August 29, 2003

Vodka Brawling: Grey Goose VS. Belvedere

Two of the nation's leading luxury vodkas - Grey Goose and Belvedere - are in a barroom brawl over an advertising campaign. Here's an excerpt from the Minneapolis Star-Tribune:

Two of the nation's leading luxury vodkas - Grey Goose and Belvedere - are in a barroom brawl over an advertising campaign. Here's an excerpt from the Minneapolis Star-Tribune:

- "At issue are ads for the French vodka Grey Goose. In the ads, Grey Goose calls itself the world's best-tasting vodka, based on the results of a 1998 taste test by the Beverage Testing Institute. The ads tout Grey Goose's winning score of 96 and list the scores of 31 competing vodkas. Among the brands that scored worse than Grey Goose is Belvedere, the Polish vodka that pioneered the luxury category in 1996. Belvedere scored a 74 in the 1998 test, ranking it near the bottom of the pack. The institute is an independent company in Chicago that conducts and publishes reviews of beer, wine and spirits. Since that 1998 taste test, Belvedere has performed significantly better in two other taste tests by the same organization, posting scores of 90 and 91. Given those higher scores, Belvedere argues, it's not fair for Grey Goose to keep printing the results of its poor showing in 1998. Belvedere took its case to an industry arbitrator, the National Advertising Division (NAD) of the Council of the Better Business Bureaus. That group agreed that Grey Goose should stop running its ads. So did the National Advertising Review Board (NARB), another industry referee. But Grey Goose said it won't abide by the nonbinding decisions of those agencies."

Now, I'm not much of a vodka drinker - I prefer beer myself - but my bet is this ends up in court. The real question is whether Grey Goose should re-submit their product for comparison - which they have not since their 1998 win... and really have no interest in doing so and risk a loss of the earlier rating. Belvedere's been damaged by the ads certainly. But, if the 1996 Yankees won the World Series, should they not be able to cite that championship benchmark? Is it not true that Grey Goose won in 1998 and if they're citing that date in the ads, should Belvedere be able to make them cease and desist?

- Arik

August 28, 2003

Ringtone Piracy Growing in Asia, Highlighting Paradox of "Duplicable Creative" Goods & Failure to Overcome Supply & Demand

It would seem that one of the latest revenue generators for mobile phone companies and copyright holders alike - downloadable ring-tones - is being scuttled throughout Asia. In what has seemed to be an almost pure-profit business - what's it cost to produce a ring-tone download anyhow? - it seems fortunes are getting skinnier in yet another digital market, thanks to piracy.

It would seem that one of the latest revenue generators for mobile phone companies and copyright holders alike - downloadable ring-tones - is being scuttled throughout Asia. In what has seemed to be an almost pure-profit business - what's it cost to produce a ring-tone download anyhow? - it seems fortunes are getting skinnier in yet another digital market, thanks to piracy.

This reminded me of the fundamental paradox in all such "duplicable creative" products, and how copyright holders have tried to overcome the iron law of supply and demand. The question is, if products are no longer scarce, does price elasticity still apply to them?

Because of the ubiquity of well-informed buyers in the modern business environment (i.e., they are aware of all competitive alternatives), the chief and only means by which true wealth can be generated by any group or individual entrepreneur today is through the sale of essentially cost-free-to-manufacture goods - in other words, recorded media such as music, movies, written works or software products.

So, the only stuff anybody can make that will have essentially zero manufacturing cost (and therefore unlimited profit margin) must be digital and therefore easy to copy. On the other edge of that sword, the characteristics of being digital mean those goods can be copied esssentially for free, as long as there's someone interested enough to crack the DRM (digital rights management) watermarking that diables copying or performance of that product outside its authentically paid-for copyright license. Okay, Arik, all pretty obvious so far, right?

The point is, what did they expect? That ringtones would never be pirated? What does the motion picture industry expect, following the example of the RIAA's failure so far to stop the erosion of the record industry - a loss of 30 percent of CD sales in the past two years alone. In other words, the business of selling CDs is no longer a business at all, despite the comparative health and popularity of music culturally. Cinema is next... and has already been impacted. What will happen to e-books...? What do you think will happen? Even Apple is seeing its lauded iTunes service affected by customers that are reselling their songs to other users, just to prove a point.

In the end, I think, duplicable creative goods will only be protected in order to compete just like any other commodity... on the economic foundation of supply and demand... the very principle that copyright holders have been trying to overcome in order to create wealth. If a good is no longer scarce (the very definition of cost-free-manufacture) then it no longer has value. Culturally, media consumers have simply woken up to that realization.

