 2008. News Corp. also would have to submit to arbitration in disputes over how much it can charge rival networks for its Fox programming.

To some, the more ominous consequence of the Comcast deal would be in controlling Internet service. Comcast is the country's largest provider of high-speed Internet service via cable, with 5.3 million subscribers.

Increasingly, consumer groups and many technology heavyweights, such as Microsoft Corp., Apple Computer Inc. and Amazon.com Inc., have urged the FCC to ensure that the few major Internet service providers not be able to keep certain Internet content off their systems.

Suppose, for example, that Time Warner's cable Internet service decided to make it hard to get non-Time Warner movies online. Or Verizon's DSL Internet service decided it was not in its interest to let non-Verizon Internet telephone traffic over its network.

"As a content company, it [Disney] was a powerful force in favor of keeping the net neutral - so it could compete equally with other content companies to sell its content," said Stanford University law professor Lawrence Lessig. "But why compete when you've got control over the pipes?"

Internet service companies have repeatedly said they have no interest in content discrimination, saying it would only drive customers to seek alternatives.

And FCC Chairman Powell, who has championed deregulating the media and Internet industries, has resisted seeking network-neutrality rules. But in a speech last weekend, he for the first time sent a message to industry that "net freedom" is an important principle and that the FCC will be watching for violations. "As we continue to promote competition among high-speed platforms, we must preserve the freedom of use broadband consumers have come to expect," Powell said.

However unlikely between companies don't directly compete, regulators might scuttle it before it gets off the ground if it looks as though the deal might have a negative impact on consumer prices. "I don't know if Comcast will get Disney or not, it's a hostile bid," Michael K. Powell, FCC chairman told John McCain during Senate Commerce Committee testimony yesterday. "A merger of that magnitude will undoubtedly go through the finest filter at the commission as is possible, I assure you."

Further, Roberts managerial skill in the more turbulent world content programming is still relatively untested, reminiscent of the disastrous mega-media-mergers of the past – AOL with Time Warner and Vivendi with Seagram - a pair of deals that collectively squandered nearly a quarter of a trillion dollars of shareholder value.

After the blows Disney's suffered in the past year, from the board turmoil to the Pixar alliance crumbling, Eisner will not survive this challenge, and Comcast may prevail in the end - it became market leader among cable operators after a similarly hostile $50 billion transaction to acquire AT&T's cable operations, after a similar reaction by AT&T as Disney's, under interestingly similar circumstances among boards.

But Comcast has weaknesses of its own - Roberts family members have special shares that give them a 33 percent voting stake with financial ownership of only 2 percent, which could make an excellent excuse for Disney to reject the offer.

Comcast president Stephen Burke is a key player in pulling off this deal, having been a Disney executive for 12 years before joining Comcast in 1988 and was one of many once thought a possible successor to Eisner. Burke's father was a top exec at Capital Cities, which bought the ABC television network before it merged with Disney. Yesterday, Burke criticized the performance of several Disney divisions and predicted that Comcast would be able to increase the company's cash flow by between $800 million and $1.3 billion within three years.

The most interesting part of the developing story is whether a white knight will join the fray to compete and cobble together a deal with Disney. A renegade like Barry Diller has always wanted to own a network, but it's uncertain whether he's got the wherewithal to compete in a bidding war. And, Viacom, who owns CBS and Paramount, and GE, who is currently occupied integrating NBC with Vivendi’s Universal media empire, would both face regulatory scrutiny that would almost certainly kill any of their attempts. Likewise, cable competitors Cox and EchoStar don't have the resources to make a run and neither does Time Warner really. Murdoch's News Corporation has said he's not interested... which isn’t very surprising at the moment, but might change if he smells fear on either side.

Microsoft is perhaps the most intriguing possibility (thus the pics of Bill) - a combination that would make things interesting to say the least, but which would be fairly out of character for Microsoft, which prefers arms-length cooperation with content creators and distributors, despite relatively small investments in vehicles like MSNBC and Slate.com - plus, they've never done an acquisition of more than a couple of billion dollars. But, following last week's joint collaboration announcement between Disney and Microsoft on protecting digital content assets for distribution over the Internet, and the ample resources Microsoft has at hand ($53 billion in cash), the combination would be a powerful one.

Whatever happens, because Microsoft already owns 7.4 percent of Comcast, it would control some 4 percent of a combined Disney-Comcast. And, that could give Microsoft leverage over the course of the deal and afterward as it looks to push its software beyond the maturing market for personal computers and into the developing boom in digital entertainment. With the next version of Microsoft's market-dominant Windows OS not expected for another two years or more, digital audio and video will need to keep PC sales humming. Even a minority ownership in the combination would be enough to strengthen links between Microsoft's software, Comcast's distribution and Disney's entertainment assets.

"At one time Microsoft seemed very intent on expanding its media role, particularly when looking at the perceived threat of then AOL and Time Warner," said Joe Wilcox, analyst at Jupiter Media, "But right now, the company is now focusing on getting back to basics." Microsoft also proved to be a key player when Comcast acquired AT&T's cable business, exercising its influence both through its stake in Comcast and a $5 billion investment it made in AT&T.

In the end, timing is everything, and it will prove once again the quality and importance of good timing if Roberts can lure the board to the negotiating table, given the current perception of Disney weaknesses at the moment, not least of which has them lacking a poison pill to help block such an attempt. Whether we think this deal makes as much sense as the AT&T deal did in 2002 - after all, what does Comcast know about running theme parks, sports teams (hockey's Flyers and basketball's 76ers, notwithstanding) and merchandising to children - Comcast still buys content from companies like Disney and if they can pull it off, it will represent a change in perspective for everyone in the media sector, as scale and scope becomes paramount to compete with Murdoch and Comcast-Disney.

