August 25, 2003

August 14th Northeast Blackout, FirstEnergy and the Consequences of Deregulation

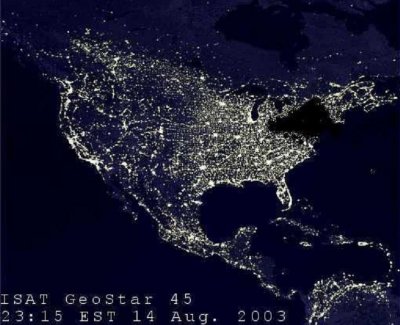

The Geostar snapshot above features a notably darkened Northeast United States, back on August 14th, as everyone struggled to get home on a Thursday evening. While the experience points up the solidarity places like New York City now feel during times of stress in the wake of 9/11, it was still a HUGE inconvenience and affected the whole country, effectively shutting down business for the remainder of the day and into Friday.

In the meantime, I've found a couple of interesting articles in the storm of coverage - the first one from WashingtonPost.com, discussing how competitors are pointing the finger of blame at one another as American Electric Power traces back the collapse to FirstEnergy, a big competitor of theirs. The second one is more interesting (and worthy of excerpts) from CorpWatch that looks at why FirstEnergy (arguably the culprit behind the blackout) will probably escape any regulatory backlash from the Bush Administration:

- The immediate cause of the largest blackout in U.S. history is being traced to FirstEnergy, the Akron, Ohio, energy giant that is a product of the merger of seven utilities: Toledo Edison, Cleveland Electric, Ohio Edison, Pennsylvania Power, Pennsylvania Electric, Metropolitan Edison and Jersey Central Power & Light.

On Aug. 14, FirstEnergy's 550-megawatt, coal-fired Eastlake power plant in Ohio stopped running at 2 p.m. In response, FirstEnergy began to pull roughly 20 percent of its load of electricity out of Michigan to meet its needs. This transfer overloaded several transmission lines, causing them to trip. Non-FirstEnergy plants in Ontario, Canada, began supplying energy to the underpowered Michigan market, which then led to overload on those transmission lines. This movement of power in Canada deprived New York of power it had relied on, which led to the blackouts there.

And here's the critique:

- Bush's energy deregulation is making America vulnerable for two reasons. First, America's transmission system was designed to accommodate local electricity markets, not the large, freewheeling trading of electricity and movement of power over long distances under deregulation. Sending power over a much wider area strains a transmission system designed to serve local utilities. That's why state regulators in the Midwest warned FirstEnergy and other utilities months ago that the transmission network was vulnerable to a blackout. But these concerns were ignored by these energy corporations.

Second, state-based deregulation means utilities are no longer required to reinvest ratepayer money back into the transmission system, as deregulation replaced that orderly planning with reliance on "the market." But the market has been unwilling to make the necessary investments in transmission. In particular, the market has not functioned properly as loopholes were punched in the Public Utility Holding Company Act (PUHCA) over the past decade.

PUHCA, slated for full repeal by the Republicans in both the House and Senate energy bills, is the last federal regulation that requires giant energy companies to disclose crucial financial details and limits the types of non-electricity investments they may make. If PUHCA is repealed, a wave of mergers will likely result, leaving a handful of companies (like Southern Co., ExxonMobil and FirstEnergy) in control of our electricity - with no effective regulators looking over their shoulders.

In the case of the August blackouts, the deregulated wholesale markets of the Midwest and Northeast - typically cited as models for national deregulation by the Federal Energy Regulatory Commission - failed in their ability to provide reliable and affordable power. As a result, wholesale prices remain higher than under regulation, and nearly 96 percent of the 40 million residential consumers in the remaining 15 deregulated states lack access to competitive electricity suppliers.

FirstEnergy's financial problems are the heart of the question, of course. The consequences are that the American taxpayer ultimately will probably have to foot the bill for the energy industry's poor fiscal discipline.

- Arik

Posted by Arik Johnson at August 25, 2003 01:35 PM | TrackBack "Competitive Intelligence applies the lessons of competition and principles of intelligence to the need for every business to gain awareness and predictability of market risk and opportunity. By doing so, CI has the power to transform an enterprise from also-ran into a real winner, with agility enough to create and maintain sustainable competitive advantage."

"Competitive Intelligence applies the lessons of competition and principles of intelligence to the need for every business to gain awareness and predictability of market risk and opportunity. By doing so, CI has the power to transform an enterprise from also-ran into a real winner, with agility enough to create and maintain sustainable competitive advantage."