- Arik

August 27, 2003

Is a Trade Secret Still a Trade Secret if it’s No Longer Secret? DVD Encryption Safe for Now from First Amendment Arguments for Free Speech

In a Monday ruling, the California Supreme Court decided that distributing the computer code behind the DeCSS app, designed to crack the CSS copy-protection on DVD movies, over the Internet was a violation of trade secret law. In what was an apparent victory for Hollywood, the broader application of trade secret law is the real question. That is, is it still a trade secret if it’s no longer secret?

That was the argument by the Electronic Frontier Foundation in their support of defendant Andrew Bunner, alongside Bunner’s First Amendment rights. "We'll go back down to the court of appeal and present the facts and it will be painfully clear that DeCSS is not a secret," said Cindy Cohn, EFF’s legal director. "It's on T-shirts [ed. the pic here shows the legal one, which you can also buy here]. It's on neckties. It's in thousands of places. Just do a Google search and you'll find it."

So, does that mean that a company’s customer list or secret sauce formula still has protection even if some Norwegian teenager figures out how to post it to the Internet (Jon Johansen, originator of the DeCSS code, was acquitted by Norway of trade secret wrongdoing in January)?

In the end, this wasn't a clear victory for either side - the court made no determination of whether the code was, in fact, a trade secret... It'll be up to a lower court to decide what to do next. Because it's available essentially everywhere - Google it and see - and, it was also likely possible to do the same four years ago, although perhaps with a bit more fuss... Therefore, the code was not secret and would thus not be protected by Calfornia's trade secret law.

That means that if a trade secret is ever published, even if it was misappropriated by hackers or spies or whatever, it's no longer a trade secret. Who's right? Comment here and let us all know what you think.

- Arik

P.S. - check the following links for further info and watch for more on the issue:

August 26, 2003

Honeymoon Over with VoIP & Regulators? ILECs & Bells Sigh Relief

With the notable exceptions of AT&T and Qwest, it would appear the ILECs and Bells have finally managed to lobby through to regulators the idea that VoIP services such as Vonage – which Aurora happens to use extensively for voice communications – should be regulated as phone companies by states. The FCC is still taking a wait-and-see approach.

There’s a great piece on the recent Minnesota PUC decision to try and regulate Vonage, despite the company’s appeal to the contrary; plus, Pulver.com’s coverage of the whole states-vs.VoIP fight is good as well.

- Arik

August 25, 2003

August 14th Northeast Blackout, FirstEnergy and the Consequences of Deregulation

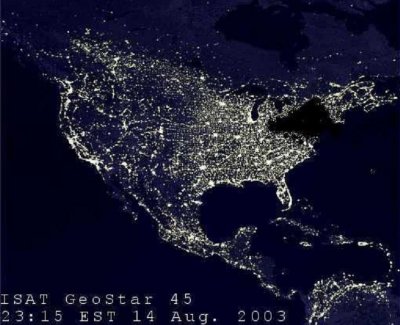

The Geostar snapshot above features a notably darkened Northeast United States, back on August 14th, as everyone struggled to get home on a Thursday evening. While the experience points up the solidarity places like New York City now feel during times of stress in the wake of 9/11, it was still a HUGE inconvenience and affected the whole country, effectively shutting down business for the remainder of the day and into Friday.

In the meantime, I've found a couple of interesting articles in the storm of coverage - the first one from WashingtonPost.com, discussing how competitors are pointing the finger of blame at one another as American Electric Power traces back the collapse to FirstEnergy, a big competitor of theirs. The second one is more interesting (and worthy of excerpts) from CorpWatch that looks at why FirstEnergy (arguably the culprit behind the blackout) will probably escape any regulatory backlash from the Bush Administration:

- The immediate cause of the largest blackout in U.S. history is being traced to FirstEnergy, the Akron, Ohio, energy giant that is a product of the merger of seven utilities: Toledo Edison, Cleveland Electric, Ohio Edison, Pennsylvania Power, Pennsylvania Electric, Metropolitan Edison and Jersey Central Power & Light.

On Aug. 14, FirstEnergy's 550-megawatt, coal-fired Eastlake power plant in Ohio stopped running at 2 p.m. In response, FirstEnergy began to pull roughly 20 percent of its load of electricity out of Michigan to meet its needs. This transfer overloaded several transmission lines, causing them to trip. Non-FirstEnergy plants in Ontario, Canada, began supplying energy to the underpowered Michigan market, which then led to overload on those transmission lines. This movement of power in Canada deprived New York of power it had relied on, which led to the blackouts there.

And here's the critique:

- Bush's energy deregulation is making America vulnerable for two reasons. First, America's transmission system was designed to accommodate local electricity markets, not the large, freewheeling trading of electricity and movement of power over long distances under deregulation. Sending power over a much wider area strains a transmission system designed to serve local utilities. That's why state regulators in the Midwest warned FirstEnergy and other utilities months ago that the transmission network was vulnerable to a blackout. But these concerns were ignored by these energy corporations.

