August 30, 2005

Hurricane Katrina: Disaster Impact on Energy Markets

Hurricane Katrina made landfall Monday but avoided a potential "Worst-Case Scenario" for the U.S. energy industry... and, as an extension, for the U.S. economy as a whole.

Hurricane Katrina made landfall Monday but avoided a potential "Worst-Case Scenario" for the U.S. energy industry... and, as an extension, for the U.S. economy as a whole.

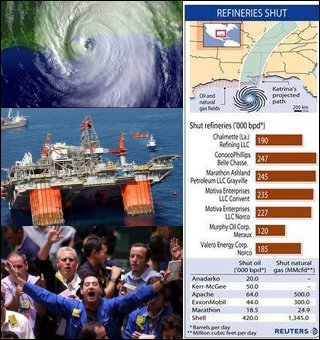

As crude oil futures on the New York Mercantile Exchange reached $70.80 Sunday night (topping $70/bbl again Tuesday), up $4.67 from Friday, refineries and oil rigs on the Gulf Coast were shut down, and employees evacuated, shrinking oil output and creating more anxiety about fuel. Gasoline prices are expected to climb as refinery capacity is limited by the storm, and the impending storm cut oil production in the Gulf of Mexico by more than 600,000 barrels a day, or more than a third of the area's normal output of 1.5 million barrels a day. Large refining and oil-shipping installations in southern Louisiana shut down for the weekend too, which left energy analysts biting their nails because the Gulf Coast is such a major hub for both oil production and refining. "We are still in the soap-opera phase where everyone is still wondering what is going on," one analyst told the NYT. But the Times also spoke to a super-specialist, a guy who does disaster-risk analysis for refineries, and he didn't seem too bothered. "Usually the refineries fare pretty well, as long as they batten down the hatches and wait it out," he said.

Meanwhile, the White House suggested President Bush is at least open to tapping the U.S.'s strategic petroleum reserve; the only inconsisency in this approach being, the strategic reserve is full of crude oil, while the potential Katrina-caused shortage isn't of crude. As one analyst put it, "The crunch is on refineries." So, if the reserves will just have to queue up for refining, apart from the PR (and market-calming?) effect, how much good would it do to open up the reserves?

The LA Times has great coverage of the energy angle:

Most of the energy facilities in Louisiana, Mississippi and Alabama were shut down as Katrina roared through the region, which accounts for about one-third of the 5.5 million barrels of oil that the United States produces each day and more than 20% of its daily natural gas output.If repairs to damaged Gulf oil platforms, refineries and pipelines take weeks or months, shortages of oil, gasoline and natural gas could develop, sending prices of those commodities even higher and threatening the U.S. economy, analysts said. But it will take time to gauge the full extent of the hurricane's damage, adding uncertainty to the energy markets at a time when oil suppliers struggle to keep pace with rising demand.

"We're in an information vacuum because it's going to be another couple of days until we get a meaningful damage assessment," said David Pursell, a principal at Pickering Energy Partners Inc. in Houston.

The industry's trade group, the American Petroleum Institute, urged consumers to "use energy wisely" in the meantime.

Analysts noted that the region was slow to recover from last year's Hurricane Ivan, in part because damage to underwater pipelines wasn't immediately apparent or easy to fix.

Pipeline damage "is generally more difficult and costly to repair," analyst Doug Leggate of Citigroup Global Markets Inc. said in a note to clients.

The U.S. benchmark grade of crude oil for October delivery shot as high as $70.80 a barrel in overnight electronic trading before closing at $67.20, up $1.07 for the day on the New York Mercantile Exchange. That fell short of the Nymex record close of $67.49 a barrel set Thursday. Adjusted for inflation, oil peaked at more than $90 a barrel in early 1981.

But natural gas and gasoline futures set Nymex records Monday.

Natural gas for September delivery jumped $1.055 to $10.847 per million British thermal units as the winter heating season looms. Natural gas also is used to generate nearly half of California's electricity.