My final verdict: on balance, I think far from a done deal, but if Disney's stock price takes any hits and Comcast can boost its own - or Microsoft gets involved, it's over for Eisner. Can Disney compete without Comcast? Probably, but only if it can make an acquisition of its own - Cox is looking awfully attractive lately.

- Arik

February 11, 2004

Oracle vs. PeopleSoft: Department of Justice Signals Against Merger as PeopleSoft Rejects its Determined Rival’s Latest Bid in Hostile Takeover

One of the chief reasons I’ve been hesitant to opine any thoughts on the Oracle vs. PeopleSoft hostile takeover for the past eight months was because of the competitive dynamics of the industry and the likelihood that regulators might oppose the matter entirely, essentially mooting the point of any significant competitive analysis beyond FUD-factoring Larry Ellison against Craig Conway. This despite what appeared to be a warming of relations between the two firms in the past week, as Oracle upped its bid and PeopleSoft playing hard-to-get by teasing that the offer was still just not dear enough.

Lo and behold, in an announcement posted to PeopleSoft’s Web site last night, PeopleSoft revealed it had been informed by the U.S. Department of Justice that the staff of the Antitrust Division has recommended that the Department file suit to block Oracle's proposed acquisition of PeopleSoft and that the staff recommendation has been submitted to the office of the Assistant Attorney General pending a final decision no later than March 2nd, 2004.

The recommendation represents a significant victory for PeopleSoft and CEO Craig Conway, a former Oracle executive, who has predicted antitrust regulators would block Oracle from consuming his company. Conway had argued the takeover would hurt competition in the $20 billion market for business applications software used to automate a wide range of administrative tasks for companies large and small while Oracle had argued the deal would create a stronger competitor to German market leader SAP and a surging Microsoft as it enters that market.

On Monday, PeopleSoft had rejected Oracle's latest tender offer, coming late last week as Oracle raised its bid from $19.50 to $26 a share indicating Oracle was determined to complete the deal. This set the stage for a showdown at PeopleSoft's shareholder meeting on March 25, having called Oracle's $9.4 billion cash offer "inadequate" and issuing a more detailed analysis of its rejection of the bid, in the strongest indication yet that it might negotiate if the price was right. PeopleSoft said the bid valued it at a lower earnings multiple than other enterprise software companies and was below the price target set by analysts, implying a multiple of only 27-28 times earnings based on PeopleSoft’s expected earnings. By comparison, SAP trades at 32 times expected 2004 earnings, while Siebel, which is recovering from a deep earnings slump, stands at 46 times prospective earnings.

The analysis of the Oracle bid and PeopleSoft's decision to reverse its earlier position and make price rather than regulatory considerations the main argument for its rejection suggested that last week's renewed strategy from Oracle may have shifted the dynamics of the takeover battle. Before yesterday’s DOJ recommendation, PeopleSoft's shareholders would have been able to decide at next month's meeting whether they wanted the company to give more serious consideration to Oracle's offer, despite Oracle's complaints that PeopleSoft's poison pill takeover defense prevents it from taking control in the short term and essentially means shareholders have no power to influence the outcome of the bid.

However, that point is moot if regulators don’t approve and Oracle can’t win on appeal – so, here’s a quick run-down of the antitrust dynamics at work.

Throughout the DOJ’s probe, Oracle has essentially argued that competition is robust, with hundreds of mid-size and small software companies all competing to offer applications to handle different business administration needs. The company has argued that if it bought PeopleSoft, the combined company still wouldn't possess a number one market share position in any major business software category.

PeopleSoft, on the other hand, argued that the software market was far more narrowly defined, saying that a market for software "suites" exists in the form of prepackaged software applications designed to work together and that PeopleSoft, SAP and Oracle were the three principle competitors in that market, which would be reduced by one key player after an Oracle acquisition.

PeopleSoft has argued that Oracle launched its bid in June last year simply to disrupt its pending acquisition of JD Edwards and the market for business application software. Oracle, who dominates the database software market, ranks third in the biz-apps market behind PeopleSoft following its JD Edwards buy-out and the leader SAP. Investors had always anticipated that the merger could run into anti-trust problems with U.S. or European regulators, which was why PeopleSoft's shares had traded below Oracle's most-recent offer.

For those without knowledge of the full background here, it gets pretty interesting. In a statement, Oracle spokesman Jim Finn said the initial proposal to merge the business applications units of the two companies had come from PeopleSoft's Conway, who thought he should run the combined business. But when Oracle countered by offering to buy PeopleSoft, "Conway said he wouldn't sell at any price," Finn said. "He then began a long and intensive lobbying effort...(that) resulted in complicating and prolonging the Justice Department review of this merger." Finn added, "While no decision has yet been made, Oracle believes this merger will eventually be approved," indicating a fight ahead on appeal should a ruling come down officially against the merger.

In addition to the regulatory review, the merger is also being challenged in court by PeopleSoft and by the Attorney General's office of Connecticut. Oracle, in response, has a lawsuit pending against PeopleSoft over the actions it has taken to try to block the takeover, including "golden parachute" severance payments estimated at more than $60 million for Conway alone. Oracle also complained that a customer assurance program PeopleSoft put in place puts the company at risk of having to pay out up to $1.55 billion in the event of an Oracle takeover.

There’s little chance Assistant Attorney General Pate will ignore eight months of work by the Antitrust Division or the 200-plus depositions from PeopleSoft’s software customers saying how Oracle’s takeover would make their business software more expensive. The most important key conclusions however are that the department has defined the software market narrowly and has determined where there could be higher software prices as a result of a combination, after an earlier definition of the market in question as one for core financial and human-resources systems sold to large and complex organizations - a market served by only SAP, Oracle and PeopleSoft.