Second, state-based deregulation means utilities are no longer required to reinvest ratepayer money back into the transmission system, as deregulation replaced that orderly planning with reliance on "the market." But the market has been unwilling to make the necessary investments in transmission. In particular, the market has not functioned properly as loopholes were punched in the Public Utility Holding Company Act (PUHCA) over the past decade.

PUHCA, slated for full repeal by the Republicans in both the House and Senate energy bills, is the last federal regulation that requires giant energy companies to disclose crucial financial details and limits the types of non-electricity investments they may make. If PUHCA is repealed, a wave of mergers will likely result, leaving a handful of companies (like Southern Co., ExxonMobil and FirstEnergy) in control of our electricity - with no effective regulators looking over their shoulders.

In the case of the August blackouts, the deregulated wholesale markets of the Midwest and Northeast - typically cited as models for national deregulation by the Federal Energy Regulatory Commission - failed in their ability to provide reliable and affordable power. As a result, wholesale prices remain higher than under regulation, and nearly 96 percent of the 40 million residential consumers in the remaining 15 deregulated states lack access to competitive electricity suppliers.

FirstEnergy's financial problems are the heart of the question, of course. The consequences are that the American taxpayer ultimately will probably have to foot the bill for the energy industry's poor fiscal discipline.

- Arik

August 24, 2003

U.S. Using Former Hussein “Mukhabarat” Intelligence Personnel in Iraq

Sunday’s Washington Post reported that, “occupation authorities have begun a (not-all-that-) covert campaign to recruit and train agents with the once-dreaded Iraqi intelligence service to help identify resistance to American forces here after months of increasingly sophisticated attacks and bombings, according to U.S. and Iraqi officials.”

In the wake of the suicide truck bomb that hit the United Nations headquarters last week, this is seen as a growing recognition that U.S. forces must co-opt their former enemies if they are to prevail against further guerrilla activities directed against them.

Here are a couple of excerpts:

- “The emphasis in recruitment appears to be on the intelligence service known as the Mukhabarat, one of four branches in Hussein's former security service, although it is not the only target for the U.S. effort. The Mukhabarat, whose name itself inspired fear in ordinary Iraqis, was the foreign intelligence service, the most sophisticated of the four. Within that service, officials have reached out to agents who once were assigned to Syria and Iran, Iraqi officials and former intelligence agents say.”

“Of the four security branches, the Mukhabarat was the best-treated and often supplied agents for the other branches. The largest was internal security, known as Amn al-Amm, which focused on domestic intelligence. The third was special security, which protected government officials. These three answered to the presidency. Only military intelligence was nominally independent of Hussein's inner circle and operated within the Defense Ministry. The Baath Party, with membership in the millions, provided a check of sorts, with its almost endless network of informers in every town and village.”

“Within the Mukhabarat, former intelligence officers say, the branches dedicated to Iran, Israel and, during the 1990s, the United Nations were the most important. One officer, a 23-year veteran who spied on the United Nations, said about 100 agents worked on Iran, between 75 and 100 on the United Nations and 50 each on Israel and Syria, in addition to their networks and contacts.”

- Arik

August 23, 2003

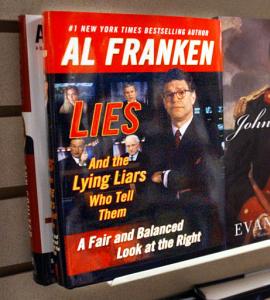

"Unfair and Off Balance": Fox News Loses Suit Against Satirist, Franken Laughs All the Way to the Bank

Here’s an excerpt from the New York Times story from Saturday:

- “If anything, the lawsuit only benefited Mr. Franken. His book had been scheduled for release in September, but the publicity caused the publisher to print an extra 50,000 copies, for a total of 435,000, and to roll the book out on Thursday. After the ruling yesterday, it moved to the No. 1 spot on the best-seller list at Amazon.com. The network filed for the injunction on August 11. Fox News Network trademarked the phrase "Fair and Balanced" in 1998 to describe its news coverage, and network lawyers claimed that Mr. Franken's use of the phrase in his book would "blur and tarnish" it. Fox also objected to the use of a picture of Bill O'Reilly, one of its prominent news personalities, on the cover, claiming that it could be mistaken as an endorsement of the book. But these arguments were met by laughter in the crowded courtroom, as Fox tried to defend its signature slogan. Part of the network's burden was to prove that Mr. Franken's use of the phrase "fair and balanced" would lead to consumer confusion. One round of laughter was prompted when Judge Chin asked, "Do you think that the reasonable consumer, seeing the word `lies' over Mr. O'Reilly's face would believe Mr. O'Reilly is endorsing this book?" The giggling continued as Dori Ann Hanswirth, a lawyer for Fox, replied, "To me, it's quite ambiguous as to what the message is here." She continued, "It does not say `parody' or `satire.'" Ms. Hanswirth said Fox's "signature slogan" was also blurred, because people who were not associated with the network, which owns the Fox News Channel, also appear on the cover with Mr. O'Reilly. Judge Chin said, "The president and the vice president are also on the cover. Is someone going to consider that they are affiliated with Fox?" The courtroom broke into laughter again. Ms. Hanswirth replied, "It's more blurring, your honor." After more discussion about what was and what was not satire, and about the definition of "parody," Judge Chin decided that Mr. Franken's work was of "artistic value." "Parody is a form of artistic expression protected by the First Amendment," he said. "The keystone to parody is imitation. In using the mark, Mr. Franken is clearly mocking Fox." He said Mr. Franken's work was "fair criticism." Judge Chin said the case was an easy one, and chided Fox for bringing its complaint to court.

UPDATE: On Monday 25 August, Fox News dropped the suit.

- Arik

August 22, 2003

As Gillette Fights Schick over Mach 3 and Quattro, Rayovac Liked Remington So Much They Bought the Company

… Prompting Me to Ask, What’s the Deal with Batteries and Shaving?

As Gillette, the world's largest maker of shaving products (and owner of Duracell, by the way), went to court last week to counter a new competitive threat from its closest rival, Schick-Wilkinson Sword (owned by Energizer), another battery company (Rayovac) jumped into the shaving business as Rayovac bought out Remington for $322 million, plus debt. Here's an excerpt from the Gillette/Schick battle:

As Gillette, the world's largest maker of shaving products (and owner of Duracell, by the way), went to court last week to counter a new competitive threat from its closest rival, Schick-Wilkinson Sword (owned by Energizer), another battery company (Rayovac) jumped into the shaving business as Rayovac bought out Remington for $322 million, plus debt. Here's an excerpt from the Gillette/Schick battle:

- “Gillette filed a suit against Schick over Quattro, the first four-blade razor, for an alleged patent infringement. The suit, filed in a federal court in Boston, alleges that the new razor uses technology that Gillette developed to allow the three blades on its Mach 3 system to extend progressively closer to the face and provide a smoother shave. Gillette claims it spent $750 million to develop Mach 3. "We welcome honest and innovative competition but we will vigorously defend our valuable intellectual property," said Peter Hoffman, the president of Gillette's grooming division. The lawsuit is seeking preliminary and permanent injunctions and triple damages. Gillette has a commanding 70% share of the world market for wet-shaving products, with Schick a distant second, at 18%. But the lawsuit was viewed by analysts as a reaction to the increasing threat posed by Schick. In a market where new product development over the past few years has often hinged on the addition of further blades, Schick has stolen a march on Gillette with Quattro. While Schick was preparing the launch of the four-blade razor, the people in the research and development department of Gillette were still adding a third blade to its Sensor brand due for launch next year. The drug company, Pfizer, acquired Schick in 2000 as part of its takeover of Warner Lambert and had always intended to sell the business on. Analysts say that, in the interim, Schick received little management attention or marketing push, leaving it in a state of destabilizing uncertainty for two years. It was bought by Energizer, the U.S. battery maker, earlier this year and has since shown signs of renewed verve. Two weeks ago it reported a 27% jump in quarterly blade and razor sales. Schick is planning to launch Quattro in the U.S. market next month for $8.99. The company has already begun to make a dent in Gillette's U.S. women's market sales with the Intuition brand. The razor has three blades surrounded by a bar of soap and is more convenient for women to use in the shower. The brand is held to be behind a 2.9% gain in Schick's U.S. market share to 17%. Gillette at the same time has fallen 4.3% to 63%, according to market data firm Information Resources. 'I think this shows the seriousness with which Gillette takes the Quattro as a threat to its core blades and razors business,' said Joseph Altobello, an analyst at CIBC World Markets."

Here’re a few background links:

- Arik

August 21, 2003

Wireless Phone Companies Soon Free to Woo Landline Competitors

The FCC is taking up discussion of forcing wireline telcos to make phone number portability mandatory, as they’re now forcing wireless carriers to. The decision would go a long way toward making it possible for wireless phone companies to solicit business from landline customers, and accelerate the already precipitous decline in wired subscriber growth already so prevalent a trend within many demographics.

Face it… it’s just easier for most people to get a wireless phone they can always be near and ditch their stodgy old corded phone. Good story from Mercury News.