Gasoline futures for September delivery soared 13 cents to $2.061 a gallon. The rally probably means motorists will see pump prices climb even higher.

In California, the average retail price of regular gasoline hit a record $2.77 a gallon in the week ended Monday, up 2 cents from the previous week, the Energy Department said. The price stood 67 cents higher than a year earlier. The U.S. average price slipped two-tenths of a penny to $2.61 a gallon, up 74.4 cents from a year ago.

Still, industry experts found silver linings in the hurricane's clouds. They noted that some refineries continued to operate, albeit at reduced rates. The stock market closed higher, including shares of oil companies that are major players in the Gulf of Mexico, such as Exxon Mobil Corp., Chevron Corp. and Marathon Oil Corp.

Oil giant Saudi Arabia also said it stood ready to boost its daily production by more than 1 million barrels a day, to 11 million, to fill any supply shortages caused by Katrina.

And President Bush didn't immediately release oil from the U.S. Strategic Petroleum Reserve — a storage facility filled with 700 million barrels of oil for national emergencies — signaling that the White House didn't yet expect a major shortage of supplies. The government might use the reserve to make oil loans to refiners facing shortages, government officials said, just as it loaned more than 5 million barrels after Hurricane Ivan.

The reserve "is there for emergency situations, and that would include natural disasters," White House spokesman Scott McClellan said on Air Force One as Bush flew from Texas for appearances in Arizona and Southern California. The administration has rejected calls to release some of the reserve to mitigate high energy prices, saying Bush would consider the move only in response to a major disruption in supplies.

On Capitol Hill, Rep. Joe L. Barton (R-Texas), chairman of the House Energy and Commerce Committee, asked Bush on Monday to take such action if the hurricane "wreaks havoc" on U.S. oil supplies. Sen. Barbara Boxer (D-Calif.) urged the president to immediately tap the reserve to provide "some relief from skyrocketing oil prices."

Although Hurricane Katrina's damage has yet to be tallied, the initial effect appeared to be less than the cataclysm some feared, said Phil Flynn, senior market analyst at Alaron Trading Corp. in Chicago.

After a weekend filled with televised images of Katrina bearing down on the Gulf Coast, "it looks like New Orleans may be spared from annihilation, the levees might hold and the refineries might not be underwater, and that is a big positive for our country," Flynn said.

Still, there was no discounting even the initial pain of Katrina's punch.

Tracking devices on two drilling rigs under contract to Shell Exploration & Production Co., a U.S. arm of Royal Dutch Shell, showed that they had drifted from their normal locations, Shell spokeswoman Darci Sinclair said.

"Until the storm has completely passed and it's safe for us to send out crews and evaluate, we won't know what, if any, damage has occurred," Sinclair said. Shell expected to start sending out crews Monday evening, she added.

Another drilling platform broke free of its mooring in Mobile Bay, Ala., and slammed into a bridge, the Alabama Department of Transportation said. It was uncertain who owned the platform.

The fundamental question of what the price of oil will do, and the resulting pressure on gasoline, natural gas and heating oil prices heading into fall and winter, has more to do with refining capacity (which has just been cut, remember, by Katrina) than with exploration and extraction.

I predict the price of a barrel of light sweet crude will fall back to $40/bbl even while natural gas, heating oil and gasoline goes in the other direction. After all, we'll be in oversupply of rawer materials until refineries can get back online.

- Arik

Posted by Arik Johnson at August 30, 2005 07:53 AM "Competitive Intelligence applies the lessons of competition and principles of intelligence to the need for every business to gain awareness and predictability of market risk and opportunity. By doing so, CI has the power to transform an enterprise from also-ran into a real winner, with agility enough to create and maintain sustainable competitive advantage."

"Competitive Intelligence applies the lessons of competition and principles of intelligence to the need for every business to gain awareness and predictability of market risk and opportunity. By doing so, CI has the power to transform an enterprise from also-ran into a real winner, with agility enough to create and maintain sustainable competitive advantage."