That means the department's conclusions on any anticompetitive effects would NOT be focused specifically on Conway's software "suites" argument, which PeopleSoft had said there was a market for shortly after Oracle launched its bid, which is what led many to believe suites were also the focus of the DOH probe.

Putting limits on the market definition to just financial and HR for large, complex businesses means that all those other pesky facts applying to any broader markets get tossed out as the DOJ skips over any markets for selling software to mid-size or small businesses, the market for customer relationship management and supply chain management, or anything on the database front. This all appears a decided advantage for Oracle, as well as the lack of any argument that Oracle has pricing power in the database market that it will be able to leverage into business applications software, similar to the way Microsoft's Windows monopoly has been tied to competing in other software markets, such as Web browsers and office-suite applications.

However, software license sales alone don’t account for all those billions in revenue generated by SAP, Oracle and PeopleSoft, as sales of software services, support and maintenance to existing customers generate annuity income every month once the customer makes a software purchase.

The DOJ is also concerned with whether new competitors could enter the market in the event that Oracle increased prices, and supposedly, the staff report will conclude that the price of new software licenses could be driven higher in the narrowly defined market if there are only two competitors, instead of three, and that few new suppliers will fill the gap in a market defined as "core HR and financial software for large customers".

On top of that, should the DOJ look at maintenance and support for existing PeopleSoft customers, Oracle could be seen to have a near-monopoly there, post-merger. Many believe a merged Oracle-PeopleSoft could generate a tremendous influx of new customers which the combined company could enforce its monopoly on. And, if the DOJ accepts that analysis, it will be virtually impossible to argue that any new company could enter and compete in delivering support and maintenance services on Oracle and PeopleSoft software.

Still, understanding Larry Ellison, he’s probably not finished yet – he’s likely to recommend the company fight any official ruling from the DOJ that might materialize in March, although the likelihood that Oracle would prevail in that is also poor. Should Oracle appeal however, Conway and PeopleSoft will have a few months more fight ahead – but, in my view, this DOJ Antitrust Division recommendation essentially kills the deal.

- Arik

February 10, 2004

Donald Trump, NBC and the Race to Be "The Apprentice"

Is it necessary for a woman to be a flirt to get ahead in business? Act a little trampy? Many of us know (from experience) how dangerous an underestimation that can be, yet to watch the hit NBC reality show, "The Apprentice", one would think men are all bumbling idiots compared to the bombshell-sexualized tactics the women have used to lead the men in four straight victories of boys-against-the-girls competition to become Donald Trump’s next protégé.

It got so bad last week that Trump precipitated a "corporate reshuffle" to give the guys a fighting chance at staying alive, mixing the teams up and finally kicking one of the women to the street instead of the suite. Slate had a nice critique of the bump-&-grind tactics employed by the girls to beat the boys at every turn:

-

No one disputes that the women's conduct is effective: The show mostly just proves that prostitution really is the world's oldest and most lucrative profession. But debate rages over whether it's appropriate in today's business world. A Nexis search including the terms "Trump, Apprentice, and sex" reveals that 206 articles on the subject have been written. The breakdown generally goes like this: Male reviewers find the whorish conduct sad but entertaining, older women find it shameful and degrading, and younger women, particularly the cute ones, find it liberating and thrilling. One letter to the New York Times crows: "Sex is power!" Which echoes the sentiments of the show's female contestants who say things like: "If being attractive is wrong, then what we do is wrong."

All this discussion, interesting as it may be, misses the real point of The Apprentice. The gender conflict is a side issue, a distraction. The truly interesting anxiety at work in this show is generational: These women and men are revealing the massive gap between the way young men and women, and older men and older women, think about sex.

Who is having a great time on the set of The Apprentice? The Donald, for one. Trump is having the time of his life because these hot young foxes are falling all over themselves to please him—and doing so in the wee-est of garments. Now, that is good business for him and for his powerful associates—a generation of moguls who can mouth platitudes about equality but still date only preteen models. In one episode Donny Deutsch—the head of an advertising agency—lauds the women's team's efforts to launch an ad campaign—the ads they come up with are so phallic they get named "the testicle ad." As Deutsch hands them the win he cackles delightedly that their presentation (in stewardess costumes) had "set the women's movement back 70 years." This week sees Trump stepping into an elevator with one co-ed team and leering at one of the men: "Nice to have these girls with ya, huh?" Moments later, as the group crowds into George Steinbrenner's office, Steinbrenner greets Trump with a hug and crows lechily, "I knew there would be pretty girls!"

Who else is having a blast on The Apprentice? The girls! They are kicking the men's butts by celebrating their own. They've stolen Ally McBeal's résumé but lost the self-doubt. Their de rigueur business uniform: tight low-rise jeans, belly-button shirts, and stiletto boots. Their giggly delight is about their power, and one hesitates to begrudge them. Sure, they have a moment's misgiving when they meet trump's Italian supermodel girlfriend. You can see it in their eyes: Why fight to work for Trump, when you can get him to work for you? But overall, the sex for power bargain is working for them. They are on their way up. There is a perfect synergy between what the young women want and what the old men have, and all the show's sparks comes from that truth.

I like to wonder what Martha Stewart thinks of this show - if she would approve of using physicality as a short-cut to power-brokering or she's "above all that"...?

Something tells me Martha used every advantage she had at her disposal, just like the girls on the show. But, Martha had real moxie - not just a nice walk. I like it if only for the class conflict - let's hope that, when success comes so easily, the girls on the show won't try to cut corners to get ahead in other ways.

Until then, I like the show - not for any serious lessons about business success really - although it does instruct that it's best to seize every opportunity... each day and with each new challenge, the group gets better at making hay while the sun shines. Let's hope the guys can use some of their assets sooner rather than later and turn tables on the girls - or at least, maybe the girls will learn to use their assets a little more creatively.