- Arik

August 20, 2003

Retailers Poised to Repel Threat of Parent/School Backlash on Sexy Back-to-School Clothes, Just as Fall's Abercrombie & Fitch Catalog of Mostly-Naked Kids Debuts

The latest A&F catalog surfaced in the past few days, just in time for back-to-school shopping, filled with images of frolicsome youngsters – except, most were not only wearing practically no clothes at all but were engaged in all sorts of fleshly playfulness. Is it time for parents to finally rebel against such marketing tactics?

The latest A&F catalog surfaced in the past few days, just in time for back-to-school shopping, filled with images of frolicsome youngsters – except, most were not only wearing practically no clothes at all but were engaged in all sorts of fleshly playfulness. Is it time for parents to finally rebel against such marketing tactics?

Another article I noticed today talked about the not-so-subtle negotiations parents and their junior-high-age “tweener” kids go through in getting prepped for school – again, mostly surrounding how much skin kids can bear.

In an era when more schools than ever are heading back to uniforms rather than allow such skimpy fashions, is it really a smart move for retailers and apparel marketers to ignore the voice of parents struggling to put their Britney-emulating geniis back in the bottle.

- Arik

August 19, 2003

Verizon Wireless Walks Into Walkie-Talkie Market and Lawsuits by Rival Nextel for Trademark Infringement, Drops Charges of Nextel Corporate Espionage

Verizon Wireless’ frontal assault on Nextel’s primary point of competitive differentiation – it’s Direct Connect feature – is hitting the streets; 95 percent of Nextel’s 11.7 million customers use the push-to-talk feature, and AT&T Wireless and Sprint are both expected to launch their own similar offerings later this year. Still, interoperability between networks is far from a done deal and that’s going to give Nextel some much needed breathing room to improve their service and pricing.

The amount of time it takes to connect the call will also be advantageous for Nextel, who began to prepare for the competitive threat from Verizon by going nationwide with Direct Connect in July.

Meanwhile, both Verizon and Nextel are being suitably litigious in their competitive strategy: in June Verizon filed a lawsuit against Nextel, saying the company had used “corporate espionage” to acquire prototypes of its new handsets and gained unauthorized access to its network; while Nextel sued Verizon over the use of the words “Push-to-Talk” as a trademark of Nextel’s service.

Still, Push-to-Talk is more Motorola’s technology than anyone’s and MOT appears to be ready to use it to propel it forward and out of its current funk with ambitious new plans to sell next-gen handsets.

- Arik

Here are a few more supplemental links on the issue:

August 18, 2003

AMD Gets 64-Bit Competitive Leverage from Opteron & Athlon64 in Battle with Intel

Shares of Advanced Micro Devices shot up, after an influential tech stock strategist said AMD’s new Opteron and Athlon64 microprocessors pose the “biggest-ever threat” to the dominance of industry hegemon Intel Corporation. Has Intel allowed AMD a point of competitive leverage in their ongoing battle by being slow to market with its own 64-bit microprocessor?

Shares of Advanced Micro Devices shot up, after an influential tech stock strategist said AMD’s new Opteron and Athlon64 microprocessors pose the “biggest-ever threat” to the dominance of industry hegemon Intel Corporation. Has Intel allowed AMD a point of competitive leverage in their ongoing battle by being slow to market with its own 64-bit microprocessor?

Investment newsletter publisher Fred Hickey told Reuters that, “an endorsement by IBM of AMD's Opteron chip has given the Sunnyvale, California-based chip maker momentum to break into the business of selling chips for use in data-serving computers used by businesses. ‘They're threatening Intel like they never had,’ Hickey said in an interview following comments he made earlier to the financial weekly Barron's. Intel is ‘facing their biggest threat in history,’ he said.”

In another quote from the same Reuters piece, “Hickey said the likelihood of widespread acceptance of AMD's chips has never been greater. He said he expects Sun Microsystems Inc. to use Opteron chips in some of its business computers. Hickey also said he expects major PC manufacturers to adopt AMD's new Athlon64 line of chips for home computers. Intel has downplayed the need for 64-bit computers in the home, and has not announced any plans to sell 64-bit chips designed for home users. Apple Computer …

- Arik

August 15, 2003

Made-in-America, Wal-Mart & the Cheapening of U.S. Consumers

Why do people shop at Wal-Mart? Because it's cheap, that's why. And one of the chief reasons for Wal-Mart's price competitiveness is the $12 billion worth of goods it imported from China last year. To put that in perspective, the U.S. only imported $125 billion altogether from China in 2002; Wal-Mart represents 10 percent of the total!

I found a great article on the subject recently and excerpts are below:

http://www.industryweek.com/CurrentArticles/Asp/articles.asp?ArticleId=1473

- "When asked, most U.S. consumers today will say they prefer to buy American brands and U.S.-made products, but with the influx of foreign goods -- U.S. imports totaled $1.2 trillion in 2002, 11% of U.S. GDP -- buying American is no longer practical in some instances and impossible in many others. Other priorities, such as quality, durability, style and price -- especially price -- often take precedence."

"Younger people who grew up shopping at the Wal-Mart on the outskirts of town may be the least likely to care if the label on their MP3 player says it was made in the U.S.A. or China. They've grown up with the global economy. With ongoing factory closures and layoffs it's increasingly unlikely that they or their parents work for a manufacturing company. Especially considering that less than 15 million people in United States (approximately 10% of the workforce) are employed in manufacturing today. Also, one wonders if it is even possible for a company to rely entirely on U.S.-based suppliers when so much of machinery, telecommunications equipment, packaging, uniforms and other commonplace supplies are coming from overseas."

- Arik

August 14, 2003

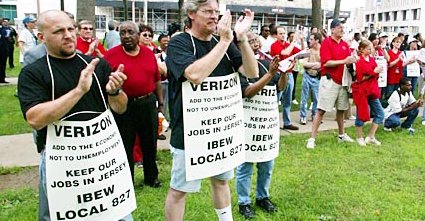

A.F.L.-C.I.O. Dials Up Competitive Threat in Verizon Union Fight

The New York Times reported that Verizon's union is willing to fight dirty to strengthen their negotiating position:

- "The A.F.L.-C.I.O. plans to start by urging roughly 3.5 million people — those from families with union members in five Eastern states where Verizon is the dominant phone company — to log their names, addresses and phone numbers on a Web site, where they could be easily compiled for submission to AT&T."

That's more than 10 percent of Verizon's customer base in the states affected, something AT&T has said they'd both welcome and be able to handle. Since union-sponsored boycotts in the telecom market are tough for unions to promote or enforce, wholesale switching of service providers appears to be the hardball alternative... except for the paradox that, the very act of reducing a customer base to the advantage of a top competitor means fewer union jobs will be needed in the end.

- Arik

August 13, 2003

Jennufleck Schadenfreude - "Gigli" Flops to Our Collective Delight

The disaster film "Gigli" - whoops, I mean, disastrous film - continued to run in 2,215 theaters this past weekend but pulled in a three-day total of only $678,640, which translates to an average of three people in the theater per screening. Yowza.

The disaster film "Gigli" - whoops, I mean, disastrous film - continued to run in 2,215 theaters this past weekend but pulled in a three-day total of only $678,640, which translates to an average of three people in the theater per screening. Yowza.

There's a good article in the Washington Post about why we're all so delighted about it. Here's a great quote from that piece:

- "Though fascinated by the rich and famous, we also resent their tendency to engage, at the drop of a hat, in wild, romping, bouncing-off-the-walls sex. We resent their threesomes. We are astonished by their fivesomes. We think their sevensomes are completely beyond the pale. We are all too aware that they have a tremendous amount of sex in Jacuzzis, sometimes right there in the Jacuzzi store showroom. Sex on sailboats, sex on mountaintops, sex in vintage automobiles in the cargo hold of sinking ocean liners - they're unstoppable. Why can't they be like ordinary Americans and slowly turn into inert blobs of undifferentiated protoplasm so devoid of erotic allure that gender can only be determined with a chromosome test?"

Here's a toast to all the movies we never see that entertain us by how truly awful (we've heard) they are, than by how much we really like them.

- Arik

August 12, 2003

Fox News vs. Al Franken

While I've always thought Al Franken was entertaining, I never thought he was a brilliant analyst... Can you name one observation this guy has really ever made? Certainly nothing worth being sued over - but that's just what Fox News is about to do.

My instincts tell me Franken's gonna end up laughing all the way to the bank from the loads of publicity this is bound to stir up for what would have otherwise been just another mediocre critique of right-wing journalism. Way to go, O'Reilly... real smart.

- Arik

August 11, 2003

Price Discrimination, the Internet & Buyer's Remorse - Bye-Bye, Privacy; Hello, Negotiation

Price discrimination isn't just for the airline yield management system anymore. So says Andrew Odlyzko of the University of Minnesota's Digital Technology Center.

In an AP story I read wired to my local newspaper over the weekend, I found it ironic and enlightening that, in an era when the Internet was supposed to erode the ability and incentive for companies to discriminate between customers in terms of prices offered for the same goods and services, just the opposite has happened.