- Arik

February 09, 2004

The Battle for M&A Marketshare: Merrill Lynch vs. Goldman Sachs, Morgan Stanley, Citigroup and J.P. Morgan Chase

As the mergers and acquisitions market comes back around and Merrill Lynch struggles to recover from its scandal-prone past, it’s putting a big push on recovering marketshare against stronger competitors Goldman Sachs and Morgan Stanley as well as upstarts Citigroup and J.P. Morgan Chase. A Reuters excerpt from a couple of weeks ago describes their progress and ongoing challenges:

As the mergers and acquisitions market comes back around and Merrill Lynch struggles to recover from its scandal-prone past, it’s putting a big push on recovering marketshare against stronger competitors Goldman Sachs and Morgan Stanley as well as upstarts Citigroup and J.P. Morgan Chase. A Reuters excerpt from a couple of weeks ago describes their progress and ongoing challenges:

-

Merrill's top brass credits their tireless discussions with corporate executives over the past three years, when few were interested in doing deals. They also point to a fledgling business model that links investment banking more closely with other products.

Still, analysts and bankers - none of whom wanted to be quoted - say Merrill may have trouble hanging onto its remaining top talent. And rivals like Citigroup and J.P. Morgan Chase & Co., which can lure potential advisory clients with their lending prowess, are not likely to go away.

Merrill Chief Executive Stan O'Neal is hammering home his quest for profits, even if it requires ditching certain products, especially those that will not lead clients to buy other higher-margin offerings. And even if it means the company must sacrifice some market share in a particular area.

"Our first metric is profitability," said Greg Fleming, who shares the top post at Merrill's global markets and investment banking.

Still, he said market share does matter. The company expects to be a top 3 player in higher-margin businesses like M&A and in the top 5 across all of its product lines.

"You can't argue you're an expert in something if you're 11th or 12th in the league tables," Fleming said.

Merrill, which reported a record profit on Wednesday, finished 2003 in third place on global announced merger deals, just a whisker behind No. 2 Morgan Stanley. Merrill worked on 16.7 percent of the global merger deals, up from 13.7 percent the year before, according to Dealogic, which ranked Goldman Sachs first.

Merrill's share was still off significantly from 32.4 percent in 1999, when it ranked second behind Goldman, but the company, like other traditional investment banks, has ceded ground to the new breed of superbanks like Citigroup and J.P. Morgan.

Amid O'Neal's deep cost cuts of the past few years and the various scandals that rocked Wall Street, Merrill lost some key talent, including Casey Safreno, the global head of health care banking, and virtually its entire media team.

Fleming and Steve Baronoff, Merrill's global head of mergers, acknowledge they must fill certain holes. They already brought back Victor Nesi to lead media and telecom banking, and have landed AT&T Wireless as a client.

"From an M&A point of view, most of our industry groups are well covered," Baronoff said, although Merrill is looking to hire bankers in countries like France and Germany.

He said Merrill could selectively add coverage bankers, who help handle all aspects of a client's investment banking needs, in the media, consumer and industrial segments.

Former Merrill bankers said, however, that few star bankers have left because opportunities were limited in the depressed merger market. But with more deals in the works, rivals might poach those who remain, since some are still bitter about the rampant layoffs.

Some Wall Street observers were mildly surprised about Merrill's uptick in advisory work because reports in The New York Times and BusinessWeek have indicated that O'Neal sees less value in the mergers business than the retail side and asset management.

Although strategic advisory work accounts for only about 3.3 percent of Merrill's revenues, O'Neal's reported views about investment banking are still perplexing - and disputed internally - since he came up through the banker ranks, while his predecessor, David Komansky, did not.

"Stan, from my point of view on the M&A side, has been a breath of fresh air," Baronoff said. "Stan is very accessible to clients. He has CEO impact."

While Merrill sounds confident about its merger advisory infrastructure, it will have a tougher time warding off external factors, particularly the encroachment of lending heavyweights like Citigroups.

"The traditional banks want to argue that M&A is a brains business having nothing to do with brawn," said one former banker, "but the financial reality for the clients may be that they can't afford to look at it that way, even if it means they're going to compromise the advice they get."

Although Merrill touts its knack for complicated cross-border deals and hostile takeovers, it is also banking on its own brand of one-stop shopping, including help arranging a wide variety of funding options.

For example, it points to its work with British pub company Spirit Amber, which last year acquired Scottish & Newcastle Plc, the nation's largest brewer. Merrill was sole adviser and bookrunner for a secured debt facility, and it contributed equity to the deal.

"Our vision isn't a single product," Fleming said. "Our vision is driven around developing a relationship with a client, where they will turn to us for any form of investment banking and advisory service they're looking for help on."

Still, Merrill Lynch will need to continue to execute to recover its previous standing in the M&A market, as new rivals Citigroup and J.P. Morgan Chase force market leaders Goldman Sachs and Morgan Stanley to fight even harder. Whether Merrill can avoid getting caught in the middle of that battle for market share will depend on their ability to execute according to their strengths and exploit competitors’ weaknesses.

- Arik

February 08, 2004

Competing in Madison’s Mid-Winter Meltdown Indoor Satellite C.R.A.S.H.-B. Sprints Regatta

Today’s blog is pure fun and games, as my brother Derek (left, above) and I competed in Madison’s Mid-Winter Meltdown Indoor Satellite Regatta for Concept II’s C.R.A.S.H.-B. sprints. I hadn’t done this is almost 15 years – since I was on the UW-Madison Men’s Crew team, in fact, and it was Derek’s first time out ever. Making it all the more remarkable was our relatively strong showing.