In doing a little more research on the subject, I found another intriguing article from BusinessWeek Online that called discriminatory pricing the "holy grail of capitalism". Here are two good quotes from that one:

- Economic theory posits that price discrimination - where companies charge individuals based on their ability to pay and their value as a customer - is desirable since it makes trade more efficient. Yet it rankles consumers, who perceive differential pricing as unfair. The fact that business travelers, whose corporations can arguably afford it, pay more for airline seats than a vacationer has made air travel more popular and routine. At the same time, the price discrimination that charges two people different prices for the same class of service infuriates those who pay more.

- In 2000, Coca-Cola tested a vending machine that would raise prices on a hot, humid day and lower them when temperatures fell. Today, Amazon.com knows what, when, and how often customers buy and is experimenting with offering personalized bundles -- buy two books and get a discount, for example - to induce people to buy more. Twenty years ago, neither experiment would have been possible.

That's why people hate to negotiate - in dealing with used car salesmen, one can't help feeling like something of a "sucker" by the time the transaction is finished. People fear buyer's remorse even more than they fear getting taken for a ride - that fundamental sense of fairness in negotiating power remains truly illusory.

Of course, Priceline.com has set something of a standard on this front, by allowing customers to set their own prices for the stuff they buy; provided, would-be buyers understand the penalties of bidding too low.

It would seem, the carefree days of buying something for the posted price are long gone. And I'm not thrilled at having to negotiate my way to the best deal for every little grocery store purchase the rest of my life either.

- Arik

August 08, 2003

SCO Against the World, Microsoft Lends a Hand in Hopes of Squashing Linux

I've been watching the developing SCO vs. The World situation with interest lately - especially with LinuxWorld in full swing this past week and Microsoft's (rumored $50 million) license of SCO's UnixWare (purportedly to fund SCO's legal assault on the Linux community). But, I'm mostly left shaking my head as reading the latest on who's suing whom and why. If you haven't clued in to the story yet, here's a dozen background links on the subject - these should provide a good primer and I'll refer back here for future posts:

-

Fighting SCO Fear and Loathing at LinuxWorld

Red Hat files suit against SCO

SCO sets Linux licensing prices

Forbes Person Tearsheet - Darl McBride

Red Hat Chief Rallies Linux Troops

Analyst finds SCO's "proof" credible

In the end, Linux and open source software more generally face a challenge that's more paper tiger than real threat. I think it's a shakedown and a scam by SCO to harvest some blackmail money from a cheap IP acquisition made a few years ago. SCO's puppetmasters (see links above from Forbes) have something of a history of this sort of thing.

What's more, if SCO would simply show the world the Linux kernal code they claim is theirs - something they've still refused to do except for a few in the analyst community, as mentioned in the links above - some say it would take all of two hours to get it rewritten... problem solved. But, then SCO doesn't get paid, right?

SCO's approach makes me think they took a page from the RIAA's playbook of public relations. Charging a few hundred bucks on average for every box running Linux worldwide would certainly raise some cash - but more importantly, from Microsoft's perspective, it would virtually eliminate the Linux price advantage over Windows.

However, I don't think, when the evidence of the infringing IP is finally revealed, that - as Red Hat is suing to have done ASAP - SCO will be able to prevent wholesale rewrites in avoidance of those recently announced licensing fees; and, only a fool would actually pay SCO anything at this point, without any guarantee of a refund when SCO's proven wrong.

- Arik

August 05, 2003

BuyMusic Copycats iTunes Ads to Beat Weak Apple Product Strategy to Windows Users

There was a good Slate article today that looked at the ads you've been seeing lately from BuyMusic that look like flat-out copies of Apple's iTunes ads. They're trying to make hay while the sun shines - since iTunes is Mac-only (for the moment), BuyMusic is attempting an undercut and outmanuever strategy to beat Apple to Windows users with cheaper downloads and similar service (though, one cannot burn a mix-CD of songs as with iTunes, I'm told).

iTunes has been a big hit with fans and presents a real challenge to many artists - check out the good story at BusinessWeek on the subject.

Despite my personal dislike for knockoff marketing tactics, it might just work - and, shame on Apple for apparently trying to restrict the iTunes business as mere leverage to sell more Macs - a mistake that panned out with iPod. Apple dropped the ball when it didn't see iTunes as a business independent from the Mac platform, and by ignoring Windows users altogether, they effectively created tremendous opportunity for competitors. In that respect, BuyMusic deserves to win.

Still, the reason Apple's been so successful in the music business the past few months has nothing to do with price or marketing, and everything to do with Apple's new core competence. That is, Apple makes products people find cool enough that they can set trends and drive style among the coolest-of-the-cool hipsters that create pop culture. That unique position is what led the music industry to partner up with Apple on iTunes in the face of profligate MP3 piracy - if Apple can make it cool to honor copyrights, that culture shift bodes well for a music industry that's otherwise on its way to an early grave.