We arrived early for the Men’s Heavyweight Open flight and the Men’s Heavyweight Master’s was about to begin, but we hadn’t intended to row TWO 2,000-meter pieces. Still, it’d be a good warm-up if we didn’t kill ourselves and it was awhile until the Open started, so we decided to row it. Now, if you’re not familiar with the Concept II ergometer, pictured behind us in the photo above, competitors row 2,000 meter sprints and try to cross the finish first. This amounts to something between a six minute and nine minute workout, but it’s all-out, pull-as-hard-and-fast-as-one-can to win. It’s a challenge that needs to be trained for to really do well... which I know I didn't really do enough of. ;-)

Of a field of six competitors in the Men’s Heavyweight Master’s flight, Derek took the gold medal with a 6:29.6 final time (that’s a 1:37.4/500-meter split, which is how you pace yourself). To put that in perspective, the world-record time is something substantially south of 6:00 and a 1:25/500-meter pace – those guys are animals. I came in fourth with a 6:58.4 (a 1:44.6 pace, representing Derek’s fitness and leverage superiority over his big brother). ;-)

Next, after recovering and stretching, we were astonished to see the next flight coming up in just minutes, so we got motivated after cheering along a few other sprints – Men’s and Women’s Lights and Heavys as well as Veteran classes and Juniors. Then, it was the Men’s Heavyweight Open race, with eight guys on the deck, counting Derek and I.

Through the pain and sweat, the crowd was fun to listen to as they cheered us on watching the virtual boats on the monitors above us. I lost my pace at about 1,000 meters to go, but recovered and finished with a sixth-place 7:02.4 (a 1:45.6/500-meter split), and Derek won by seconds with a 6:25.6 overall (a speedy 1:36.4/500-meter pace), putting him in the gold medal for a second time the same day. To row two of these sprints the same day is gutsy enough, to win twice within an hour of each race is pretty cool, but to do so on the first day you’ve ever competed in the sport is pretty extraordinary.

As you can all tell, I’m awfully proud of my baby brother. Way to go Derek!

- Arik

February 07, 2004

Jeep vs. Hummer

Hummer and Jeep are going at it - with Jeep running an rather risky ad designed to fight back against Hummer's popularity even as the two brands start a somewhat unlikely battle for marketshare - the Hummer based on the latest military vehicle technology, while Jeep's is based on its World War II predecessor. Here's an excerpt from the IHT, detailing the fight between DaimlerChrysler's Jeep and General Motors' Hummer:

-

Jeep, a division of DaimlerChrysler, recently began running a commercial that showed a bunch of children tooting around in toy Jeeps while a fat child struggled to get his go-cart Hummer out of the mud.

"If it's not trail-rated, it's not a Jeep 4x4," a little girl says to the fat child in a cutesy, I-told-you-so tone. The ad, by GlobalHue of Southfield, Michigan, part of Interpublic Group, is a takeoff on a recent Hummer commercial that depicted a naughty child building a soapbox Hummer and then going off road to win a race. The lavish Hummer spot, by Modernista of Boston, was directed by Scott Hicks, who also directed the movie "Shine," and set to the tune of "Happy Jack" by The Who.

Why would Jeep take a swipe at Hummer?

Ever since General Motors began selling a suburbanized, if still steroidal, version of the Hummer in 2002 called the H2, analysts have pondered the effect of a brand based on a new military vehicle on the brand based on an old military vehicle.

DaimlerChrysler went on the offensive against the H2 by suing GM, asserting that the H2's grille too closely resembled a Jeep's grille.

Jeep lost the case, but Hummer still seemed to be on the mind of GM's rivals at the North American International Auto Show this month. Both DaimlerChrysler and Ford showed rugged sport utility vehicle prototypes that seemed to buck the trend toward tamer, carlike sport utilities. Ford displayed a modern version of its defunct Bronco, while Jeep unveiled a new show car, a massive block of a vehicle called the Rescue, with tire diameters of 37 inches, or 94 centimeters, and a chassis width of 80 inches.

Whether either vehicle will actually be produced is not clear, but many at the show said the Rescue's boxy design looked an awful lot like the H2.

Dieter Zetsche, the chief executive of Chrysler Group, dismissed the idea in an interview at the show. "If anything, Hummer tried to penetrate in Jeep's area," Zetsche said. "This is an absolute, original Jeep, the design of the vehicle, everything. Yes, it has the size of a Hummer, that's true. But I don't know whether there are plans to have certain size brackets restricted to certain brands. That would be new to me."

Hummer and Jeep are not easily compared when one looks at the numbers. Jeep, whose sales declined 4 percent last year, according to Autodata, is a far older brand that sold more than 440,000 vehicles last year. About 35,000 Hummers were sold in 2003.

Hummer is also a luxury brand, with the H2 starting around $50,000 and the H1, which closely resembles the Humvee military transport, at around $100,000. That is why the parking lot at the Hummer Driving Academy in South Bend, Indiana, where rich suburbanites come to learn how to drive off-road vehicles, is filled with Jeep Wranglers - the camp's instructors cannot afford Hummers.

Hummer is planning smaller, lower-priced models to fill out its lineup, which will present a broader challenge to Jeep down the road. But that could take years. Jeep plans to redesign its flagship SUV, the Grand Cherokee, this year, and it will offer a bigger version of the Wrangler.

For now, the Hummer's principal threat, many analysts say, is capturing the mystique that Jeep once had.

"Hummer has stolen Jeep's thunder in terms of image," said Peter DeLorenzo, a former Detroit advertising executive who now edits autoextremist.com, a Web site that critiques the industry.

DeLorenzo, who does some consulting work for Chrysler, added: "Jeep is no longer considered the top of the mountain in terms of off-road vehicles. The H2's image has blown past Jeep overnight."

DeLorenzo said the Hummer advertisement "might be considered one of the best car ads of its type of all time" and called the new Jeep ad "a very childish, amateurish spot that pretends to make fun of Hummer when all it does is make them look terrible."

Speaking generally, Clive Chajet, founder of Chajet Consultancy, a corporate identity specialist, said: "I think it's always risky to be negative about a competitor. It is a form of flattery by the knocker to the knockee, because you don't talk about the competition, and you don't bring attention to them."

Strong identities are increasingly important as the market is overrun with sport utilities. Jeep appears to be choosing to play the stud card, with its latest commercial being one in a series touting the brand's "trail-rated" off-road capabilities.

The Hummer driver? In the Jeep commercial, the fat child, labeled an "imitator," is left pounding futilely on his roof with his black gloves.

So, as Hummer continues to appropriate Jeep's 4X4 image in the minds of auto-buyers, whether Jeep can effectively slam its un-named-but-heavily-hinted-at competitor in its ads might determine whether being "trail-rated" can come to mean anything in the American psyche.

- Arik

February 06, 2004

Chinese Private Investigators Toe Fuzzy Legal and Ethical Lines

I read a piece in the Miami Herald a week or so ago about private investigators and their roles in CI practice in China lately. It’s interesting to compare China with the United States in the past 25 years – but I’m not sure how easy it will prove to be to predict the future of CI in China as the field evolves. In the meantime, here’s an excerpt:

-

Out of China's chaotic race to capitalism, an army of private detectives has emerged to find abundant work tracing bogus goods, tailing swindlers and capturing philandering spouses on videotape.

By some estimates, 700 to 1,000 small investigations companies now ply their trade, employing tens of thousands of paid informants, stalkers, disguise artists, cameramen and part-time snoops.

Like much business in China, the industry exists in a legal twilight zone. Banned by the central government in 1993, private-detective agencies became semi-legal again after a 2002 court ruling. Even so, there's no central registry, no federal licensing and only fuzzy legal interpretation about how gumshoes may operate.

"My understanding is that anything that is not specifically banned is legal," said Kang Yongchun, the deputy director of the Kedun Detective Office (www.kedun-detective.com) in Shenyang, an industrial city about 400 miles northeast of Beijing.

Another excerpt points out why this matters to competitive intelligence practice in China:

-

When 150 private detectives, lawyers and other experts gathered in late December in Hangzhou to discuss the outlook for private investigations, much of the talk centered on "competitive intelligence," such as tracing counterfeit goods and identifying thefts of industrial know-how.

U.S. and European security consulting companies are present in China, but they largely stick to insurance fraud and safeguarding foreign products from counterfeiting.

"Most of the work we do is brand protection," said Ewen Turner, the Shanghai-based managing director for northern China for Pinkerton Consulting and Investigations, the 154-year-old security firm headquartered in New York.

Turner said private investigation in China "is still very much a fledgling industry" and local private eyes run the gamut "from legitimate firms to one-man offices to professional informants who go around city-to-city sniffing around markets."

"There are people whose sole purpose is to go follow trucks around," the managing director said.

It's interesting to note how China has been trying adopt more sophisticated CI techniques in recent years however - I've been there twice in the past two years on lecture tours to talk about the legitimized adoption of legal/ethical CI practices over shadier industrial espionage activities that more frequently marked past intelligence forays by Chinese industry – and, in many cases, still does.

- Arik

February 05, 2004

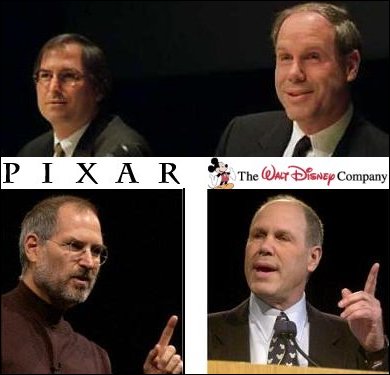

Pixar vs. Disney: Clash of CEOs and the New Competitive Challenges Both Will Face

Late last week, 10-month-old talks to renew the pact between Disney and Pixar that produced $2.5 billion in box office over the past few years, broke down as the companies failed to arrive at an agreement to move forward together - instead, they'll move forward as competitors.

Pixar's chief executive, Steve Jobs, who also runs Apple Computer, abruptly ended negotiations with Disney after no progress was made in what Disney and its financial analysts believed was just asking too much, including sole ownership of the films the two had made together under the existing agreement - including hits like "Finding Nemo", "Toy Story" and "Monsters Inc."

"What Pixar has that we don't have is John Lasseter," Eisner said during an investment conference last year. "It's like Walt in a way. He has that quirky sense of humor and understanding. John is unique." This gives Disney two years to nurture or hire its own version of Lasseter - himself a former Disney animator - to compete against future Pixar films.

Eisner faced criticism for having mismanaged one of the most profitable tie-ups in the history of Hollywood and letting Pixar go its own way. "He made them feel like second-class citizens when they were producing the best product in the country," said Stanley Gold, a former board member allied with ex-director Roy Disney who is campaigning for Eisner's ouster. "It was no way to manage talent," added Gold, who is campaigning for shareholders to vote against Eisner and three other board members up for reelection at the March 3rd shareholder meeting in a symbolic protest.

But short-term, analysts said, Disney would benefit, since it was not going to give away any of its profit from the two films left in the current Pixar deal, which had been part of the renegotiation. "Eisner had no other choice in my opinion," said Schwab SoundView analyst Jordan Rohan who estimates Disney would have forgone up to $1 billion in pretax profit over four years. "If my financial projections are correct... then Eisner will be vindicated, the company will be back and Roy Disney will find it hard to effect any change," he said.

Then, yesterday, in an conference call announcing a quadrupling of earnings on the strength of "Finding Nemo" DVD sales, Jobs ended any hope that the companies might continue their partnership by blasting Disney's own animation efforts and blaming the company for refusing to reach a compromise. Jobs said Pixar is now the "most powerful and trusted brand in animation" and is free to work with new partners.