- Arik

August 03, 2003

The Jobless Recovery: Do Productivity Gains, Forced by Cost-Cutting, Mean the Rules Governing the U.S. Economy have Changed?

Three articles in yesterday's newspapers got me thinking about the U.S. economy and the apparently jobless recovery we're moving towards in the latter half of '03. Read them here:

-

From the New York Times

http://www.nytimes.com/2003/08/02/business/02ECON.html?pagewanted=print&position=

From the Washington Post

http://www.washingtonpost.com/ac2/wp-dyn/A13503-2003Aug1?language=printer

From the LA Times

http://www.latimes.com/templates/misc/printstory.jsp?slug=la-fi-jobs2aug02001424§ion=/printstory

I also noticed a couple of left-of-center pieces from AlterNet that I thought were interesting:

Jobless Recovery

While the recession officially ended in November 2001, it doesn't appear that hiring is following past recovery trends by kicking in to drag us back to growth. So the question is: what if higher unemployment and slower wage growth are signs of a fundamental change that might be permanent?

In the up years of the economic cycle, firms produce a just a little more product than the market and customers will want to buy. This excess builds up in inventory until the firm realizes it doesn't need to make so much and lays off a few workers to meet real demand, at which point the stockpile shrinks and workers are eventually rehired to produce more again. Now, to get an economy going, government can do just a few things to get consumers and businesses spending again and putting people back to work - that is, cutting interest rates, reducing taxes and just buying more itself - which the Feds have been doing to little apparent effect.

Consumers have kept the economy stumbling along with low interest rates that have allowed them to extract money from their homes through mortgage refinancing; but, rates have started rising and people are getting more worried about their financial security, so this lending has slowed lately. Therefore, a decent recovery won't start until businesses start spending again, delayed because of the current overcapacity and modernization that had been done in the late 1990's when it was relatively easy to raise capital to invest in production modernization by selling new stock. So, companies aren't spending because they just don't need to.

When will firms start spending again? For many, never. They've moved production offshore to cheaper markets, where any increase in consumer demand in the U.S., will be met with hiring, not of American workers, but of foreign ones! We can blame the end of the Cold War and the globalization that followed as market economics took over in former command economies around the world, that brought back the rules of "Comparative Advantage" with a vengeance. It used to be, we wouldn't trade with many countries because they were political competitors; today, economic competitors are the source of dramatic disinflation in production costs, the chief benefit of which is cheap goods for American consumers. On the home front, the effect has been to increase interest rates, which could cause home values to start dropping since people won't be able to afford as much house as they could a couple of months ago.

With earnings season in full-swing, corporate profits have been fairly robust of late, but companies aren't seeking to hire new workers. Instead, they're trying to find ways to squeeze fixed-overhead costs (read, "people") out of their business through productivity enhancements - which is exactly what statistics are showing. Rising productivity has been the source of these new profits - and the rise in the stock market that has accompanied them - demonstrating that companies can stretch current workforce to meet their needs. In other words, growing top-line revenue, without growing middle-line expenses, leads to greater bottom-line profits.

And, finally, there's the recent trend of white-collar overseas outsourcing - especially in IT. The complaints of steel and auto workers of the 1980's are taking on new meaning among accountants and programmers who find themselves competing with sophisticated and creative knowledge workers in places like India, Israel, South Africa, Eastern Europe and the Philippines where costs of skilled labor are a fraction of what they are in the U.S., and competition for such jobs is so high among a relatively new and well-educated workforce that outsourcing companies can't sign companies up quickly enough to send U.S. jobs abroad. By some estimates, more than a million jobs have moved abroad in recent years. The devastation in the high-technology (computers and software) sector has left no one untouched by layoffs among friends and family, causing even greater devastation among economies in states like California.

And, this is the paradox (and price) of becoming the dominant economy in an increasingly globalized world. The more prosperous we are, relative to the rest of the world, the less secure that prosperity becomes. In the end, the only way to prevent exporting jobs is to select one of two choices: reduce our own living standards so that we can be competitive in the global marketplace; or, help raise the standard of living everywhere else to the point they have no unique comparative advantage based on commodity factors (like cost of doing business) alone.

- Arik

"Competitive Intelligence applies the principles of competition and lessons of intelligence to the need for enterprise awareness and predictability of market risk and opportunity. CI has the power to transform an enterprise from also-ran into real winners with agility enough to create and maintain sustainable competitive advantage."

"Competitive Intelligence applies the principles of competition and lessons of intelligence to the need for enterprise awareness and predictability of market risk and opportunity. CI has the power to transform an enterprise from also-ran into real winners with agility enough to create and maintain sustainable competitive advantage."