"The truth is that there has been little creative collaboration with Disney for years," Jobs said. "You can compare the creative quality of Pixar's last three films, for example, with the creative quality of Disney's last three animated films and gauge each company's creative abilities for yourself."

"We will truly miss working with Dick Cook and his terrific distribution and marketing teams," Jobs said, referring to the chairman of Walt Disney Studios. "And you would be hard pressed to find anyone who loves the original spirit of Disney more than John Lasseter, Ed Catmull or myself. But after almost a year, it's time to move on." Lasseter, a former Disney animator, is the chief creative force at Pixar. Catmull is Pixar's president.

"Not even Disney's marketing and brand could turn Disney's last two animated films, ‘Treasure Planet’ and ‘Brother Bear’ into successes. Both bombed at the box office," Jobs said. "No amount of marketing will turn a dud into a hit," Jobs said. While Disney must now face Pixar as a competitor, it retains the rights to make video and theatrical sequels and TV shows to the movies covered by the current deal. However, despite retaining the right to make sequels to Pixar films, Disney does not own the underlying technology and must recreate the millions of lines of computer code for each character. "We feel sick about Disney doing sequels because if you look at the quality of their sequels, like ‘The Lion King 1-1/2,’ ‘Peter Pan’ sequels and stuff, it is pretty embarrassing," Jobs added.

Pixar still has two movies to deliver under its current deal, including "The Incredibles," due in theaters in November, and "Cars," which will be released next year.

Disney's studio division contributed 19 percent of the company's overall operating income in 2003 and during the past five years, Pixar contributed more than 50 percent of Disney's studio profits, but if Disney had agreed to Pixar's terms, it would have forfeited hundreds of millions of dollars in profits it is entitled to under the current deal.

One factor in Disney's favor may be that Disney's studio division has found increasing success with live-action films, such as "Pirates of the Caribbean: The Curse of the Black Pearl." Strong box office returns in that area could reduce the company's reliance on Pixar profits and Disney's theme parks, which contribute the bulk of the company's revenues, also have been recovering from several years of lower attendance.

Disney has said it will release its first-ever computer-animated film, "Chicken Little," in 2005 and has several other computer and hand-drawn animated films in the works. But the big challenge for Disney will be to fill the creative vacuum left by the loss of Pixar writers and animators such as Lasseter, Andrew Stanton, the director of "Finding Nemo," and Lee Unkrich, co-director of "Monsters Inc." and several other Pixar films.

Disney has cut back its own feature animation department having earlier this month announced it would close its Orlando animation studio and shed more than 250 jobs. Computer-generated characters will largely replace hand-drawn ones in Disney's restructured animation department.

In a recent interview with The Associated Press, Disney studio chairman Dick Cook said attracting and nurturing creative animation talent is a priority. "There is a group of kids graduating today from CalArts or from UCLA or USC that are bigger, better, faster, smarter than the current group," Cook said. "They have the ability to know what the masters have done before them, and they're better than they are. Attracting that kind of talent, for us, is one of the great priorities."

"Finding Nemo," Pixar's latest film, has earned more than $800 million at the international box office to date, surpassing the record previously held by Disney's 1994 film, "The Lion King." Jobs said every major studio has expressed interest in working with Pixar and negotiations with at least four of them will begin in March and Pixar hopes to have a new deal in place by the fall.

In an e-mail, David Stainton, picked by Eisner last year as Disney's new chief of animation, tried making lemonade: "Given Pixar's demands, this is good news for the company. It is also a great vote of confidence for feature animation - confidence in our talent, our slate, and our future. You all are awesome and ready for your close-up!"

Barron's said Pixar has probably capped its earnings power for the next three years because its next two movies, "The Incredibles" and "Cars," will be released under the existing deal, which effectively gives Disney more than 60 percent of any profits, and the same report cited a Morgan Stanley analyst who said the possibility of negotiating more favorable terms on those two movies is now off the table. And, as Pixar faces Disney as a rival in the increasingly competitive animated film business, Pixar's new partner is unlikely to be as strong as Disney in family entertainment. In the future, starting with its as-yet unnamed 2006 movie, Pixar will probably bear all the production and marketing costs, Barron's said.

So, can Eisner carry on? His instincts appear to be failing him… Several months before last summer's release of "Finding Nemo," Eisner, told his board not to expect a blockbuster and suggested that such a fate might not be all that bad. Eisner said that although Pixar was excited about its film, he was not impressed by early cuts he'd seen, according to people familiar with the matter. Should the movie falter, Eisner said, Disney could gain negotiating leverage in contentious talks to extend its partnership with the highflying animation company. Pixar, Eisner concluded, may be headed for "a reality check." The computer-animated film would, in fact, prove to be a reality check for Eisner, as the critically acclaimed "Finding Nemo" would soon make more money than any animated film in history. Advantage: Pixar.

I think in the end, the real source of competition was probably in the inflated egos of the two firms' CEOs, Eisner and Jobs, both famously strong-willed and who let their personal differences cloud their objectivity in a partnership in which the spoils were evenly split. Jobs felt so slighted that he put an offer on the table designed to make Eisner so angry talks would break down and each company could go their separate ways. Here’s a great backgrounder excerpt from the LA Times, comparing the two leaders:

-

Eisner has been at the helm of Disney for 20 years. He has weathered a number of storms, including poor performance of its stock, deteriorating ratings of its ABC television network, weak sales at its retail stores, and the defection of high-level executives who have found success elsewhere. The Disney chairman is widely known as someone who will not give an inch in his business dealings, whether it's litigating over merchandising royalties for Winnie the Pooh or forcing cable operators to pay escalating fees to air Disney's ESPN network.

The equally tough-minded Jobs has survived his own share of setbacks. In 1985, the legendary Silicon Valley entrepreneur left Apple Computer, the company he co-founded in his father's garage, amid a power struggle over its direction. Like Eisner, he is guarded and intensely protective of his company's brand name. Jobs recently demonstrated his maverick vision and shrewd negotiating skills in persuading executives at Universal Music Group and other labels to sell songs online with few restrictions through Apple's iTunes Music Store. Associates say he wins some battles sheerly on the force of personality. "He is the best salesman in the technology industry, bar none," one Silicon Valley analyst said of Jobs.

The pairing of two men with such combustible personalities may have been destined for a blowup.

The companies first joined in 1991. Back then, Pixar was not an equal partner. The upstart animation company was paid a fee to create digitally animated movies that Disney would market and release.

But after the surprise success of "Toy Story" in 1995, Jobs insisted on changing the financial balance of the relationship. He demanded that Pixar be paid half the profits on the films it wholly created for Disney. When Eisner balked, Jobs nearly walked.

Still, according to sources who know both men, Eisner continued to treat Jobs - known to have a disdain for authority - in a paternalistic fashion. "Steve viewed it as a partnership and he thought Eisner treated him like a hired hand," one source said.

Many say the turning point in the unraveling of their relationship came when Jobs and Eisner collided over the fate of "Toy Story 3" and how sequels figured into their new five-picture deal.

Under the terms of the agreement, sequels would not be counted as part of the five. At the time, Disney was trying to save money and time by making direct-to-video animated sequels. That's how "Toy Story 2" was initially envisioned. But as production proceeded, Jobs could see the financial and creative potential of turning it into a major movie that would be released in theaters.

Although Eisner resisted, Jobs would not give up, according to sources familiar with the dispute. In the end, Jobs' persistence paid off for Pixar and Disney. "Toy Story 2" made more money than the original, raking in a stunning $245 million domestically in 1999.

But because the movie was a sequel, it was not counted under the multipicture deal — a fact that Jobs accepted without making a ruckus. He was not so amenable when it came to plans to make "Toy Story 3."

This time, Jobs was adamant that the sequel be counted as one of the films Pixar owed under the Disney contract. Jobs' view was that "Toy Story 2" was a giant "freebie" for Disney and that Pixar should not be forced to provide another one.

Despite a collaboration that unexpectedly enriched Disney, Eisner insisted on sticking to the letter of the contract. He refused to compromise and publicly bragged about the leverage he had over Pixar.

Jobs was livid, according to a source close to the executive.

Even Walt's nephew Roy Disney couldn't mend the rift after Jobs sought his counsel, following Eisner's 2002 congressional testimony that directly mocking Apple's "Rip. Mix. Burn." slogan exemplifying digital piracy of entertainment content. But Eisner strictly forbid Disney from visiting Pixar to screen his pet short film project "Destino" saying Disney personnel would not mingle with Pixar's during tough contract re-negotiations.

Still, those analysts who'd speculated last week's announcement by Jobs was just a negotiating ploy are left to remember words from last November, while discussing Pixar's third-quarter earnings with analysts: "If we cannot strike a deal with Disney, then we can talk with the rest of these companies and they will know that we're not just talking to them to get a better deal with Disney, because we'll be finished with Disney."

The competitive dynamics get pretty interesting to think about for other players in Hollywood, namely DreamWorks with its upcoming "Shrek II" sequel, following up on the success of "Shrek" – the first film to win Best Animated Feature at the Academy Awards. Other studios will be vying to build out an animation franchise as well, as they spot a weakened competitor in Disney – possibly with Pixar – although they’d need to tolerate the relationship.

In the end, I think Disney thought DreamWorks took the right road by building their own animation machine and this represents largely a revision of history to redeem what was originally an unexpectedly entangling decision to buy rather than build. That said, "Toy Story", the film that started it all, might not have happened without both Disney and Pixar behind the wheel.

- Arik

February 04, 2004

Are Corporations Insane?

Just in the past week or so I noticed an article on AlterNet about "The Corporation", a new documentary premiering at the Sundance film in January that also won Sundance's World Cinema Documentary Audience Award, based on the premise that corporations are legally programmed to act like psychopaths – that Enron, WorldCom, etc. aren’t the exception… they’re the rule – and the bigger companies become the worst they behave:

Just in the past week or so I noticed an article on AlterNet about "The Corporation", a new documentary premiering at the Sundance film in January that also won Sundance's World Cinema Documentary Audience Award, based on the premise that corporations are legally programmed to act like psychopaths – that Enron, WorldCom, etc. aren’t the exception… they’re the rule – and the bigger companies become the worst they behave:

-

"The corporation is a paradox," says Mark Achbar, who co-directed and wrote the documentary with Vancouver filmmaker Jennifer Abbott and law professor Joel Bakan. "It generates tremendous wealth, but at tremendous social and environmental cost."

Achbar, best-known for his 1992 documentary "Manufacturing Consent: Noam Chomsky and the Media," says that when he started working on the new film six years ago, it originally was about the anti-globalization movement. But he realized that the growing protests were really against corporate power – and despite the millions of news hours and pages devoted to mergers, acquisitions, marketing strategies and CEO profiles, no one had really examined the history and the character of the corporation itself.

An unlikely subject for a hit film, perhaps. But The Corporation's entertaining mix of interviews, cartoons and old industrial films has already won three "people's choice" prizes at film festivals, including Sundance's World Cinema Documentary Audience Award (sponsored, ironically, by Coca-Cola). In Canada, where "The Corporation" has garnered rave reviews – one compared it to "the best issue of Harper's magazine set to music" – it's currently playing to sold-out theatres across the country.

"Everybody wants to buy their products from a socially responsible corporation, not from some horrible polluter," Achbar says. "The question is, how are we going to resolve this dilemma?"

Here's another excerpt:

-